Business Loan Amortisation Table

A business loan amortisation table is a table designed to help a borrower calculate the total cost of business finance products such as small business loans. Typically, when you are approved for business lending, your business loan will be split over equal repayments scheduled over the term of your loan. Loans repaid in this way are considered amortised.

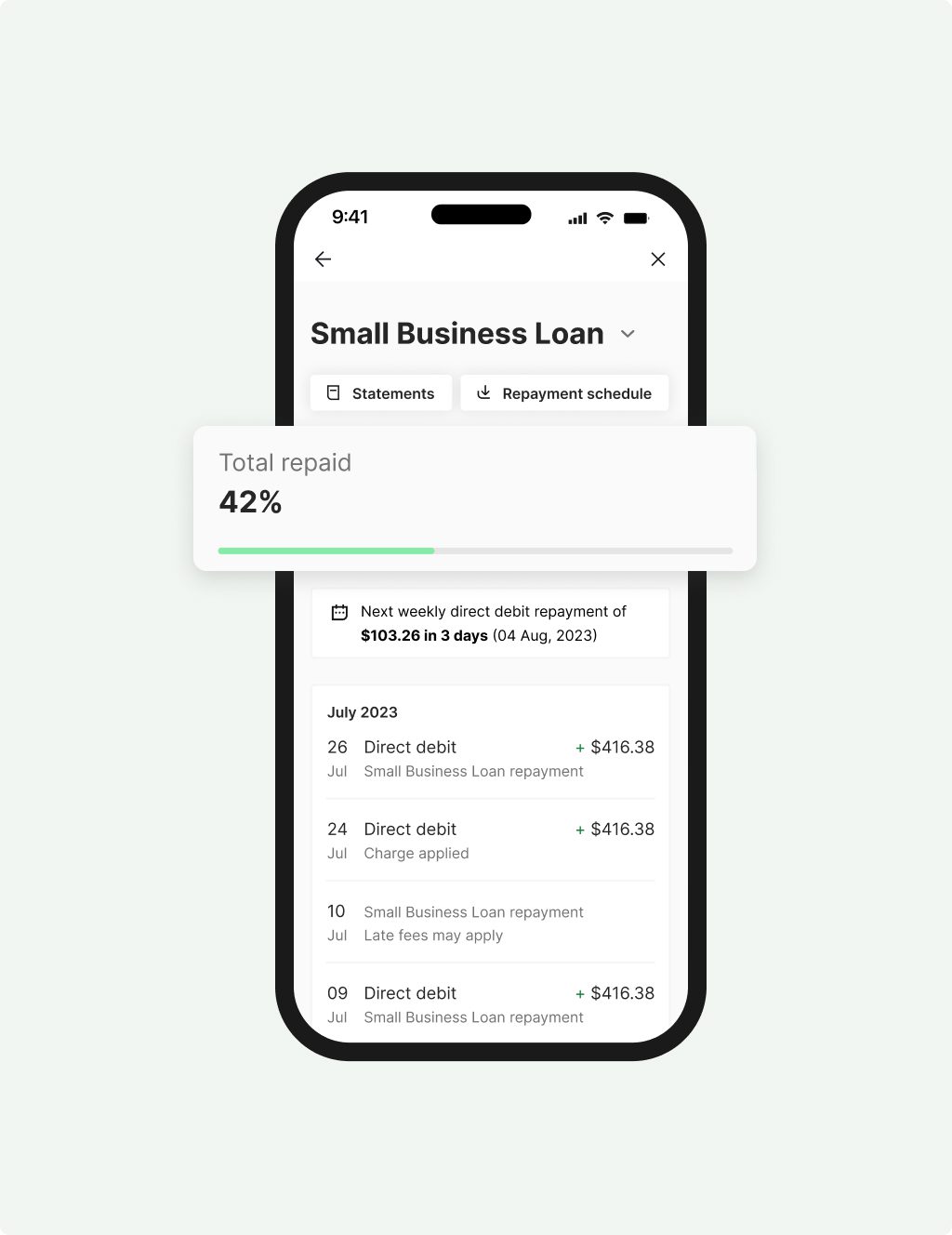

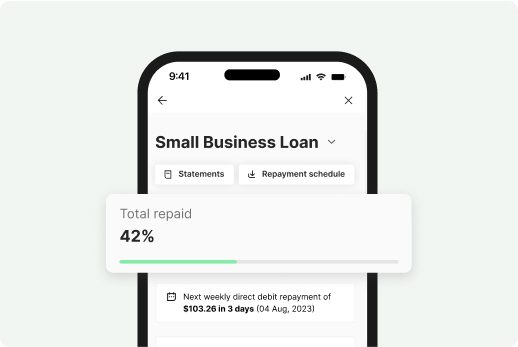

You may be offered daily, weekly or monthly payments. Each repayment that you make on your business loan will usually include a portion of the interest and principal payable on your loan – and any applicable fees. The types of fees you’ll find in the lending market may include account keeping fees and establishment fees. At Prospa we will tell you about what fees are payable and we’ll factor them into the total financed amount to be covered by the repayments you make. Prospa’s small business loans come with the option of daily or weekly repayments.

Business loans from Prospa are designed to support Australian businesses and help business owners with a fresh injection of cash flow – that can be paid back over the term of your loan with cash flow friendly repayments.

Are business loans amortised?

Business loans are generally amortised. A business loan amortisation table is a complete table showing the full schedule of repayments required for repaying the amount of your loan spread equally over your loan term. This table usually shows the principal amount (the amount that you have actually borrowed) as well as the amount of interest that you pay on that loan.

With an amortised loan, your business loan repayments may be scheduled evenly throughout the loan term and each repayment will usually be the same. However, when you begin repaying your loan, the percentage of that repayment comprising your interest amount is usually higher than it is at the end of your loan. That percentage diminishes over time and more of the repayment that you are making will actually go toward the principal amount instead. At some point, later in your repayment schedule, the majority (if not all) of the repayment that you are making goes toward the principal amount.

The purpose of a business loan amortisation table is to show loan applicants the complete repayment schedule. A debt is considered to have been amortised when it is repaid in equal repayments over the term of the debt.

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

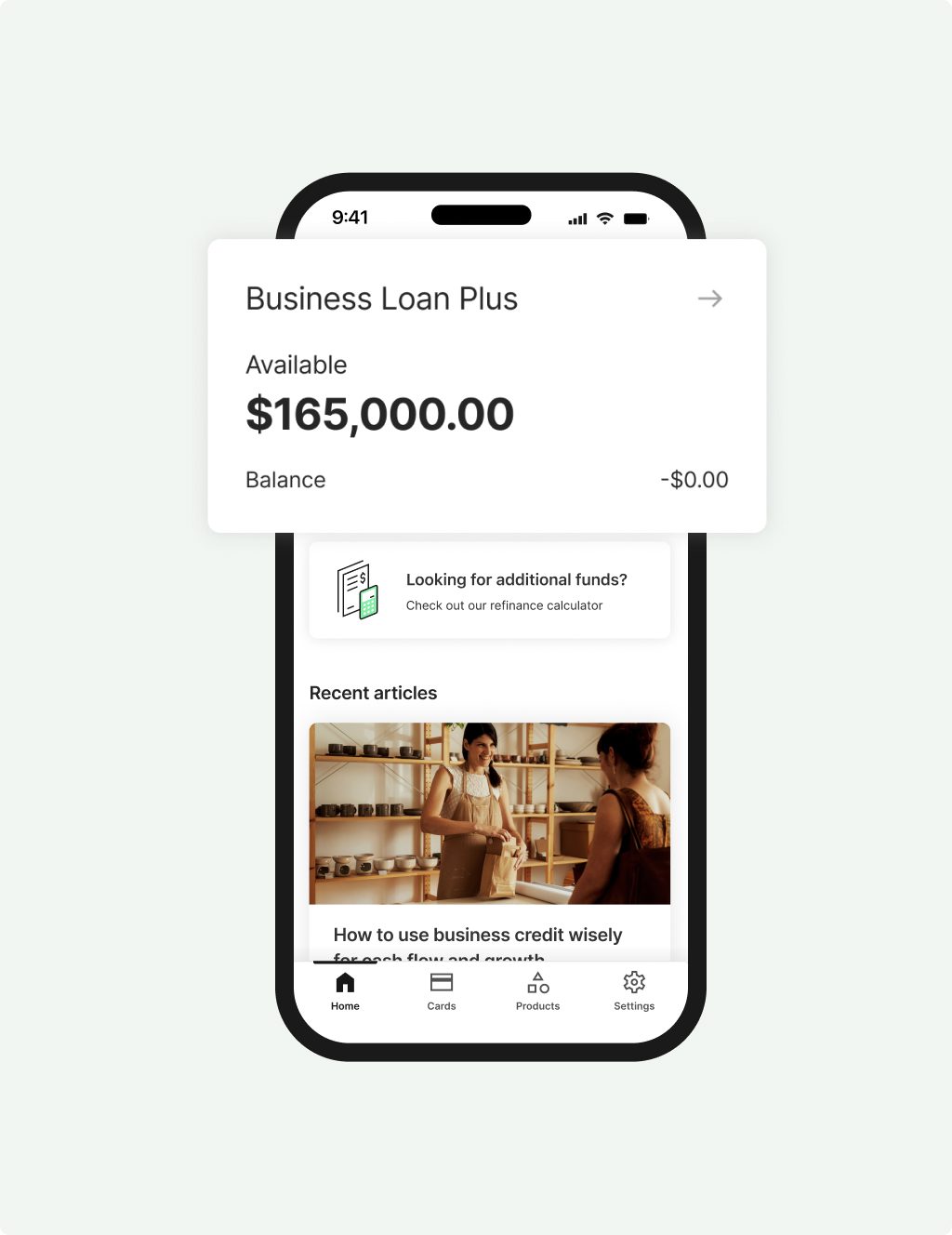

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

How is interest calculated on a business loan?

When you accept the terms of a loan contract for a business loan from Prospa, that contract will clearly show the interest rate offered to you. Business loan interest rates can be different to personal credit products like personal credit cards. To help you understand how a Prospa small business loan might work for your business, Prospa has developed a business loan calculator. You’ll need the total amount you wish to borrow and you’ll need to select the loan term from the options available. Your repayment calculations will show you the weekly repayment, number of repayments and a total payback amount. Any output from the business loan calculator is provided as a general guide only. The Prospa loan calculator applies an indicative annual simple interest rate of 19.9% p.a. to the loan amount and loan term input you select.

How much money can you borrow for a small business loan?

Business loans offered by Prospa are available for between $5,000 and $1,000,000. No upfront security is required to access Prospa funding of up to $150,000 and applications take you under 10 minutes to complete online. Decisions are fast too, so if you’re approved you could have the funds in your business account within 24 hours, or the next business day. Terms and conditions apply.

What are typical terms for a business loan?

We offer customers business loan terms of between 3 and 60 months. Use your funds from Prospa to plan and execute renovations to your business premises, open new locations, develop new product lines or invest in marketing campaigns to explore new markets. Our loan repayment schedules are cash flow friendly, designed to support your business so that it can grow and expand. We have financed over $1.65 billion to over 29,400 Australian businesses already and we maintain our 4.5/5 TrustScore with our client focused approach to small business lending.

What is the typical interest rate on a business loan?

There are a lot of factors which might affect the interest rate offered on any finance product including the amount of the loan, the business’s industry and the term of the loan. One of the main factors relates to the risk of the loan that is being offered. Lenders will usually offer lower rates to applicants with the strongest cash flows, business experience and credit ratings.

Prospa offers Australian business customers a fast and hassle-free approach to business lending. Qualification criteria for our loan products include a monthly turnover of at least $6,000 and trading history for at least 6 months. You will need an active ABN, a business account as well as personal identification details like your driver’s licence. For loans of over $250,000, you will also need to supply business financials. If approved, funding could be in your account within 24 hours of your application with fast approvals offered and quick applications which take just 10 minutes.

If you have any questions about our range of business funding, please get in contact with us. We’ll happily take you through exactly how your loan works and how easy it is to keep on top of it using our 24/7 Prospa Mobile App and Customer Portal.

Apply online today for fast business loans from Prospa and discover what a fresh cash injection into your business could help you achieve.

Choice

Borrow up to $1M with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |