Calculate your repayments

Use Prospa’s business loan calculator to quickly calculate your loan repayments

Please select a product

Calculations are based on your input and are for illustrative purposes only. They are not forecasts, offers of credit or financial advice and do not imply product suitability. Subject to applicable law, Prospa will not be liable for any loss or damage arising from your use of the calculator. Terms and conditions, standard credit criteria, and applicable fees apply to Prospa products.

This calculator uses a fixed annual percentage rate (APR) of 31% as the interest rate to calculate repayments, which include only the principal and interest, with a 3.5% origination fee.

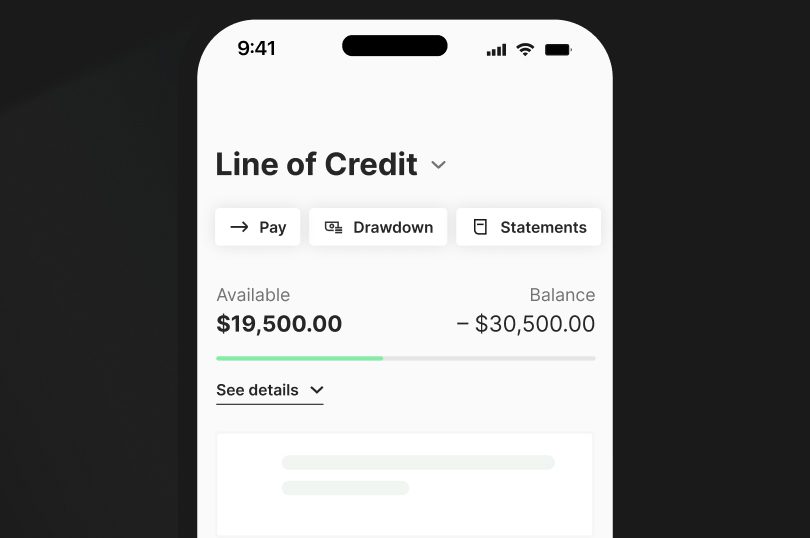

To calculate repayments, this calculator uses a fixed annual percentage rate (APR) of 31% as the interest rate and a weekly service fee of 0.046% of the facility limit. Calculated repayments include principal, interest, and fees. Repayments are calculated based on the first drawdown amount and do not consider the facility limit. The calculated repayments may not be sufficient to repay the total loan amount. At the end of the term, any outstanding balance must be repaid in full or over an additional two-year payment plan.

Simplify Your Business Financing with Our Loan Calculator

Take control of your business’s financial planning with Prospa’s easy-to-use business loan calculator. Instantly calculate your potential repayments, including principal, interest, and fees, for loans up to $500K with terms up to 5 years. Whether you’re considering a small business loan or exploring our flexible line of credit, our calculator helps you understand your borrowing options and plan with confidence.

No matter your business goals, Prospa is here to provide fast, transparent funding tailored to your needs. Try our loan calculator today and see how we can help your business thrive.

One platform

A range of funding solutions

Already know what

you’re after? .

Need help?

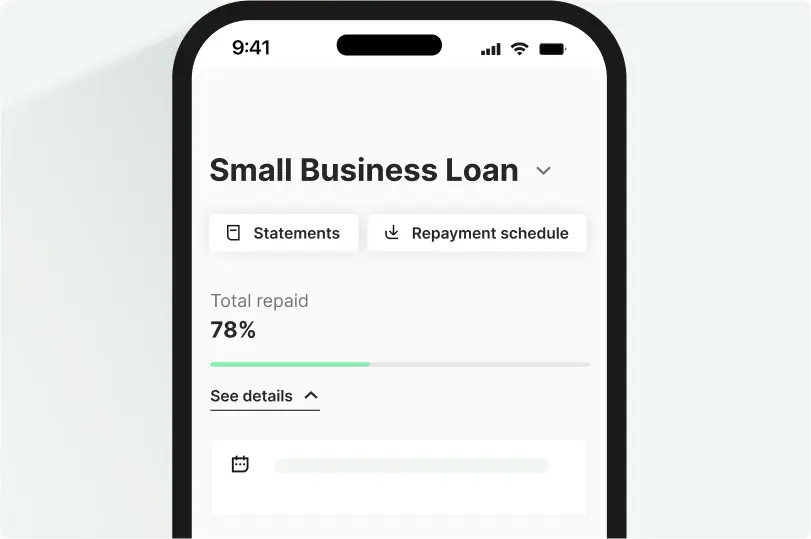

Greater flexibility and control

To keep business moving

Interest savings

Easy application

Apply online in under 10 minutes, with no credit checks to see if you're eligible.

Minimal paperwork

No lengthy forms and no stressful processes, so you can get back to running your business.

Fast approvals

Once we have all your necessary application details, we can provide a decision in as little as one business day.

No upfront credit checks

Zero impact to your credit score to check if you are eligible.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Frequently asked questions

The application process for Prospa business loans is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150K or less, you need your driver licence number, your ABN and your BSB and account number. For loans over $150K you’ll also need some basic financial statements, like a P&L and cash flow.

A decision on a Prospa business loan can happen in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision on your business loan in as little as one business day.

If you apply for a Prospa small business loan before 4pm on a business day and your application is approved, it is possible to have money in your account the next business day.

We provide loan amounts between $5K and $500K. When you make an application for a specific amount we consider a variety of factors to determine the health of your business and the level of repayments your business can support. The total amount of your loan will depend on the specific circumstances of your business.

This is a common question, but business loan interest rates vary due to many factors. These include the type of facility (business loan, equipment loan, commercial loan, business overdraft, line of credit, credit card etc), the amount borrowed, what business assets the funds will be used for, whether the funds are unsecured or secured, whether it is a fixed or variable interest rate, and factors such as the industry the business operates in, how long the business has been running, whether the business has sufficient cash flow to support the loan, and the overall ‘health’ or creditworthiness of the business.

It’s best to talk to our friendly customer service team to see how they can help you get the best business loan interest rate for your business. We’ve helped businesses across the country with funds to grow and for cash flow support – we could help your business too.

There are no hidden fees for our business loans, and you’ll know exactly how much you need to pay, and when, from day one. There’s no compounding interest, no penalties for early repayment and no additional fees (as long as you make your payments on time).

Prospa doesn’t charge an Application Fee. You can apply for a business loan with Prospa with no upfront cost or obligation to proceed.

We do charge an Origination Fee that covers the costs associated with setting up and managing the loan. You are only charged this fee if you proceed with the loan. Our Origination Fee is 3.5% of the business loan amount for loans up to $150K and 3% for loans above $150K. .

You can choose to repay the entire amount of your business loan early at any time. If you choose to repay your entire loan early, Prospa may provide you with a discount on the remaining interest that is payable on your loan. The level of discount applied to your repayment amount will depend on how far you are into the loan term and will be at least 25% of the remaining interest payable on your loan.

There are no additional fees for early repayment and no balloon payment at the end of your loan. Any outstanding late fees or default fees will not be waived. Once you make the final payment your balance will be $0. If you wish to repay the entire balance of your loan early, you should call Prospa on 1300 882 867 to obtain your early repayment figures and relevant payment details.

Other questions?