Business LoansFast, easy, flexible

Compare our business loans

For fast funds

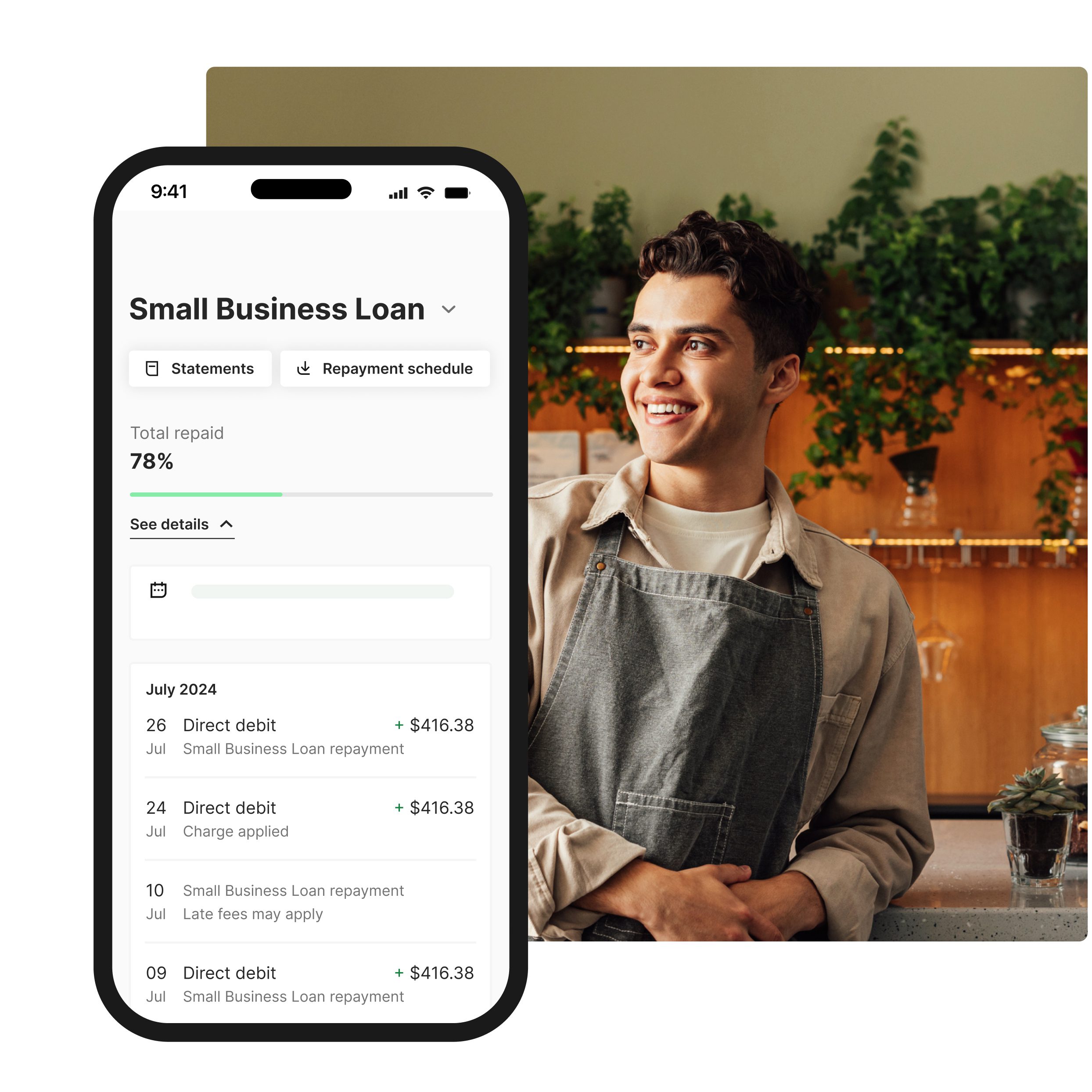

Small Business Loan

- From $5K up to $150K

- Up to 3 year terms

- Easy application and funds available same-day

- No upfront security required

- Unlimited extra repayment to save on interest

For big plans

Business Loan Plus

- From $150K to $500K

- Up to 5 year terms for lower weekly repayments

- Same day approvals on funding up to $250K

- Security may be required for over $150K in Prospa funding

- Unlimited extra repayment to save on interest

How it works

Apply in minutes

Get a fast decision

Access your funds

Or consider a Line of Credit

Why Prospa

About us#1

online lender to small business in Australia

12+

over 12 years of experience

$4B

Small business loans

50K

over 50K business funded

How our customers have put their funds to work

Read customer storiesGetting into the details

Is my business eligible?

At Prospa, your eligibility depends on a few key factors. Your business must meet our minimum criteria:

- For most industries, 6 months trading history

- Minimum monthly turnover of $6K

- Business owner must be 18+ years

- Business owner must be an Australian citizen or permanent resident

We’re here to help, so feel free to get in touch and our team will check if you qualify.

How do I apply?

Simply complete our online form in as little as 10 minutes and get a decision within a business day – often just a few hours. For all applications, you’ll need:

- Your driver’s license

- Your ABN

- Your BSB and account number

- Bank statements

- Some basic financial statements like a P&L and cashflow, for loan amounts above $150K

How much can I borrow?

The amount you can borrow depends on several factors, including the financial health of your business, revenue projections and creditworthiness. Discover which of our products suit your business needs:

- Prospa Small Business Loan – Borrow from $5K to $150K

- Prospa Business Loan Plus – Borrow from $150K to $500K

- Prospa Business Line of Credit – Ongoing access to $2K to $500K

What is the interest rate?

When you apply for our business loan, we will assess the risk profile of your business and provide you with a customised offer including loan amount, term and interest rate.

Our interest rates are determined based on various factors, including your industry, how long you’ve been in business, your credit history and the health of your cash flow.

Speak to one of our specialists and they will work to find a solution that suits your individual business needs.

Are there any fees?

There are no hidden fees for our business loans, and you’ll know exactly how much you need to pay and when from day one.

You can apply for a loan with Prospa with no upfront cost or obligation to proceed.

When you take out a business loan with Prospa, the only fee you will incur is an origination fee, which covers the costs associated with setting up and managing the loan (as long as you make your payments on time).

Do I need security to access funds?

For our Prospa Small Business Loan and Prospa Business Lines of Credit, no asset security is required upfront to access up to $150K.

If you continue to meet your obligations under the facility, such as payment obligations (as detailed in your contract), security will never be required. For facilities over $150K, Prospa takes security in the form of a charge over your assets.

Can I pay out the loan early?

You can choose to repay the entire amount of your business loan early at any time. You can also choose to make unlimited extra repayments to help pay off your loan faster.

If you choose to repay your entire loan early, Prospa may provide you with a discount on the remaining interest that is payable on your loan.

The level of discount applied to your repayment amount will depend on how far you are into the loan term and will be at least 25% of the remaining interest payable on your loan.

FAQs

Common questions answered

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

For a Business Loan or Line of Credit up to $150K, you must have:

- From 6 months trading history

- Monthly turnover of $6K

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Business Loan or Line of Credit over $150K, you must have:

- Minimum 2 years trading history

- Annual turnover of $1M

- Property or asset ownership

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

Often, you can have the funds in your account in as little as 1 hour after settlement.

We offer Business Loans or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit up to $150K, no asset security is required upfront to access. And provided you continue to meet your loan obligations (as detailed in your contract), asset security won’t be required.

For funding over $150K, or where your combined exposure to our products exceeds $150K, property ownership required, and asset security may be required.

We do charge a small establishment fee of 3-3.5%. Provided you continue to meet your loan obligations (as detailed in your contract) this will be the only Prospa fee you will pay.

For funding over $150K, a registration fee may apply if we register a caveat or mortgage over real property you own.

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 1300 882 867. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

In additional to your weekly repayments, you can choose to make unlimited extra repayments with no extra cost. Any extra repayments on your business loan will help you to pay off your loan faster and save on interest.

Loan repayments are due weekly. To help you avoid missing repayments we’ll automatically deducted your repayments from your nominated business account weekly.

You can also choose to make extra repayments at any time or pay out your loan early, in full. If you decide to do this please speak to our friendly business loan specialists on 1300 671 307. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

There are a number of options you can explore when you want to compare business financing options. Here are some to think about:

Line of Credit: If you are looking for a better way to streamline or fill cash flow gaps, a Line of Credit may be the right funding solution for you. With a Business Line of Credit, you can get ongoing access to funds and only pay interest on what you use. We offer a Business Line of Credit $500K, with a renewable 2 year term.

Equipment financing: Equipment loans are a way to finance purchases of equipment for your business. This type of finance is usually secured against the value of the business asset you wish to purchase. This can sometimes help to secure a low rate, although this isn’t always the case. So, if you need to purchase business machinery, IT equipment, tools, or even work vehicles, a Prospa Business Loan could be a good alternative to equipment finance.

Vehicle finance, Business car loan, Machinery finance: This can be a handy way of updating your fleet vehicles or to cover the cost of large assets like harvesters, excavators or commercial cookers. A Prospa Business Loan may be able to cover these items, talk to us today to find out more.

Business overdraft: This handy type of finance can help small businesses cover short-term cash flow gaps. It is often used to cover bills like payroll which can fluctuate if you employ seasonal casuals. It’s also useful to pay suppliers on time if you’re waiting for your own invoices to be paid by your customers. See you can use Prospa’s Line of Credit in a similar way.

Some commercial loans require a deposit. And while you don’t need a deposit to apply for funding with us, however it is a good idea to have a clear understanding of all of your finances before you apply.

It’s OK if you don’t have pages and pages of financial analysis to reference. We understand that small business operators are up against it and often struggle to keep up with the paperwork.

Like traditional lenders, we conduct credit checks to look at your personal credit score in conjunction with your business health. Credit reporting bodies will compile a report on your credit worthiness based on a range of factors which include how many loan applications you have already made, your current credit if you have any, any overdue bills, past bankruptcy if applicable and any pending writs or court judgments.

At Prospa, we don’t rely solely on your personal credit score, we focus on evaluating the health of your business. We have developed a complex credit assessment tool which takes into account over 450 separate pieces of information. It’s unique to Prospa and allows us to take the time to really understand how your business operates and what loan amount will be the most applicable to your business’s long-term stability.

For funding up to $150K you will need 6 months bank statements. And instead of having to submit pages of bank statements, you can connect to your bank account so we can instant assessment your financials.

For funding over $150K we’ll require additional financials like a P&L statement, as well as your ATO portal.

Use our loan calculator to see how much you can afford to borrow.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of the loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 1300 882 867, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 1300 882 867.