Your business, funded faster

Already know what

you’re after? .

Need help?

Greater flexibility and control

To keep business moving

Interest savings

Why Prospa

About us#1

online lender to small

business in Australia

12+

over 12 years of experience

$4B

Small business loans

50K

over 50K businesses funded

How our customers have put their funds to work

Read customer storiesFAQs

Common questions answered

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $250K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

For all Prospa funding:

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Small Business Loan up to $500K, you must also have:

- From 6 months trading history

- Monthly turnover of $6K

For a Business Line of Credit up to $500K, you must also have:

- Minimum 6+ months trading history

- Monthly turnover of $6K

- Property or asset ownership

For a Business Loan Plus from $500K up to $1M, you must also have:

- Minimum 3 years trading history

- Annual turnover of $2M

- Property or asset ownership

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

Often, you can have the funds in your account in as little as 1 hour after settlement.

We offer Business Loans up to $1M or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit up to $150K, no asset security is required upfront to access. And provided you continue to meet your loan obligations (as detailed in your contract), asset security won’t be required.

For funding over $150K, or where your combined funding to our products exceeds $150K, property ownership required, and asset security may be required.

A Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

We do charge a small establishment fee of 3-3.5% on our Small Business Loan or 2-3% on our Business Loan Plus. Provided you continue to meet your loan obligations (as detailed in your contract) this will be the only Prospa fee you will pay.

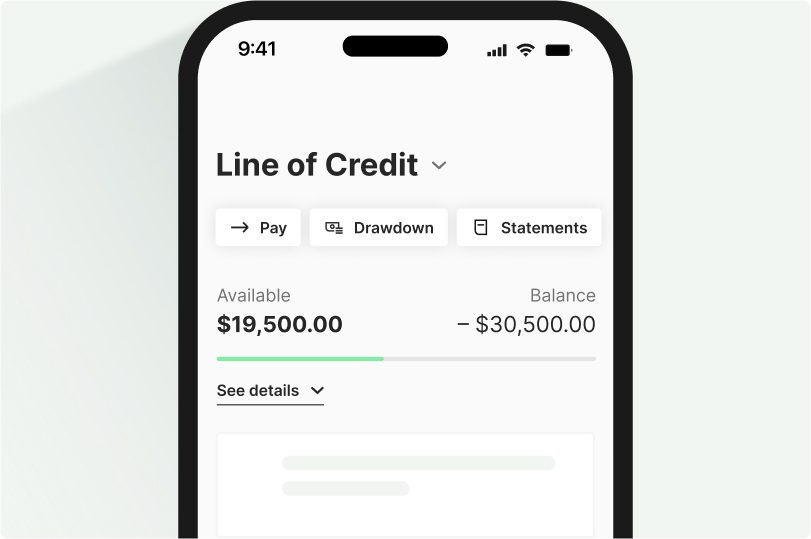

For our Business Line of Credit, we charge a small fee of 0.046% for ongoing access to funds. For a Line of Credit of $40K, this is less than $3 per day (the cost of a cup of coffee). We do not charge an origination or establishment fee.

For funding over $150K, a registration fee may apply if we register a caveat or mortgage over real property you own.

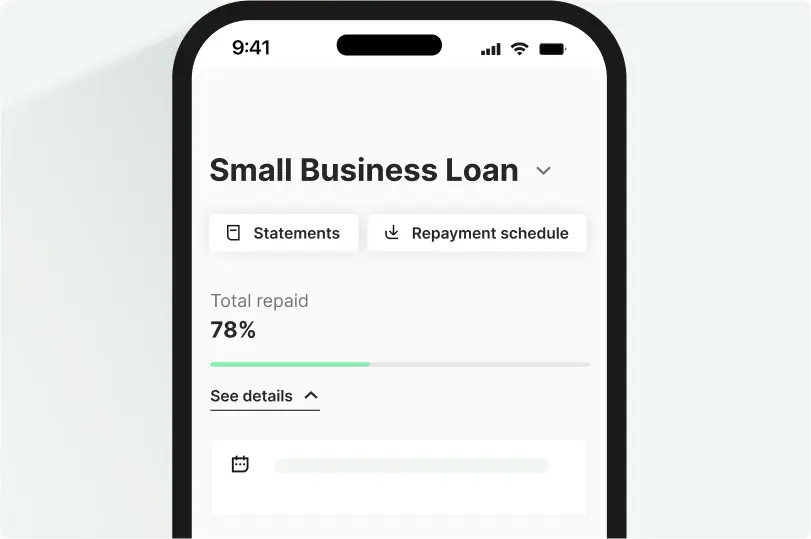

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 1300 882 867. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

Protecting your information, and being clear about how we collect, use, exchange and protect your information, is of huge importance and a vital part of our relationship with you. View our Privacy Policy.

Yes. We use industry recognised encryption standards to protect your personal, sensitive and financial data and are aligned to ISO27001 and NIST CSF, validating our commitment to customer data security and privacy. We use an advanced bank verification system link to instantly verify your bank account information online so we can provide a fast response.

We are Australia’s #1 online lender to small business and we can help. Our dedicated customer support team will understand your business and find a finance solution to suit your needs. We work with Australian small business owners from NSW to QLD, Victoria to WA and everywhere in between.

Unlike traditional lenders, we don’t require the usual pages of reports, financial statements and business plans when you apply. Instead, we offer a quick online application with a fast decision and funding possible in 24 hours. Minimum trading history applies, your ABN and a drivers licence to get started.

If you’re concerned about being baffled by banking jargon, we’ve simplified our loan application process so there’s no more complex terminology around cash flow, low interest loans, fixed rate loans versus variable rates, the loan term, terms and conditions and whether you are in a position to refinance in the future. It’s simple and easy to understand.

With Prospa, you’ll have a clear understanding of what’s expected, how much your weekly repayments will be and when they’ll be due.

Call 1300 882 867 to get started on your business loan application today.

There are a number of options you can explore when you want to compare business financing options. Here are some to think about:

Line of Credit: If you are looking for a better way to streamline or fill cash flow gaps, a Line of Credit may be the right funding solution for you. With a Business Line of Credit, you can get ongoing access to funds and only pay interest on what you use. We offer a Business Line of Credit $500K, with a renewable 2 year term.

Equipment financing: Equipment loans are a way to finance purchases of equipment for your business. This type of finance is usually secured against the value of the business asset you wish to purchase. This can sometimes help to secure a low rate, although this isn’t always the case. So, if you need to purchase business machinery, IT equipment, tools, or even work vehicles, a Prospa Business Loan could be a good alternative to equipment finance.

Vehicle finance, Business car loan, Machinery finance: This can be a handy way of updating your fleet vehicles or to cover the cost of large assets like harvesters, excavators or commercial cookers. A Prospa Business Loan may be able to cover these items, talk to us today to find out more.

Business overdraft: This handy type of finance can help small businesses cover short-term cash flow gaps. It is often used to cover bills like payroll which can fluctuate if you employ seasonal casuals. It’s also useful to pay suppliers on time if you’re waiting for your own invoices to be paid by your customers. See you can use Prospa’s Line of Credit in a similar way.

Some commercial loans require a deposit. And while you don’t need a deposit to apply for funding with us, however it is a good idea to have a clear understanding of all of your finances before you apply.

It’s OK if you don’t have pages and pages of financial analysis to reference. We understand that small business operators are up against it and often struggle to keep up with the paperwork.

Like traditional lenders, we conduct credit checks to look at your personal credit score in conjunction with your business health. Credit reporting bodies will compile a report on your credit worthiness based on a range of factors which include how many loan applications you have already made, your current credit if you have any, any overdue bills, past bankruptcy if applicable and any pending writs or court judgments.

At Prospa, we don’t rely solely on your personal credit score, we focus on evaluating the health of your business. We have developed a complex credit assessment tool which takes into account over 450 separate pieces of information. It’s unique to Prospa and allows us to take the time to really understand how your business operates and what loan amount will be the most applicable to your business’s long-term stability.

To apply for a Small Business Loan:

For amounts up to $250K we require:

- 6 months bank statements

- ATO Tax Portal access (For amounts >$100K)

For amounts above $250K we require:

- 12 months bank statements

- ATO Tax Portal access

- Financial statements

Use our loan calculator to see how much you can afford to borrow.

Yes. After building a strong presence in Australian, in 2019 Prospa launched in New Zealand. The challenges for business owners in New Zealand wanting to access finance were similar to those in Australia. In fact, small business loans in New Zealand were previously only available from larger financial institutions, that didn’t seem to offer the products and services that small business owners were looking for. With over half a million small businesses in New Zealand, there are many opportunities to support the growth and cash flow of kiwi small businesses. With applications in under 10 minutes and funding possible in hours, we are now helping to unleash the potential of many kiwi businesses.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of the loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 1300 882 867, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 1300 882 867.

Information about the Prospa Business Account is provided by Hay Limited (ABN 34 629 037 403 & AFSL 515459), the issuer of the Prospa Business Account and Prospa Visa Business Debit Card. Prospa Innovations Pty Ltd (ABN 98 609 580 734), a wholly owned subsidiary of Prospa Advance Pty Ltd (ABN 47 154 775 667), is a corporate authorised representative (AFS representative number 1313363) of Hay Limited. All information is factual and should not be considered as financial product advice. Please make sure to read the Financial Services Guide, Target Market Determination, Product Disclosure Statement and the Card and Account terms before making decisions about the product. Eligibility criteria, fees, terms and conditions apply.