Prospa Line of Credit Funding your way

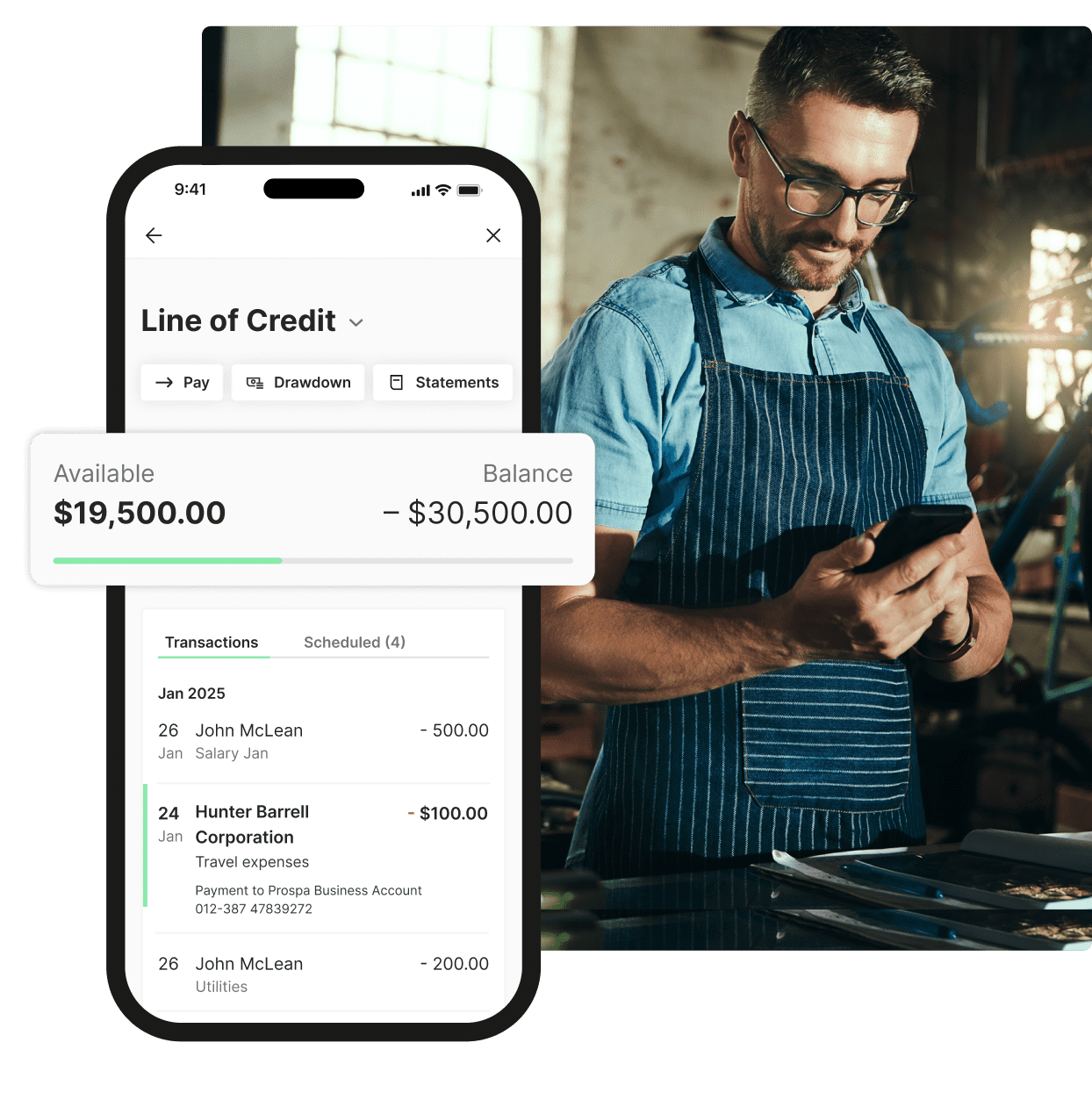

Keep your cash flowing. Access funds when you need, use what you want, but only pay interest on what you actually use.

Stock up, Pay Down, Stay Ahead.

Whether you’re stocking up, catching up, or just keeping things moving, our Business Line of Credit gives you the flexibility to manage your day-to-day with cash always at your fingertips – it’s funding your way.

up to $500K from day 1

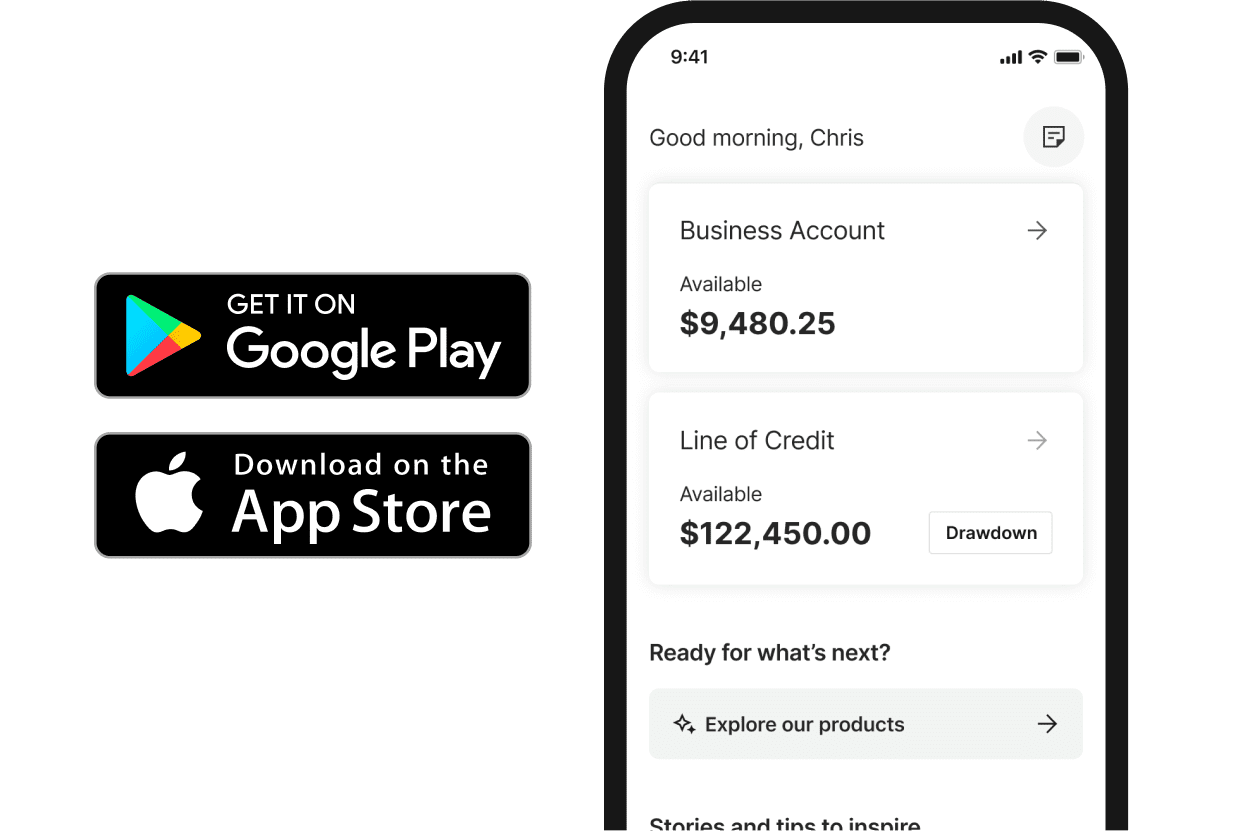

directly from the Prospa App

the amount you actually use

How we do credit, differently

| Prospa’s Line of Credit | Most other Lines of Credit | |

|---|---|---|

| Easy application | ||

| Funding in hours | ||

| Access up to your credit limit at anytime, for the entire term | ||

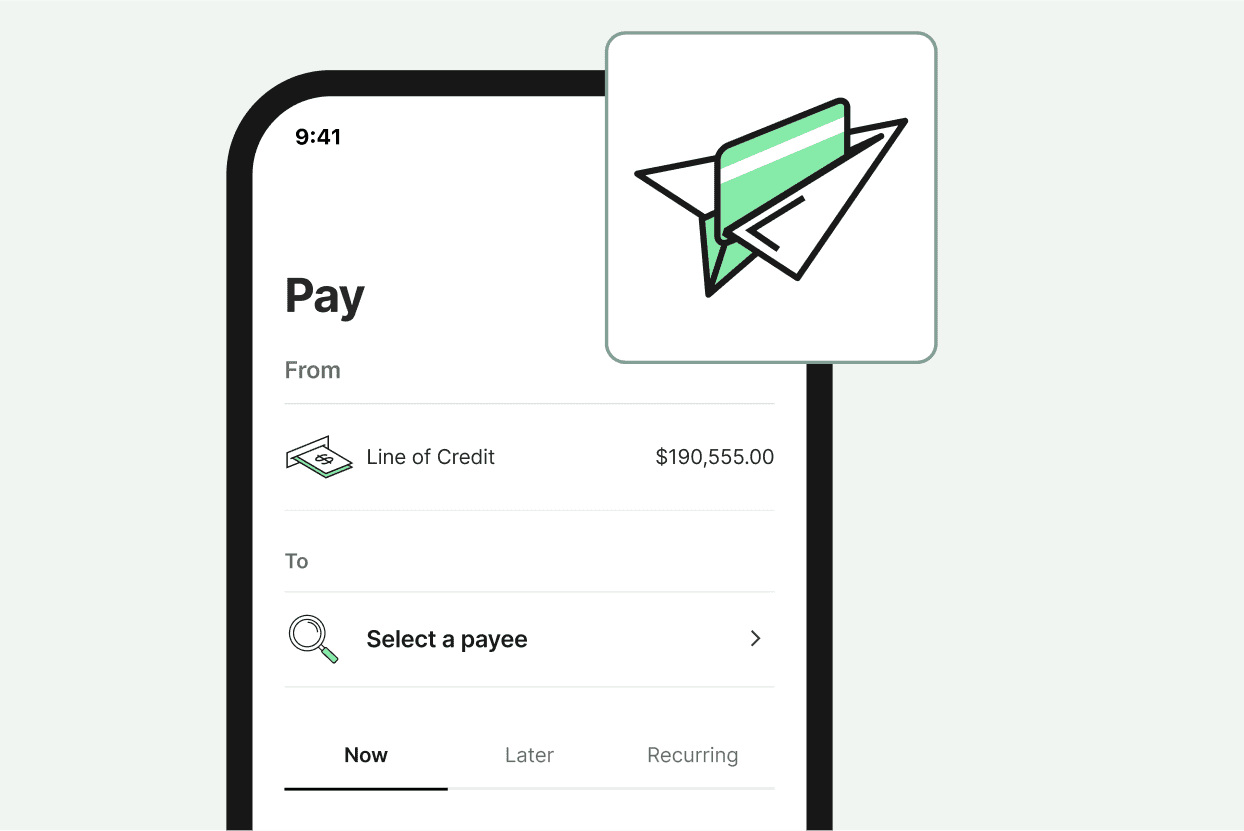

| Make payments directly from your Line of Credit | ||

| Lower your interest with unlimited extra repayments | ||

| Access funds 24/7 via the Prospa App | ||

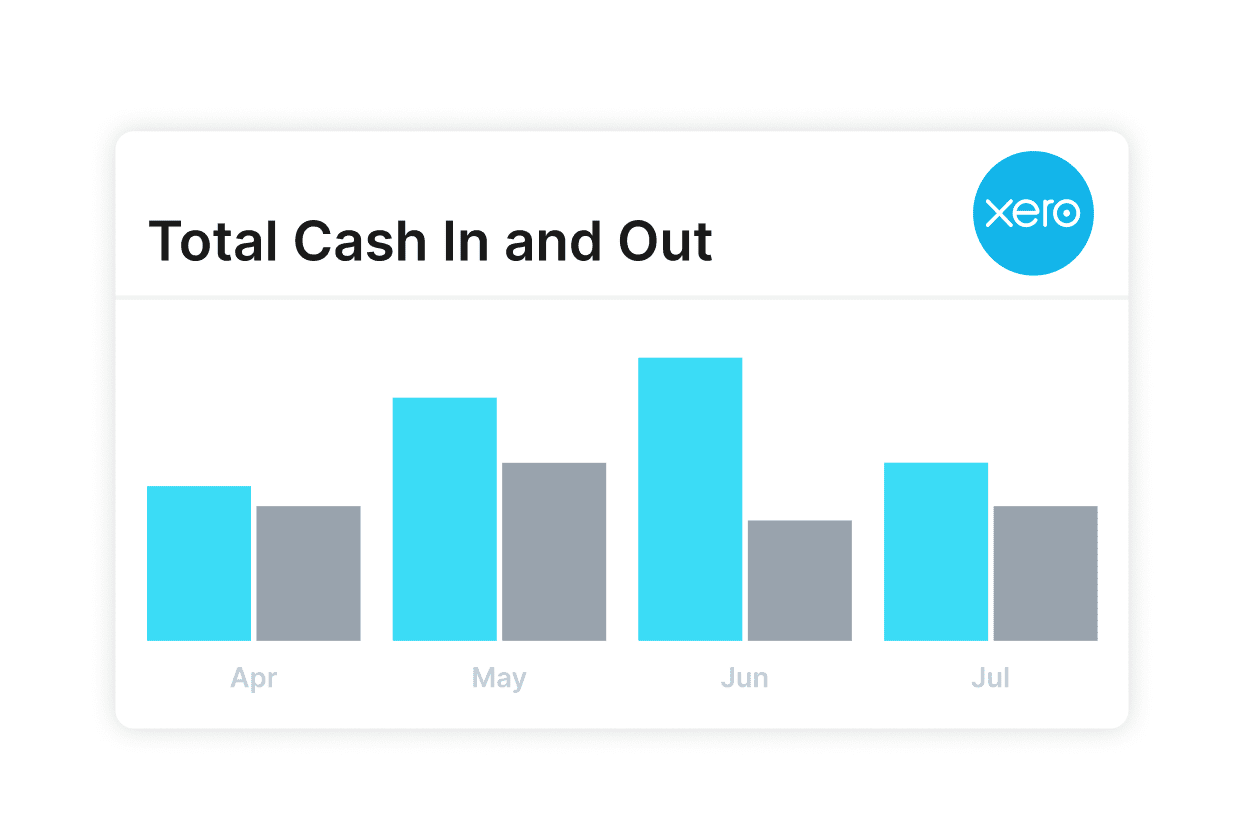

| Integrates with Xero for easy accounting |

Your cash flow, your choice

Our calculator will help you estimate how much you’ll pay per week

See full T&CWe’ll help simplify your admin too

Let Xero do the heavy lifting

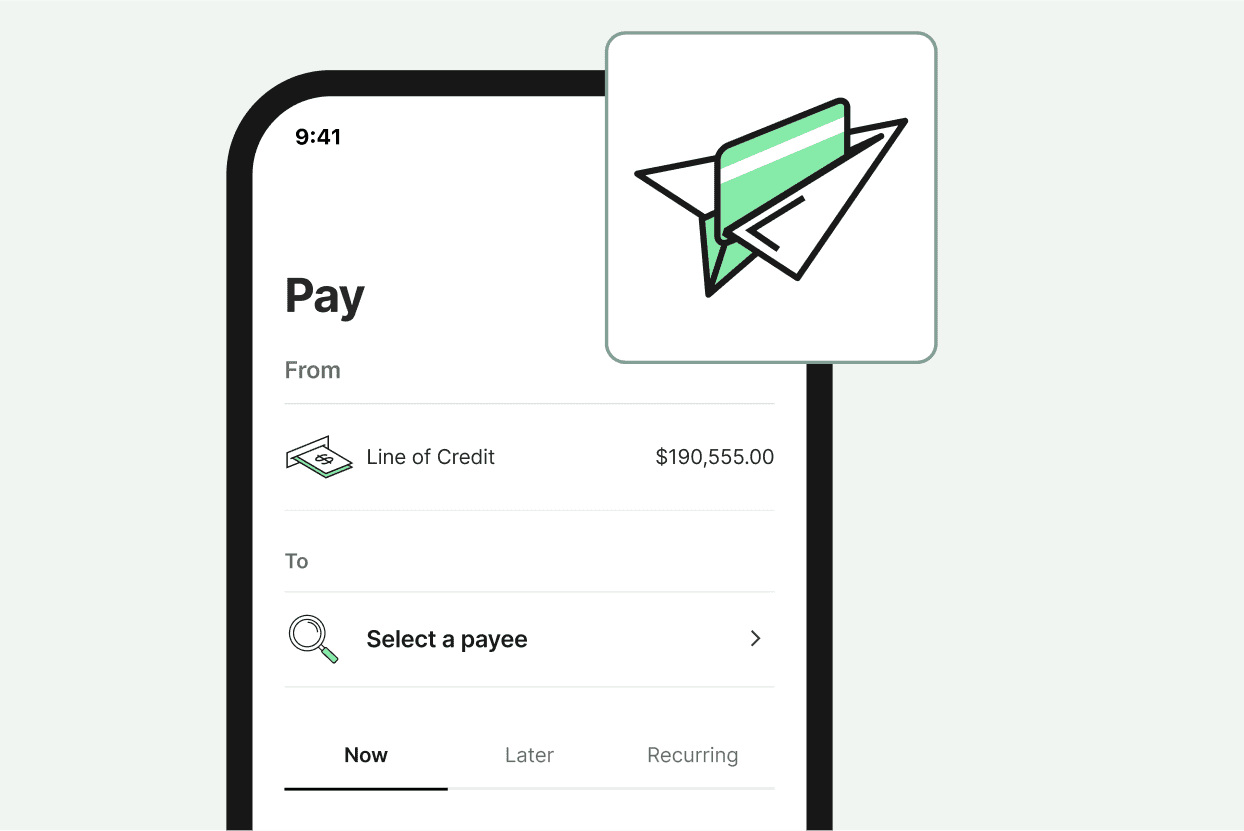

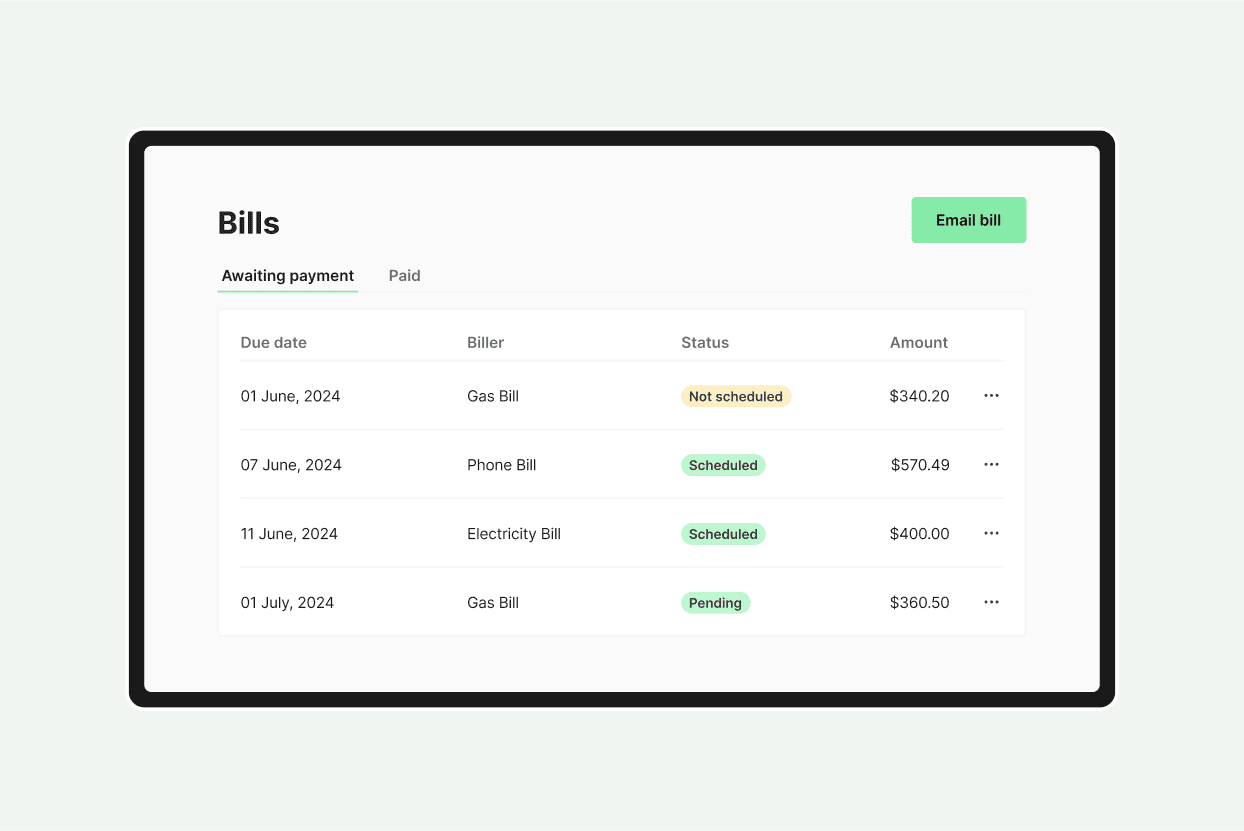

Easily make payments to vendors or suppliers

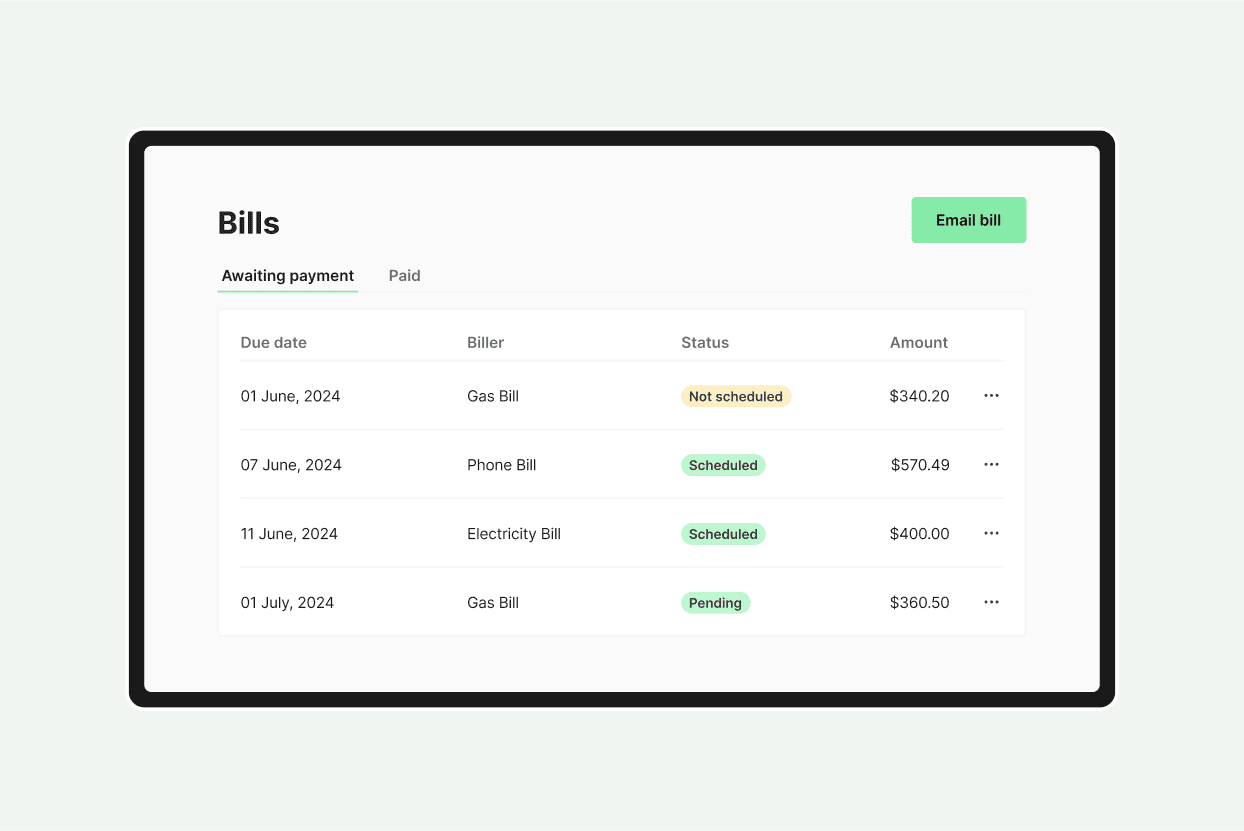

Simplify and automate your bills

Manage your cash flow, wherever your business takes you

Let Xero do the heavy lifting

Simplify and automate your bills

Easily make payments to vendors or suppliers

Manage your cash flow, wherever your business takes you

How to apply

01

Apply in minutes

02

Get a fast decision

03

Access your funds

Apply in minutes

Join the 50,000+ small businesses that we’ve helped today.

Customers making it happen with a Prospa loan

Read customer storiesRecent articles

Stories to inspire you, tips to save you time

FAQs

Common questions answered

With the Prospa Business Line of Credit you pay:

- A Weekly Service Fee is charged weekly from the date of Settlement.

- Interest, but you only pay interest on the funds you have drawn down, and only until you repay those funds. Interest is charged at a fixed rate, calculated daily based on your drawn balance (i.e. the amount of your facility that has been drawn down and not repaid), and interest is charged weekly. The facility limit of your Line of Credit, and your interest rate, will be based on our assessment of your business.

- Every week we will attempt to Direct Debit your business account for the repayment amount owing that week, any unsuccessful attempt will attract a $25 Dishonour Fee, as well as a Late Payment Fee.

Your Line of Credit will be available for a period of 24 months. If you wish to extend your Line of Credit beyond this 24-month period, we will need to re-assess your business situation in case anything has changed.

On or before the end of the 24-month term you can choose from the following options:

- you can apply to renew your Line of Credit for a further 24-month term; or

- you can arrange to close your Line of Credit.

If you elect to renew your Line of Credit for a further 24-month term, we will need to complete a new assessment to check whether there have been any changes in your business. If you are approved, you can also review your facility limit based on your business’s current needs.

If you elect to close your Line of Credit at the end of the term, there are two possible options available to you to repay the outstanding balance:

- you can elect to repay the entire outstanding balance at the end of the term. This can be done in one lump sum payment via BPay.

- if you are eligible, you may elect to repay your outstanding balance on a 52-week repayment plan. This repayment plan will commence immediately after your Line of Credit term finishes. At this time, your access to the facility will be suspended and the outstanding balance of your Line of Credit will be divided into 52 instalments. These instalments will be direct debited from your bank account each week along with that week’s accrued interest and Weekly Service Fee until your outstanding balance is paid down to $0. Interest will accrue on the outstanding balance throughout the 52 weeks at the same rate as your Line of Credit. To be eligible for the 52-week repayment plan you must not be in arrears at the end of your Line of Credit term.

If you do not select an option on or before the date on which the term ends or you apply for and are not approved for a term extension, your Line of Credit will be closed and, if eligible, you will be placed on the 52-week repayment plan.

We will set up an automatic repayment schedule with set weekly repayments over 24 months. The weekly repayment will comprise interest and a portion of principal as well as any applicable fees, such as the Weekly Service Fee.

So that you don’t need to worry about missing a payment, your weekly repayments will be automatically debited from your nominated business bank account.

You can choose to simply pay the set weekly repayments, or you can make additional payments at any time to reduce your drawn balance, thus reducing the amount of interest you pay. It’s up to you.

There are two ways to access and use your Prospa Line of Credit:

- Via the Prospa online portal

- Via the Prospa mobile app

Once you have logged in, you will be able to view transactions, draw down funds to your nominated business bank account, directly pay invoices and suppliers and much more.

Visit our getting started page for more details.

A Line of Credit can be used for almost any business purpose – including activities that help you manage day-to-day cash flow. For example, it could be used for paying staff wages, covering unpaid invoices, buying urgent stock, managing seasonal fluctuations, paying suppliers and much more.

You can apply for a Prospa Line of Credit if you:

- are an Australian Citizen (or permanent resident)

- are over 18 years, own an Australian business (with a valid ABN/ACN)

- Minimum 2 years trading history

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of the loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 1300 882 867, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 1300 882 867.

Other questions?