Unleash business potential at tax-time

- +1% boosted commission rates for all new customers referred and settled.

- No repayments on Prospa business loans up to $500K for the first 6 weeks to eligible Established Small Businesses.

- Exclusive funding offers for registered and accredited Prospa Partners.

Earn an extra 1% commission boost on loans up to $500K

Help your clients realise their business vision sooner with funding and earn yourself an extra +1% commission boost.

Offer valid between 6 May and 30 June 2024 (inclusive). T&Cs apply.

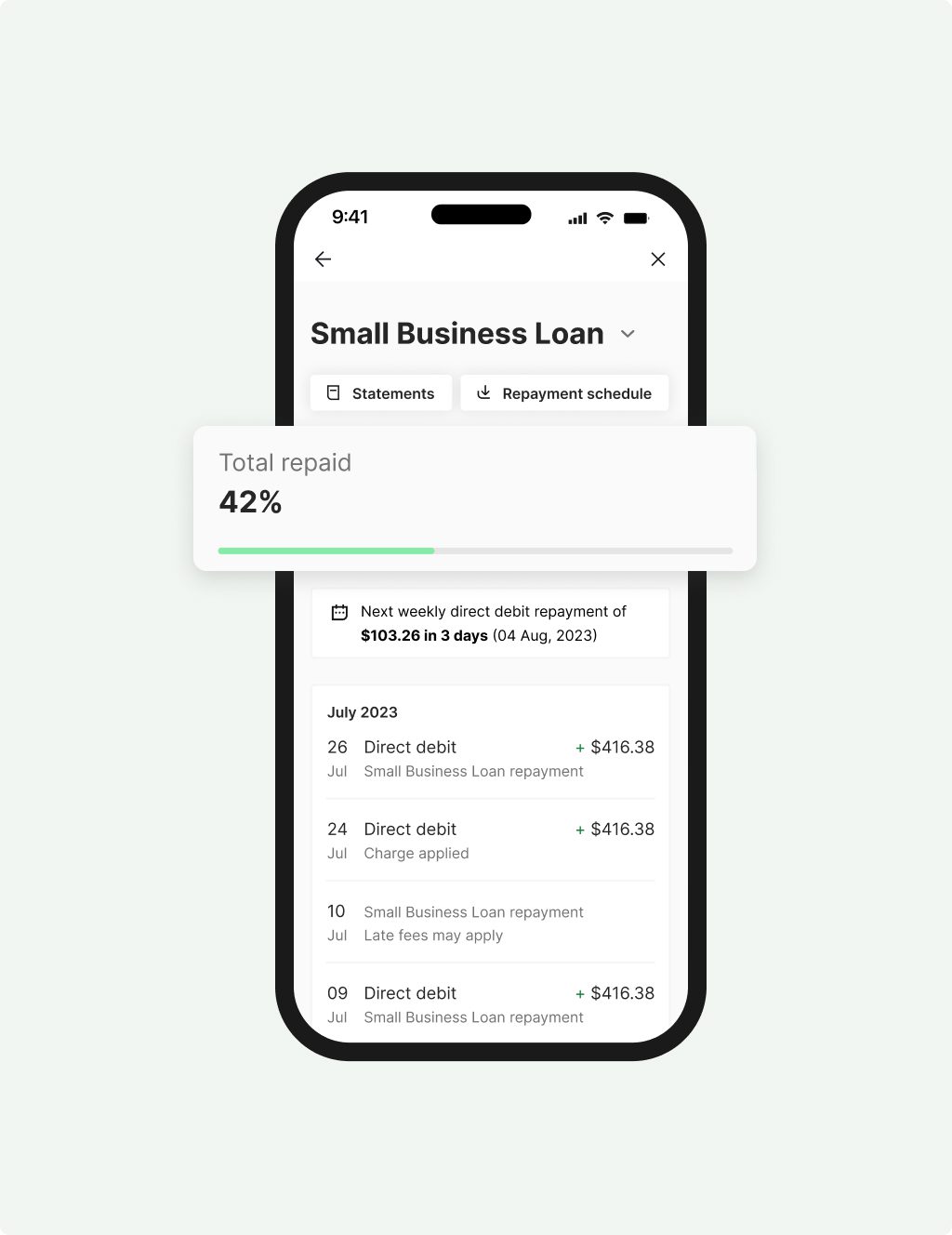

Prospa Small

Business Loan

- Loan amount: $5K – $150K

- Term: 3 – 36 month terms

- Upfront security: No asset security required upfront to access up to $150K in Prospa funding.

- Offer no repayments on Prospa business loans up to $500K for the first 6 weeks to eligible established small businesses.

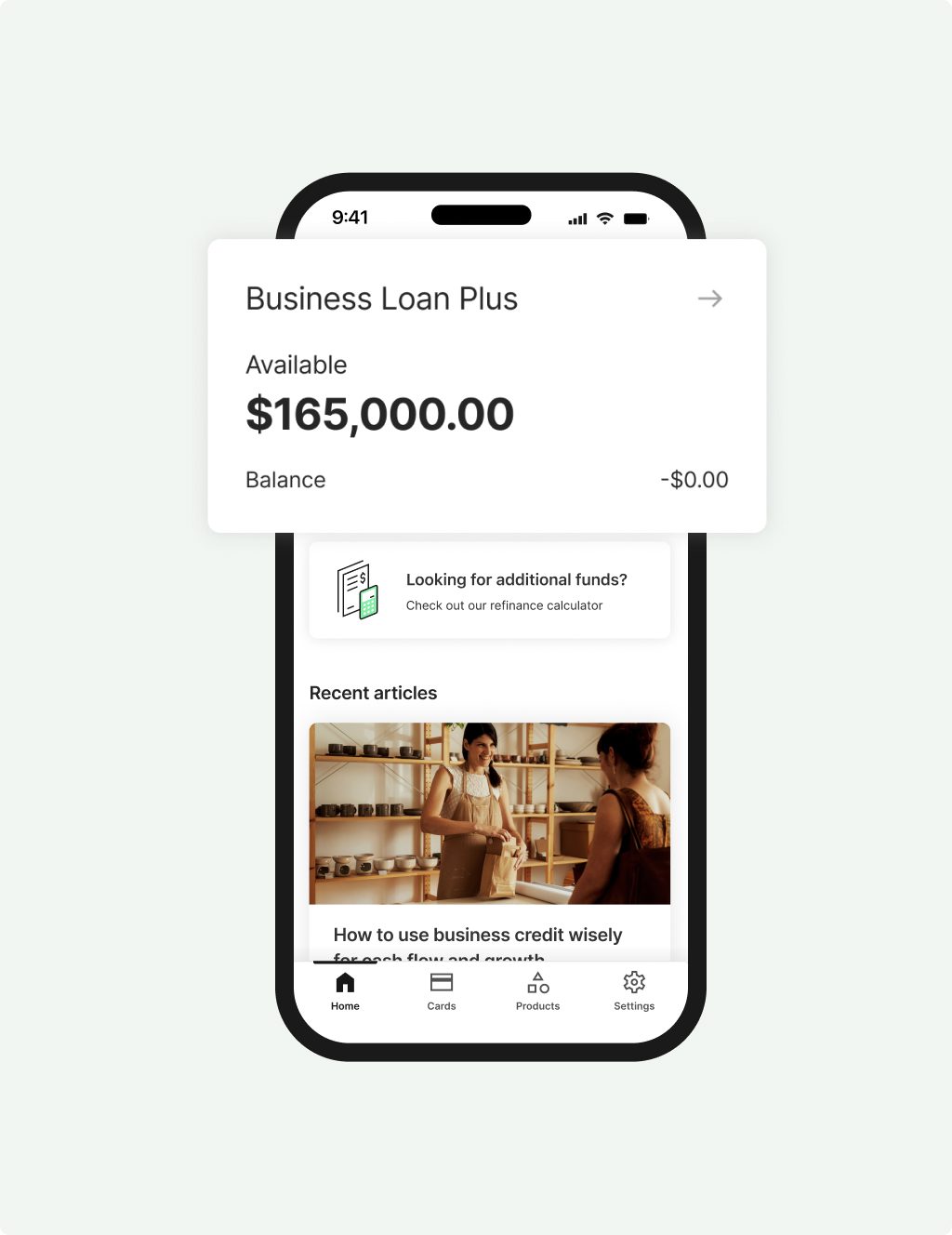

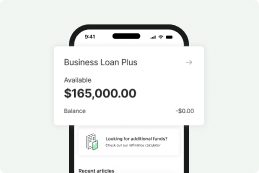

Prospa Business

Loan Plus

Offer your clients larger loans of $150K – $500k and enjoy +1% boosted commission rates for a limited time.

- Loan amount: Above $150K – $500K

- Term: 12 – 36 month terms

- Upfront security: For access to Prospa funding above $150K, we will register security over the business assets on the government’s Personal Property Security Registry (PPSR)

- Offer no repayments on Prospa business loans up to $500K for the first 6 weeks to eligible established small businesses.

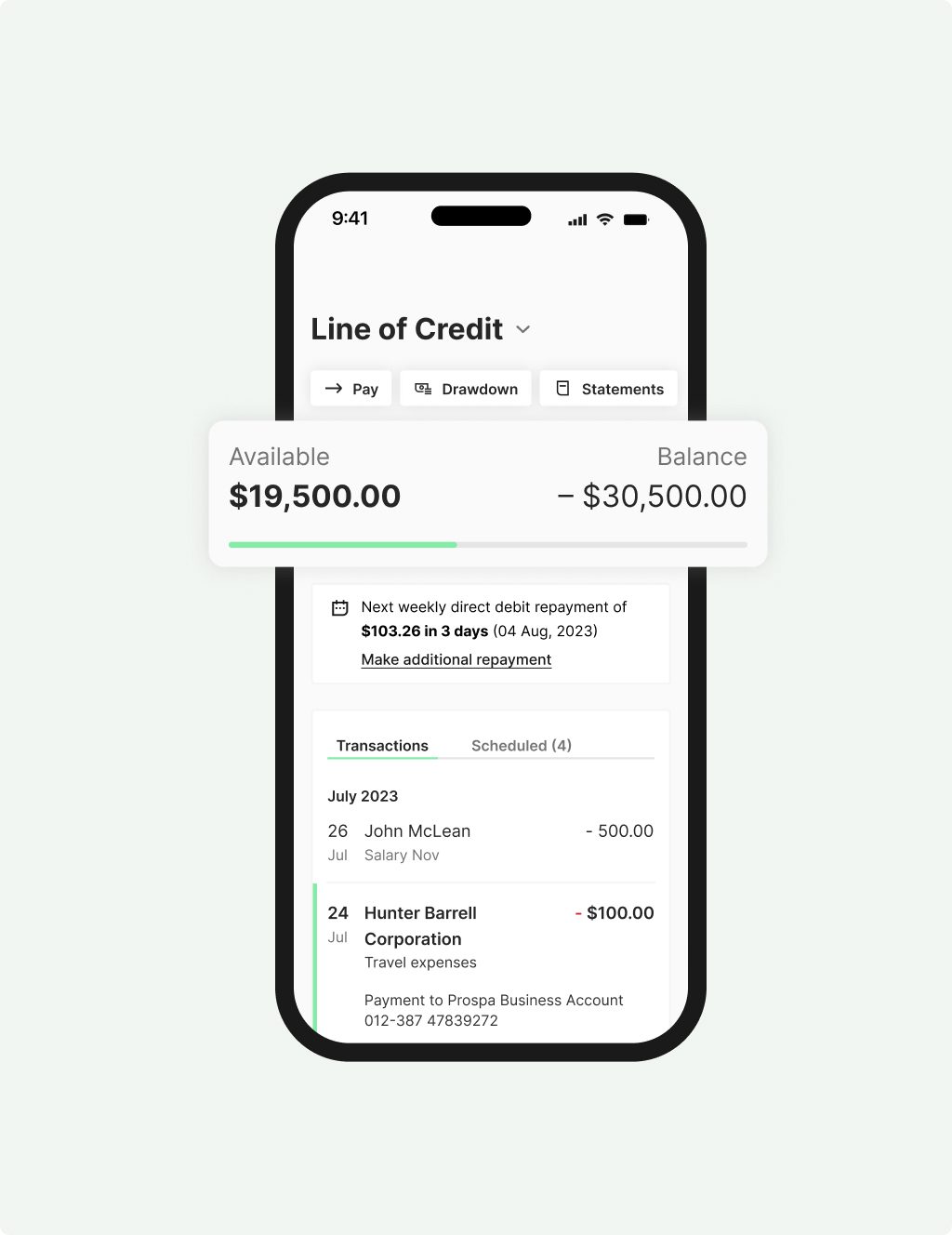

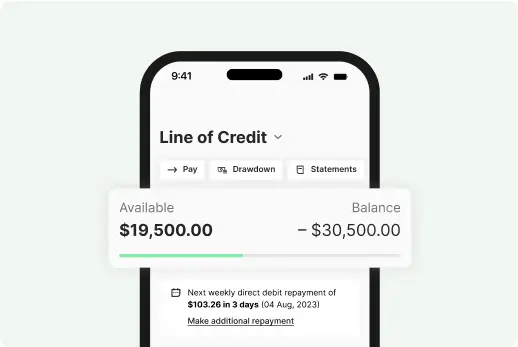

Prospa Business

Line of Credit

Offer your clients ongoing access to $2K – $150k and enjoy +1% boosted commission rates for a limited time.

- Facility amount: $2K – $150K

- Term: Renewable 24-month term

- Upfront security: No asset security required upfront to access up to $150K in Prospa funding.

Support your SME clients with the funds they need

Help your clients take advantage of instant asset write offs, capitalise on end-of-year supplier sales and bring their business vision to life sooner with funding.

It’s easy to make business happen with Prospa. Offer your SME clients fast access to the funds they need and offer no repayments on Prospa business loans up to $500K for the first 6 weeks to eligible Established Small Businesses.

| Minimum eligibility criteria for Prospa funding | Established Small Businesses eligible for 6-week no repayment period offer | |||

| Turnover | > $6K per month, on average | > $100K per month, on average | > $300K per month, on average | > $700K per month, on average |

| Time trading | > 6 months | > 2 years | > 3 years | > 3 years |

| Credit score | – | > 550 | > 650 | > 650 |

| Account conduct | Good | Excellent | Excellent | Excellent |

| Documents | > 12 months Bank Statements | > 12 months Bank Statements | > 12 months Bank Statements | > 12 months Bank Statements |

| Rates (Annual Percentage Rate) | From 29.95% (APR) | From 23.95% to 24.95% (APR) | From 19.95% to 20.95% (APR) | From 17.95% (APR) |

| Rates (Annual Simple Rate) | Estimated from 15.99% (ASR) | Estimated 12.65% to 14.05% (ASR) | Estimated 10.47% to 11.60% (ASR) | Estimated 9.39% to 9.80% (ASR) |

| Building & Trade | From 29.95% (APR) or from 15.99% (ASR)* | From 20.00% (APR) or from 10.49% (ASR)* | From 20.00% (APR) or from 10.49% (ASR)* | From 20.00% (APR) or from 10.49% (ASR)* |

Capture growth in the SME market now

Find, connect and win more business from the Established Small Business segment with a new tier of pricing and offer no repayments on Prospa business loans up to $500K for the first 6 weeks.

Loan and offer eligibility and approval subject to standard credit assessment criteria. Fees, terms and conditions apply.

Invest in your own business with exclusive funding offers

Get approved for your own Prospa Business Line of Credit or Prospa Small Business Loan up to $150K and enjoy our exclusive Partner maximum rates.

Exclusive loan offer

Get approved for a Prospa Small Business Loan up to $150K and enjoy our exclusive Prospa partner estimated maximum rate of 11.99% Annual Simple Rate (21.60% Annual Percentage Rate). Fees, terms & conditions apply.

Discounted Prospa Line of Credit

Get approved for a Prospa Business Line of Credit up to $150K and enjoy our exclusive Prospa partner maximum rate of 19.99% Annual Percentage Rate (APR). Fees, terms & conditions apply.

Marketing material to help you win business

Access free tools and resources to help you engage with referral partners, existing clients and prospects. Enjoy a full range of customisable brochures, emails, social media assets, blog articles and more.

8 Emails

Engage your referral network and existing SME clients with emails designed to address various pain points and start the conversation

25+ Social media assets

Connect with your small business clients and referral partners using the range of social media assets for Facebook, LinkedIn and Instagram.

Full marketing suite

Discover a full range of marketing material to download, customise and use to help you win business. Best of all, it’s free!

Fast & flexible

Offer your clients a range of flexible funding with fast approvals.

Convenient

Submit a scenario online and work with us direct or refer your clients to us for personalised service – either way we will keep you up to date at every stage.

Support

Locally focused BDMs backed by a team of dedicated Business Lending Specialists who get to know your client’s business.

Submit a scenario

Find out if Prospa could be the right solution for your client’s need. Fill in the details below and we’ll get straight back to you.

Thank you

We've received your details. A member of the Prospa team will contact you shortly.

While you wait, register as a Prospa Partner here to speed up the process

Already a Prospa Partner? Log in to the Partner Portal here

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2023 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, SME under $250K Loan of Choice |

| 2023 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, SME over $250K Loan of Choice |

| 2023 | FINNIES Fintech Australia Awards | Winner, Excellence in Business Lending |

| 2023 | MFAA State Excellence Awards, All States | Finalist, State Fintech Lender of the Year |

| 2022 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Short Term Loan of Choice |

Need more info?

1. 6-week no repayment period offer

The 6-week no repayment period offer is available to eligible new and existing customers who apply for a Prospa Small Business Loan or Prospa Business Loan Plus (each a “Loan”) that is approved and settled between 6 May 2024 and 30 June 2024 (inclusive) Customers approved for the offer may choose to make no loan repayments for a period of between 1 and 6 weeks from the Loan settlement date (“No Repayment Period”). During the No Repayment Period, interest will accrue as set out in the Loan contract (“Deferral Interest”). Following the end of the No Repayment Period, Deferral Interest will be paid in equal installments that form part of the regular repayments due on each payment date over the life of the Loan. The offer is only available to eligible businesses established and operating in Australia. The offer is not available in conjunction with any other Prospa offer and it may be withdrawn without notice. Existing customers must have a clear repayment history on previous Prospa products to be eligible and have no current Prospa Loan (unless that Prospa Loan is eligible for refinance). This offer will only be available when refinancing a current loan if at least 20% of the new loan amount consists of fresh capital. For example, refinancing a $100,00 loan requires fresh capital so the new loan total is at least $125,000. Loan and offer eligibility and approval subject to standard credit assessment criteria. Fees, terms and conditions apply.

2. Partner commission offer

Accredited partners will earn an extra 1% commission above the usual rates for new customers settled during the promotional period between 6 May – 30 June 2024 (inclusive) (“Promotional Period”). Offer available on Prospa Small Business Loan, Business Loan Plus, and Business Lines of Credit settled within the Promotional Period. Offer only available to partners registered and accredited with Prospa in Australia and is subject to their Aggregator’s approval to participate (if applicable). The offer is only applicable to “new customers” which is defined as either i) New to Prospa; or ii) New to Partner (existing Prospa customer referred by a new partner); or Existing Prospa customer that hasn’t had a capital product for at least 12 months and the return was initiated by the Partner. Offer is not available for refinancing any existing Prospa capital products. For the Business Line of Credit, eligible partners will receive the additional commission boost after the customer has made the first drawdown. Offer is not available in conjunction with any other partner offer. Prospa reserves the unrestricted right to withhold commission payments if it reasonably considers the Partner has not complied with Prospa’s relevant terms of engagement. The offer is only available in connection with referral of businesses established and operating in Australia. Prospa has the right to withdraw the offer without notice. Customer eligibility and approval is subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants.

3. AU Terms and Conditions Partner Small Business Loan and Business Line of Credit Offers

Offer available to eligible Partners who apply for a new Small Business Loan (SBL) or Business Line of Credit (LOC) approved and settled between 1 November 2023 – 1 November 2024 (inclusive). Partners approved and settled will receive a maximum Annual Percentage Rate (APR) of 21.60% on SBL up to $150K OR a maximum APR of 19.99% on a LOC up to $150K. Offer only available to Partners registered and accredited with Prospa in Australia who are either (i) new customers or (ii) repeat customers with $0 outstanding balance at date of application and clear repayment history on previous Prospa funding solutions. Maximum one loan per partner. Cannot be used in conjunction with any other offer. No commission earned or payable on this offer. Offer may be amended or withdrawn at any time without notice. Eligibility and approval subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants. Fees, terms & conditions apply.