In this guide we will cover

For small business owners and startup entrepreneurs, having sufficient working capital is essential to ensure smooth day-to-day operations, business growth and navigate financial challenges. Understanding and optimising working capital can make the difference between thriving and merely surviving in the Australian market, providing the liquidity and flexibility needed to respond to market demands and sustain long-term success.

- What is working capital?

- Working capital Formula & Components

- Working capital management

- Why working capital is important?

- Tools & techniques to use

- How to improve working capital

What is working capital?

The term working capital refers to the difference between current assets and current liabilities – it’s basically the funds (or potential funds) available for a business to use to support day to day operations.

A business’s working capital can be quickly determined using a simple working capital formula. The results are an important indicator of the financial health of a business, which is something that lenders look at when they are deciding on how much you can borrow.

FAQs

Working Capital FAQs

High working capital can be a good thing as it indicates that a company has enough short-term assets to cover its short-term liabilities. This implies financial stability and the ability to invest in growth opportunities. However, excessively high working capital might suggest inefficiencies, such as excess inventory or receivables, which could be better utilized elsewhere.

Low working capital doesn’t necessarily mean bankruptcy, but it can be a warning sign. Insufficient working capital can indicate liquidity issues, making it difficult for a company to meet its short-term obligations. This could lead to financial distress if not managed properly, but companies can take steps to improve their working capital and avoid bankruptcy.

Working capital and cash flow are related but distinct concepts. Working capital measures the difference between a company’s current assets and current liabilities, indicating short-term financial health. Cash flow, on the other hand, tracks the actual inflows and outflows of cash over a period, forecasting cashflow and reflecting the company’s ability to generate cash to fund operations, pay debts, and invest in growth. While positive working capital indicates good liquidity, positive cash flow shows the company is generating enough cash to sustain and grow its operations.

Manage short-term financial obligations and maintain smooth operations

Working capital formula

Working capital formula

Working Capital=Current Assets−Current Liabilities

These are assets that are expected to be converted into cash within a year, such as cash and cash equivalents, accounts receivable, and inventory.

These are obligations the company needs to settle within a year, such as accounts payable, short-term debt, and other short-term obligations.

Positive Working Capital: Indicates financial health, ability to cover short-term obligations, and potential for growth investments. Example: Apple Inc. with $100 billion positive working capital.

Suggests liquidity issues, difficulty in meeting short-term obligations, and potential need for external financing. Example: XYZ Retail with $20,000 negative working capital.

Working capital formula

Working capital formula (or net working capital formula) is a great way to measure a company’s short term liquidity and gives a clear understanding of what assets are left after short-term liabilities have been finalised.

Financial analysts use the working capital formula and working capital ratio (another quick ratio calculation) when looking at a business’s balance sheet to determine the health of the business and to understand the net working operating capital of the business at any point in time. When a business understands the relationship between assets and current liabilities, there’s a clearer picture of what’s possible in the short and long term. It allows the business to continue day to day operations with confidence, and plan ahead for future growth.

Understand How to calculate Working Capital through this example

Let’s consider a hypothetical company to understand how working capital is calculated:

Current Assets:

Cash: $50,000

Accounts Receivable: $70,000

Inventory: $30,000

Total Current Assets = $50,000 + $70,000 + $30,000 = $150,000

Current Liabilities:

Accounts Payable: $40,000

Short-term Loans: $20,000

Total Current Liabilities = $40,000 + $20,000 = $60,000

Using the working capital formula:

Working Capital = Current Assets – Current Liabilities

Working Capital = $150,000 – $60,000 = $90,000

Explaining This Example:

In this example, a business has a working capital of $90,000. This positive working capital indicates that the company has enough short-term assets to cover its short-term liabilities, suggesting good financial health and liquidity. It means this fictitious business is well-positioned to cover its immediate obligations and invest in short-term growth opportunities.

Calculate Your Working Capital Needs

Strategies for Effective Working Capital Management

Effective cash management is vital for optimizing cash flow and ensuring financial stability. By efficiently managing receivables and payables, a company can improve liquidity and handle unexpected expenses.

- Optimise cash flow by managing receivables and payables efficiently.

- Maintain a cash reserve to handle unexpected expenses.

Managing receivables effectively is key to maintaining healthy cash flow. Implementing strategies to improve collections and establishing clear credit policies can help manage customer payments.

- Implement strategies to improve collections, such as offering early payment discounts.

- Establish clear credit policies and terms to manage customer payments effectively.

Optimal inventory management ensures that a company maintains the right balance of stock, avoiding both excess inventory and stockouts. Techniques like just-in-time inventory management can be highly effective.

- Use techniques like just-in-time inventory management to maintain optimal inventory levels.

- Conduct regular inventory audits to avoid excess stock and stockouts.

Managing payables strategically is essential for maintaining liquidity and avoiding unnecessary costs. Negotiating favorable terms and scheduling payments effectively can help achieve this.

- Manage payables by negotiating favorable payment terms with suppliers.

- Schedule payments strategically to maintain liquidity without incurring late fees.

How often should a business look at its working capital?

The frequency of calculating working capital depends on the nature of the business and its operational requirements. Here are some general guidelines:

- Monthly: For most businesses, calculating working capital monthly provides a good balance between regular monitoring and operational practicality. This frequency allows companies to identify trends, adjust strategies, and address issues promptly.

- Quarterly: Some businesses, especially those with stable and predictable cash flows, may find quarterly calculations sufficient. This timeframe can still provide valuable insights without the need for constant monitoring.

- Weekly or Daily: In highly dynamic industries or during periods of financial uncertainty, more frequent calculations (weekly or even daily) may be necessary. This approach helps in making quick decisions and maintaining tight control over cash flow.

Ultimately, the frequency should be tailored to the specific needs and circumstances of the business. Regular calculation and analysis of working capital enable businesses to maintain financial health, optimize operations, and support strategic planning.

Tools and Techniques to Optimise Working Capital

- Utilise tools like QuickBooks, Xero, and Sage to streamline working capital management and gain real-time insights into financial performance.

- Use the balance sheet template to create a snapshot of your bottom line – and insights on how to improve it – our Balance Sheet solution lets you calculate your working capital and liquidity

- Use the cash flow forecast template to help calculating your cashflow that aids financial health and supports your working capital

- Monitor key ratios such as the current ratio and quick ratio to assess working capital efficiency and liquidity.

- Regularly review and update financial forecasts.

- Use conservative estimates in projections to avoid unexpected shortfalls.

- Involve multiple departments in the planning process to get a comprehensive view of working capital needs.

Need to improve your working capital quickly?

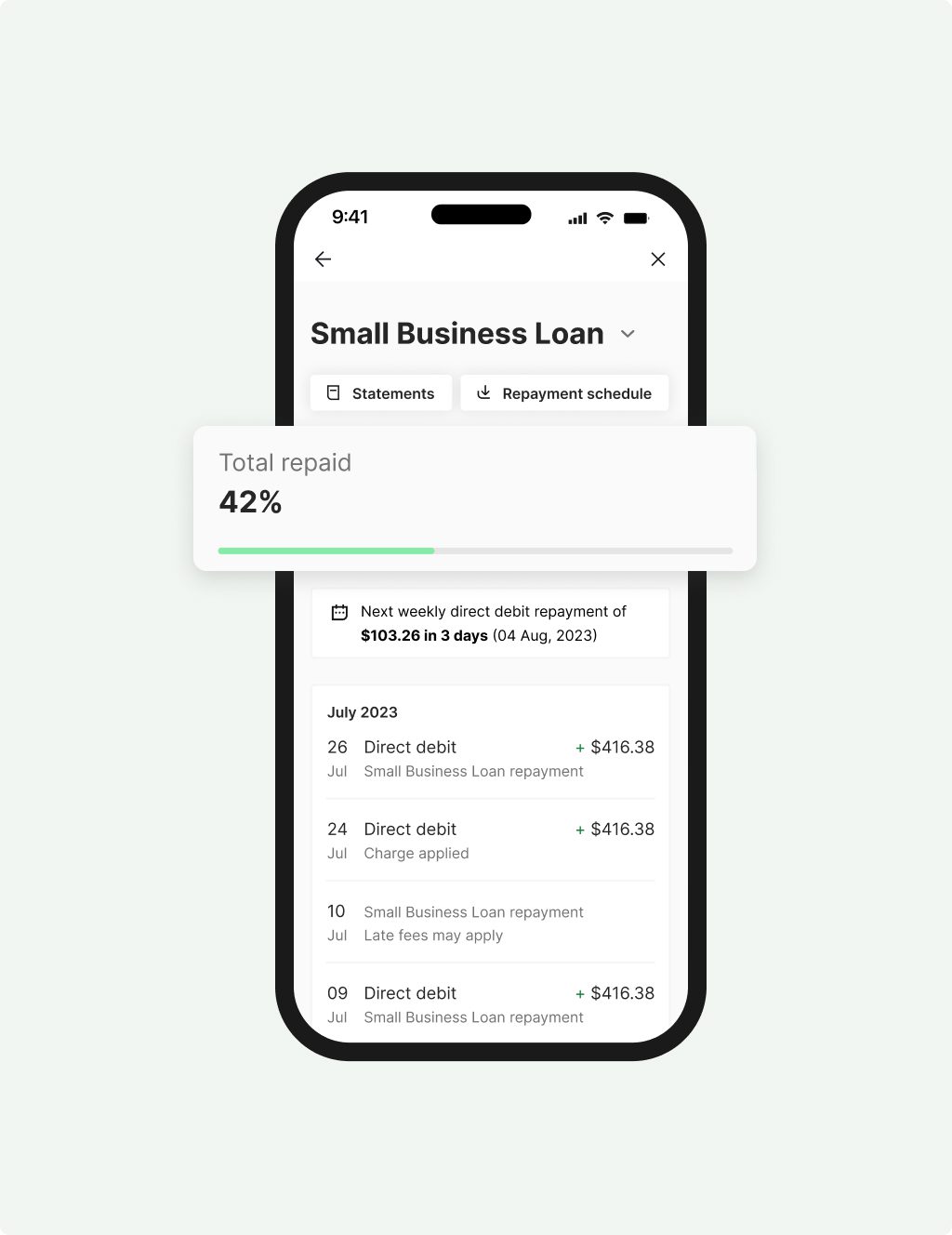

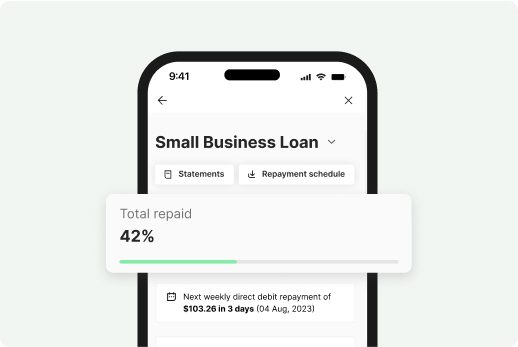

Support your working capital with our Small Business Loan solution

Most businesses don’t always have access to large cash surpluses, but the working capital formula also takes into consideration the value of resources and assets owned by the business that can be converted to cash relatively quickly. However, if your business has a long term liability and needs to boost working capital quickly, there are other options available. Prospa offers a small business loan for larger, one-off purchases or a line of credit that is perfect to support your business cash flow in the short term while you focus on growth over the long term.

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

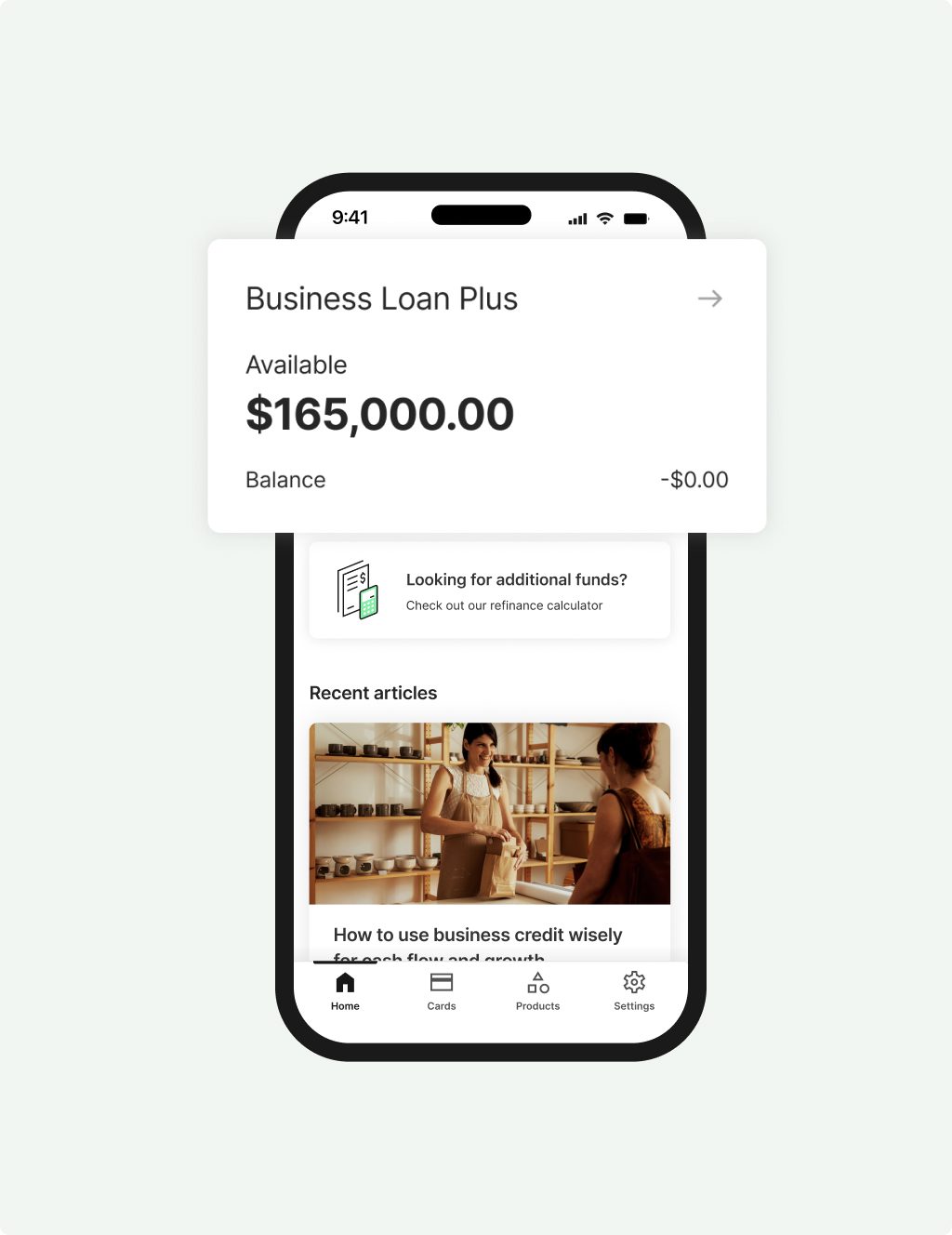

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

FAQs

Frequently asked questions

To work out your working capital, there’s a simple calculation called the ‘Working Capital Formula’. It’s basically Current Assets minus Current Liabilities. Working capital formula (or net working capital formula) is a great way to measure a company’s short term liquidity and gives a clear understanding of what assets are left after short-term liabilities have been finalised.

Financial analysts use the working capital formula and working capital ratio (another quick ratio calculation) when looking at a business’s balance sheet to determine the health of the business and to understand the net working operating capital of the business at any point in time. When a business understands the relationship between assets and current liabilities, there’s a clearer picture of what’s possible in the short and long term. It allows the business to continue day to day operations with confidence, and plan ahead for future growth.

When the working capital formula shows a positive working capital – the business is in good financial health. That means there’s sufficient liquid assets to pay off short term debt and to invest in business growth. However, when the working capital formula calculation shows a negative working capital, the business may be in trouble in the short term.

If your working capital formula points to a negative outcome, you could consider supporting cash flow by borrowing funds. There are many options available if you’re comfortable your business can support short term debt. The Prospa Business Line of Credit offers ongoing access to funds between $2K and $150K. You can use and reuse as often as you like and you only pay interest on what you use. Talk to our friendly customer service team today about finance to support your net working operating capital.

If you’d like to invest in your business, but you don’t have the assets or working capital to pay up front, you can borrow large amounts from many financial services providers. Prospa offers a small business loan of between $5K and $150K with funding possible in 24 hours. Compared to a line of credit this could be considered long term debt – but terms range from 3 – 36 months. Improve the financial health of your business today, talk to our friendly customer service team about the Prospa small business loan for investing in business growth and increasing trade.

If you’re looking to get fast access to business finance to help with net working operating capital (or cash flow) start by filling in Prospa’s no obligation . Once we receive the form, one of our friendly business lending specialists will get right back to you to finalise the application and answer any questions you might have. You’ll get a fast decision and funding is possible in 24 hours to approved applicants. With such a hassle-free experience, it’s no wonder more and more small businesses are turning to alternative lenders like Prospa to help them while they turn long term liabilities into working capital.

Once you’ve had a look at the results from your working capital formula, and you decide you need finance, the application process with Prospa takes around 10 minutes and starts with an online form. It’s a good idea to have handy your ABN, driver licence details, basic details about your business (operating years, structure & turnover) & trading business bank account details. For small business loans over $250K, you’ll also need some basic financial statements, like a P&L and cash flow.

Other questions?