Types of Business Loans

Choosing the right business loan is key to unlocking new opportunities, fueling growth, and taking your business to the next level. Our flexible loans are designed to suit any business type.

- Get access to $150K with fast Small Business Loans

- Apply for up to $500K through Business Loan Plus

- Secure flexible funding with a Business Line of Credit

Types of Business Loans for Small Business Owners

Finding the right financing option is essential for the success of your small business. With a range of business loan types available, you can choose a solution that best fits your needs, whether you’re seeking to enhance operational efficiency, pursue new opportunities, or navigate unexpected expenses. Understanding each type of business loan is essential for making informed decisions that shape your financial future.

Explore your options below and connect with a Prospa specialist today to determine the best loan type for your business needs.

Traditional Bank Term Loans

These are fixed-term loans from banks that provide a lump sum for your business. You’ll repay it over a set period with fixed or variable interest rates, making it suitable for larger, established businesses seeking long-term financing.

Eligibility:

Typically requires a well-established business with a strong credit history, consistent cash flow, and collateral.

Business Lines of Credit

Think of this as your flexible credit option. A Business Line of Credit offers flexible funding, letting you draw up to a limit and pay interest only on what you use. It’s perfect for managing cash flow or unexpected expenses.

Eligibility:

Requires an ABN, proof of revenue, and strong creditworthiness. No collateral is typically needed.

Equipment Finance

Need new equipment? This loan is specifically designed for purchasing machinery or vehicles, allowing you to acquire what you need right away and spread the cost over time.

Eligibility:

Requires a valid ABN, proof of revenue, and a quote or invoice for the equipment. The equipment itself often serves as collateral.

Invoice Financing

This type of loan allows you to unlock cash tied up in unpaid invoices. You can borrow against your outstanding invoices, giving you quick access to funds while waiting for customers to pay.

Eligibility:

Requires an ABN and a history of unpaid invoices, which act as collateral. Lenders typically review your debtor history and cash flow.

Overdraft Facilities

An overdraft provides a financial safety net, allowing you to withdraw more than your account balance for short-term needs.

Eligibility:

Requires an ABN, proof of business trading, and usually a good credit history. Overdrafts are linked to business accounts and may carry higher interest rates if unsecured.

Unsecured Business Loans

These loans don’t require collateral, so you can borrow based on your creditworthiness and cash flow without putting your assets at risk. Quick access to funds makes them great for seizing new opportunities.

Eligibility:

Requires an ABN, a minimum monthly turnover, and strong creditworthiness. No collateral is needed.

Secured Business Loans

A secured loan lets you use assets as collateral, often offering lower interest rates and access to larger amounts for growth.

Eligibility:

Requires an ABN, business assets (e.g., property or equipment), and good credit. Proven business performance may help secure better terms.

Trade and Import Finance

For businesses involved in international trade, this financing helps manage costs associated with importing and exporting goods, ensuring smooth cash flow while waiting for payments or shipments.

Eligibility:

Requires an ABN, proof of trading history, and documentation related to the import/export transaction. Assets like inventory or receivables may be used as security.

Working Capital Loans

These short-term loans help cover day-to-day operational expenses like payroll or rent, without straining your cash flow.

Eligibility:

Requires an ABN, proof of regular business revenue, and strong business cash flow to demonstrate repayment ability. No collateral is typically needed.

Fit-out Finance

Planning to renovate or refurbish your business premises? This loan is tailored for that, helping you create an ideal workspace without straining your finances.

Eligibility:

Requires an ABN, a quote or proposal for renovation, and financials showing the ability to handle repayments.

Merchant Cash Advances

Need quick cash? A merchant cash advance provides upfront funds in exchange for a percentage of your future sales, offering fast access to money based on projected revenue.

Eligibility:

Requires consistent credit card or point-of-sale transactions. The loan amount is based on future sales projections.

Business Credit Cards

These cards offer a revolving credit line for business expenses, allowing flexible spending while helping manage cash flow effectively.

Eligibility:

Requires an ABN and proof of financial stability. Approval depends on creditworthiness, and no upfront collateral is required.

01

Apply in minutes

Apply in minutes

02

Get a fast decision

Get a fast decision

03

Access your funds

Access your funds

What Loan Types Are Best for Specific Business Needs?

Cash Flow Management:

Prospa Business Line of Credit: Ideal for managing cash flow, this flexible facility allows you to draw funds as needed, with no asset security required. You only pay interest on the amount used, making it perfect for covering short-term or unexpected expenses.

Business Expansion:

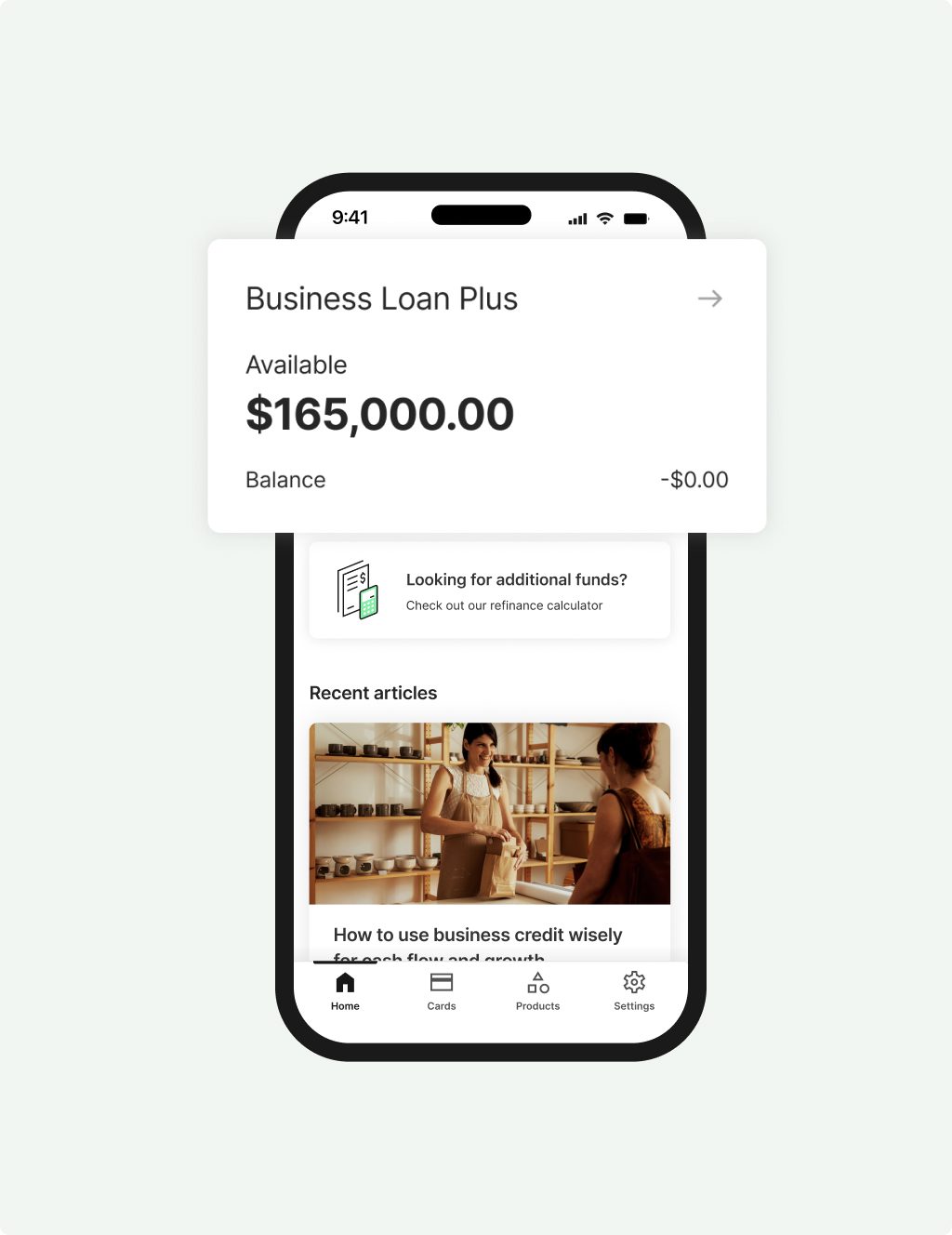

Prospa Business Loan Plus: Best suited for larger projects like expansions or renovations, this loan offers between $150K and $500K. Property ownership is required as collateral, providing access to higher funding amounts for long-term growth.

Unexpected Expenses and General Business Needs:

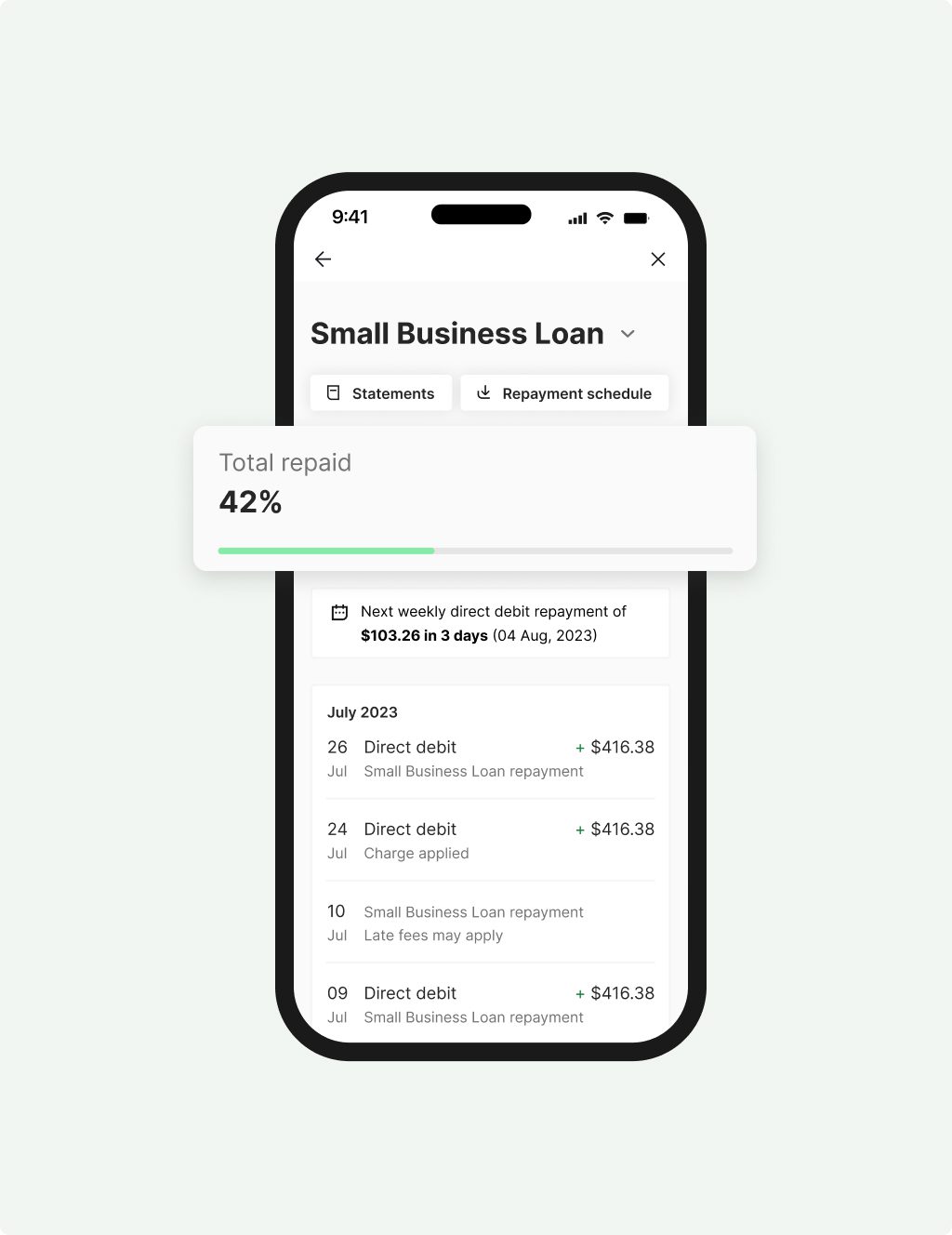

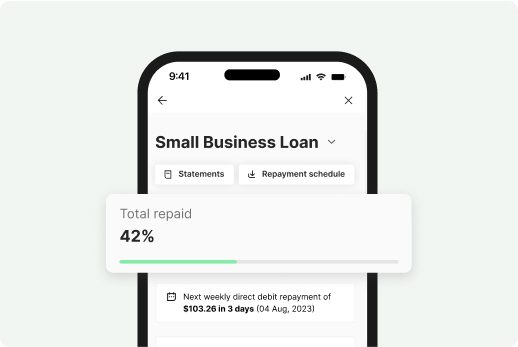

Prospa Small Business Loan: Offering loans up to $150K with no upfront security, this option is great for covering unexpected expenses, boosting cash flow, or investing in equipment. It’s a quick and flexible solution for small business owners needing fast access to funds.

Now that you’ve explored the various types of business loans available, take the next step to navigate cash flow challenges, fund growth, and invest in your business’s future with Prospa. Apply today or speak with a lending specialist to get started.

Why Choose Prospa for Your Business Financing Needs

While there are many lenders out there and many different loan types, choosing Prospa for your business financing needs means partnering with a lender that understands the unique challenges faced by small businesses. Prospa offers a streamlined application process and flexible solutions that provide a better alternative to traditional financing options. We empower you to make informed financial decisions that drive growth and stability. Unlike the lengthy approval times and strict eligibility criteria often associated with traditional loans, Prospa is dedicated to supporting your journey with quick approvals and a focus on your success.

Take action today - check out our business loan calculator and empower your growth.

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Business Loan Requirements and Eligibility

Prospa makes applying for a business loan simple and straightforward. For most loans, the following requirements apply:

- Be an Australian citizen or permanent resident

- Be over 18 years old

- Have a valid ABN and a minimum monthly turnover of $6K

- For Plus loans: 3 years of trading history, $1 million annual turnover, and property ownership

The documentation requirements are minimal. All you need is an ABN, trading figures, and bank statements for loans over $150K. No lengthy business plans are required!

Ready to apply? Get started and experience the Prospa difference.