Sole Trader Business Loan

Wondering if you can get finance as a sole trader? Have a chat with our specialists to find out if you’re eligible and discover what you could borrow with Prospa.

- Borrow from $5K to $500K

- 12 – 36 month loan terms

- Funding possible in 24 hours

- No property security required upfront to access

Prospa funding up to $150K

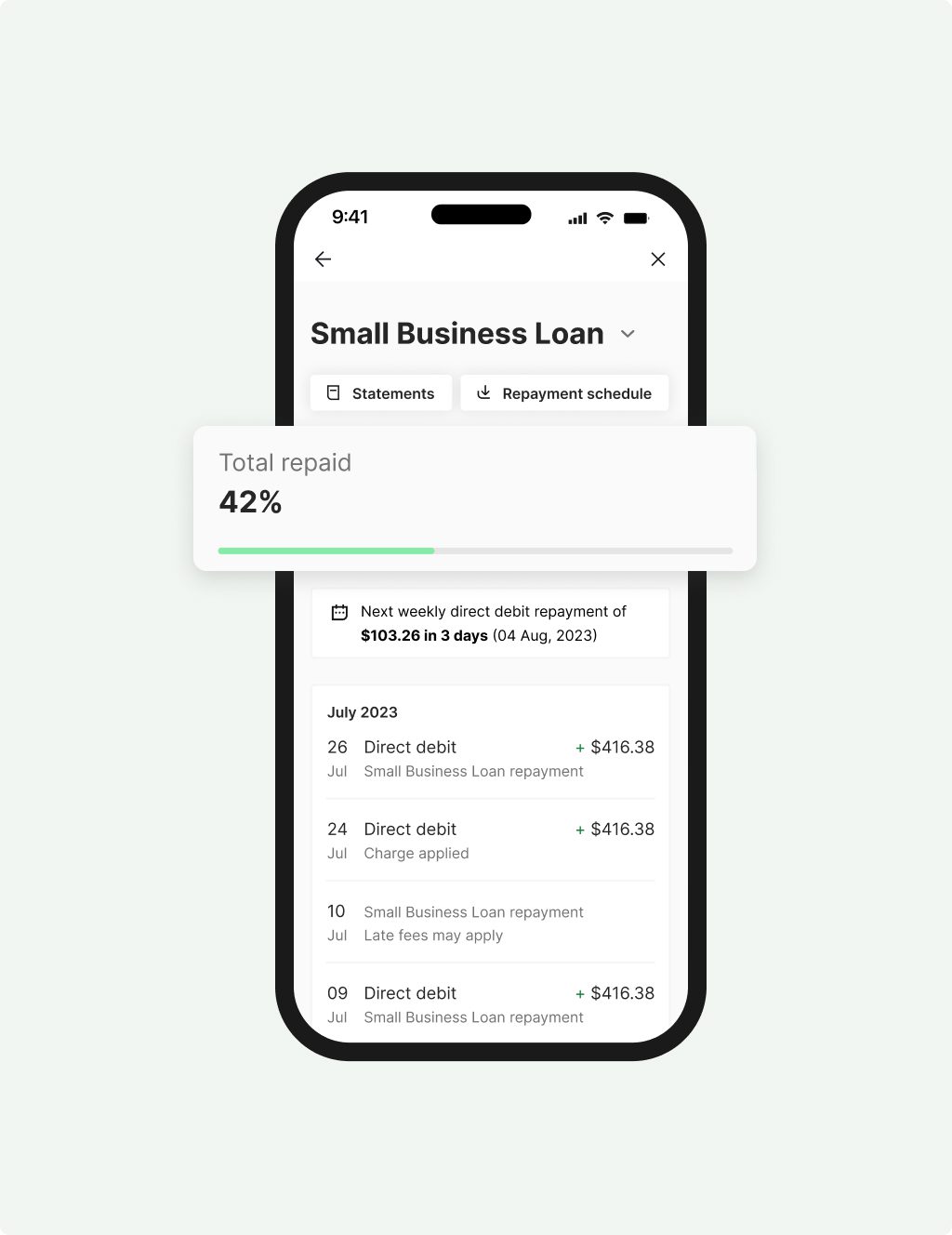

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

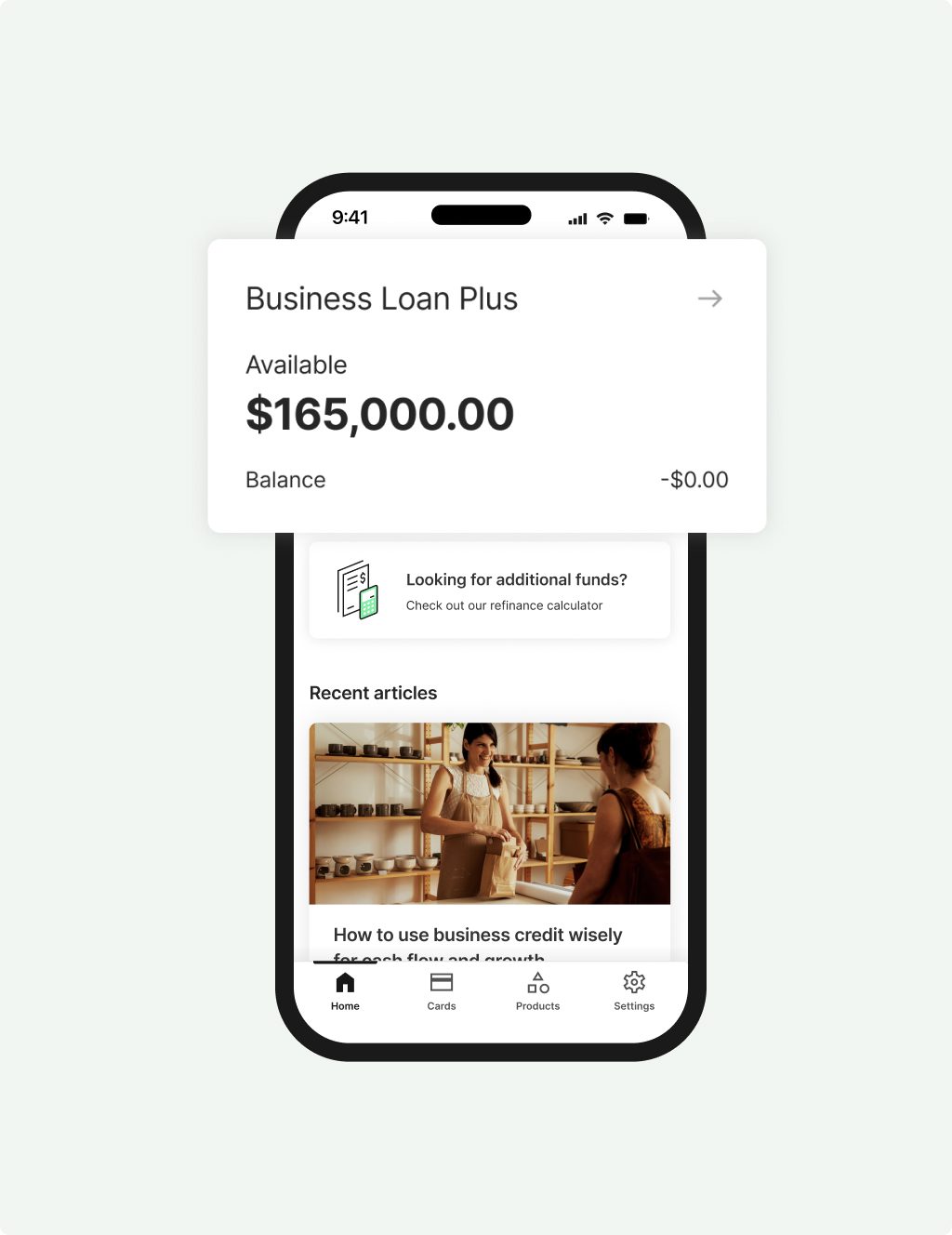

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Fast application process for funding a sole trader business

A sole trader business loan is a type of business loan. It is designed to help small businesses take advantage of growth opportunities or maintain healthy day to day cash flow. Sole traders can use business loans to expand and explore new markets, launch new products and roll out important marketing campaigns, update or upgrade existing capital assets and much more. If you are approved for a sole trader business loan you will receive a lump sum cash injection directly into your business bank account, which can be used to help create long term stability and growth. Talk to Prospa about how a sole trader business loan might be able to help your business.

Prospa has already funded thousands of businesses in Australia and New Zealand through different types of loans – including business loans and business lines of credit. We understand that every business is different and try to match a funding product to the individual needs of our business customers. We work with approved individual businesses or sole traders and tailor the loan product, setting up fixed daily or weekly repayment terms. We are committed to maintaining our 4.8/5 TrustScore, by finding new and innovative ways to ensure that the application process for our business loans is accessible and hassle-free. You can complete your loan application online for a sole trader business loan with Prospa in as little as 10 minutes.

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Customers making it happen with a Prospa loan

Read customer storiesAwards, thanks to your support

It’s nice to know we’re doing something right.

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |

FAQs

Frequently asked questions about Sole Trader Business Loans

DBA refers to ‘doing business as’ and is related to the trading name of your small business. As a sole trader, your business in Australia is registered automatically under your own name. For example, if you create a car wash business as a sole trader then your business name will be your own name. If you wish to trade under a specific business name, then you’ll need to register this business name on the Australian Business Register. Choosing a business name is a great way to help establish your brand. You could even create memorable marketing materials with your business name and contact details to help prompt customers so they know to return to your business.

A sole trader business loan from Prospa can be a great way to get the funds your business needs to launch a marketing campaign with loans for sole traders available for between $5K and $500K and with loan terms of between 3 and 36 months.

Apply now.

Stimulus loans are among a range of support packages many governments have launched in order to help small businesses (including sole traders) remain afloat throughout the COVID-19 economic crisis. In Australia, the Federal Government has created the Coronavirus SME Guarantee Scheme, under which the Government is guaranteeing 50 per cent of new loans issued by approved lenders to eligible small businesses. For the most up to date information about the Australian Federal Government’s current Coronavirus business support for businesses (including sole traders), please follow this link.

Prospa continues to support local Aussie small businesses throughout this period with our range of business loans for sole traders and other small businesses. We work hard to ensure that the application process for our loan products is fast and hassle-free, and, if approved, can tailor your business’ loan repayments to help support your cash flow and business operations. Small business loans might be able to help cover cash tied up in outstanding invoices as well as support other areas of your business. Invoice financing options can sometimes be less flexible than generic lump sum business loans such as a sole trader business loan. Ask us about our range of financing options or apply now.

We are proud to offer our customers access to a fast and hassle-free online application process for our range of finance products, including a sole trader business loan.

To begin an application for a business loan of $250K or less you will need:

Your driver’s licence number

Your ABN

Your business BSB and bank account number

For loan applications requesting more than $150K you will also need basic business financial statements such as your P&L and cash flow.

Applications take as little as 10 minutes to complete online and when you apply within standard business hours you may receive a response within the hour. For applications approved and settled before 4pm on a business day, it is possible to receive your new funds into your business bank account the very next business day.

As a sole proprietor, you can apply for a small business loan with Prospa if you meet certain criteria and can demonstrate a healthy monthly turnover.

Prospa is committed to lending prudently which means that we will evaluate key factors of your business such as your credit history and income when you apply for a business loan. One of the application criteria for a sole trader business loan relates to your business monthly turnover and this criterion must be met in order to qualify for an small business loan. Business applicants must be able to demonstrate a minimum monthly turnover of $6K over the most recent 6 months. This information is used to assess whether your business is capable of supporting the loan repayments. Other criteria exist, but you should speak to Prospa to find out more or you can simply apply now.

When you apply for a small business loan (sometimes called a sole trader business loan) at Prospa, you enjoy a fast and easy application process completed online and in generally just 10 minutes. For amounts under $150K you will need to supply your driver’s licence number, ABN and your business bank account details. We use these details combined with our ‘credit decision engine’ to quickly evaluate new loan applications and possibly return an answer within the hour. If you would like to talk to a business lending specialist to discuss your options, please feel free to contact us Monday to Friday 8.30am to 7pm (AEST) on 1300 437 594.

If you think you have everything you need to begin your application then apply online today.

Other questions?