Finance options to keep small business moving

As Australia’s #1 online lender to small business, we offer small business lending opportunities to help keep things moving in the right direction. At Prospa, we are passionate about supporting Australian small businesses and we want to help you grow and succeed.

We are more than just a small business lender. A team of Business Lending Specialists available to support you and help make your experience with your Prospa Small Business Loan or Business Line of Credit as smooth as possible.

Small Business

Loan

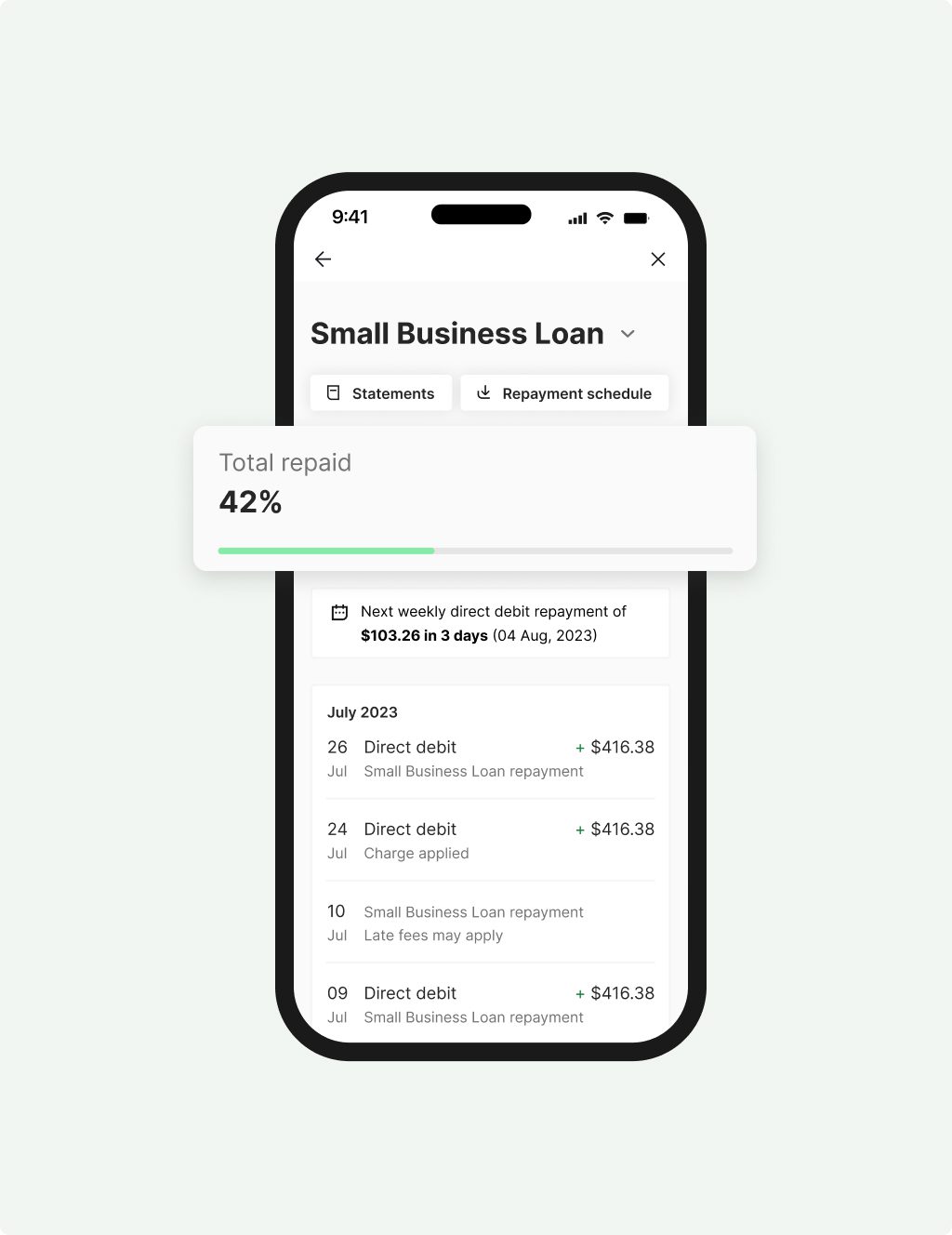

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

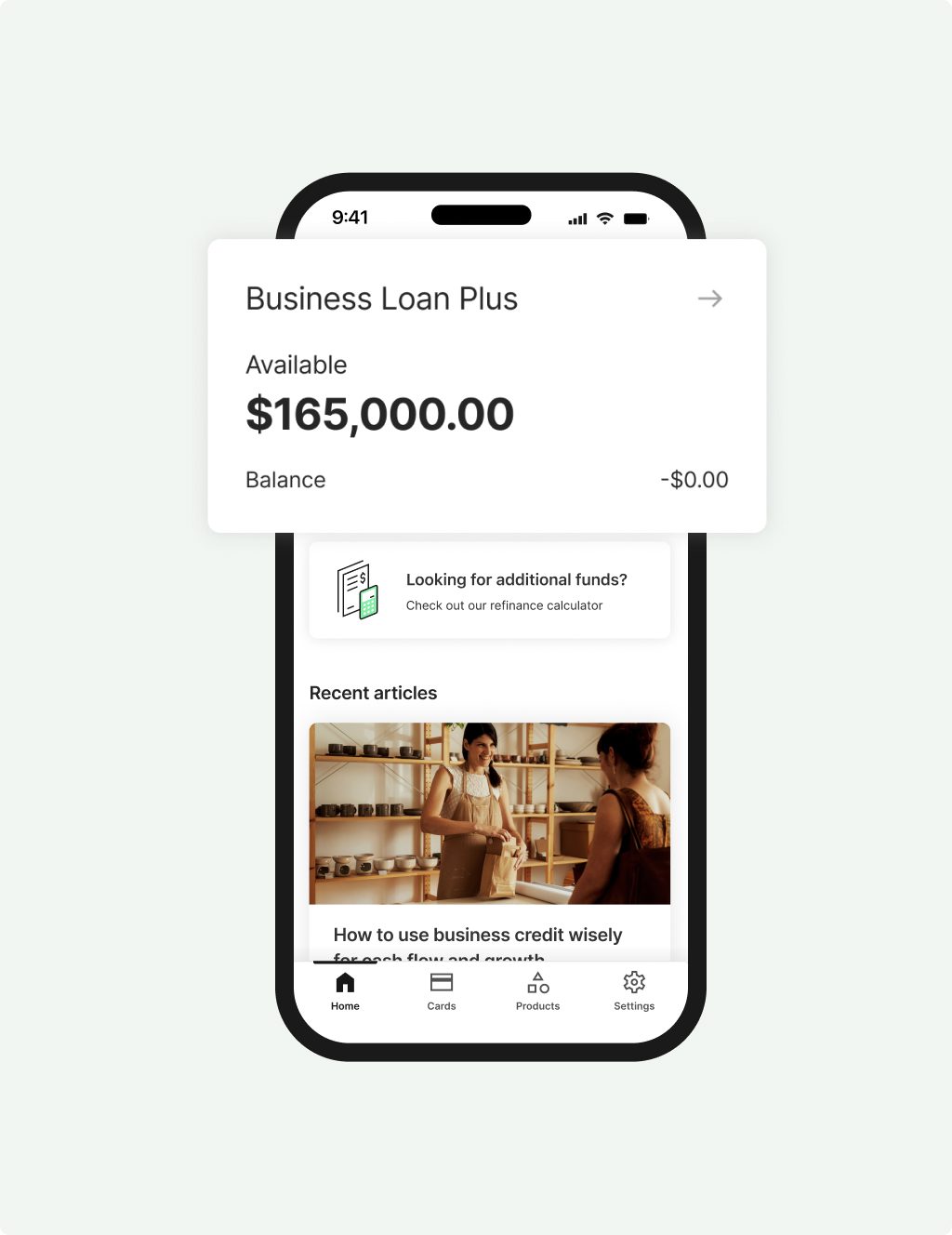

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Frequently asked questions

As a small business owner, it can sometimes be challenging to get access to finance from traditional lenders like banks. There are several reasons for this, like insufficient collateral to secure the loan or a debt to income ratio that is outside their accepted level – but mostly it comes down to risk. A small business can be seen as too risky for many traditional business lenders.

If you have been searching for ways to boost your cash flow or pay seasonal casuals, turning to traditional lenders for your small business lending may not be your best option. Although they offer business overdrafts, a business line of credit or short-term commercial loans for these situations, you need to ensure you meet all the lending criteria of the financial institution you are applying to – which can be challenging.

Short-term commercial loans or equipment finance can be used to fund the purchase of new equipment, tools, IT or a business vehicle, yet they too can often be difficult to get from the big banks due to many factors, including the size of your business or the length of the loan term that you are seeking.

Some traditional business lenders offer unsecured small business loans, but the loan amounts can be lower and the qualifying criteria are much tighter due to the lack of security. That means this type of business lending can be harder to come by from the big banks.

You could consider using a business credit card as a handy way to inject a bit of funding into your business or a quick way of covering some short-term costs. This can, however be an expensive option in the long term. Many business owners even use personal credit cards, while others prefer to keep business and personal separate.

If you are looking for finance to support your business cash flow, take up an opportunity or move your business to the next level, you should consider a small business lending specialist like Prospa. We offer flexible loan opportunities designed especially for the needs of small business with cash flow friendly repayment options and dedicated support.

If you’re looking for unsecured business loans, there are several options available in the market.

We understand small business owners may not want to use their home as security on a business loan. Our finance options are great if you want to expand into new premises, update machinery or equipment, build a new website, do some marketing or add a new product or service to your offering.

Our team is available Monday to Saturday, and you will get support from a team of Business Lending Specialists. We will discuss business lending options that will help you manage the ups and downs of small business cash flow or support business growth.

Prospa offers small business loans of between $5K and $150K. No asset security required upfront to access Prospa funding up to $150K. We have already provided over $1.65 billion in funds to more than 29,400 small businesses around Australia. If you want finance from a small business lending specialist, fill out a quick online application. We’ll get in touch and discuss how Prospa could help your business to thrive.

Other questions?

Awards, thanks to you

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |