Government assistance for small businesses in WA

The Western Australian state government has a range of state based small business grants on offer. These include targeted incentives for small businesses operating in local resources or funding to cover specific work shortages or other local business needs.

Indigenous small business grants WA help to promote business in often rural or remote areas. There are specific small business digital grants designed to support indigenous communities to create stable, ongoing online business opportunities. They cater to a range of business types at varying levels of development, focusing on those who require assistance to get their business online.

Small business start-up grants WA target financial support and skills training opportunities to help small business owners in WA navigate the difficult start-up stage – they apply to a range of industries from hospitality start-ups to local trades related businesses.

If you are searching for options to help expand your current staff and support that staff with new skills then you will find plenty of mentoring programmes, free and low-cost advisory programmes available which help to get your business acumen up to speed and teach business operators how avoid common pitfalls, particularly in the early stages of owning a business.

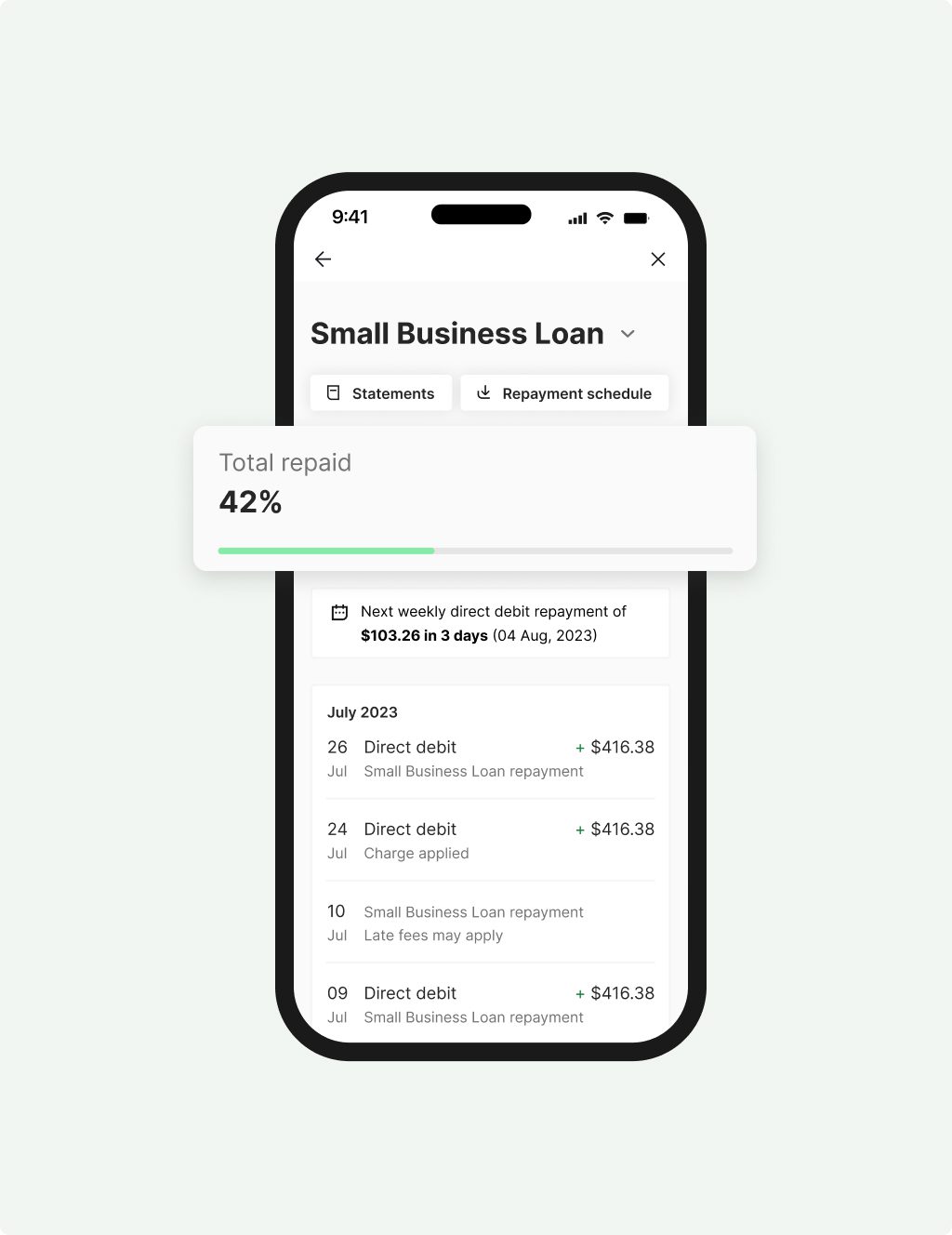

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

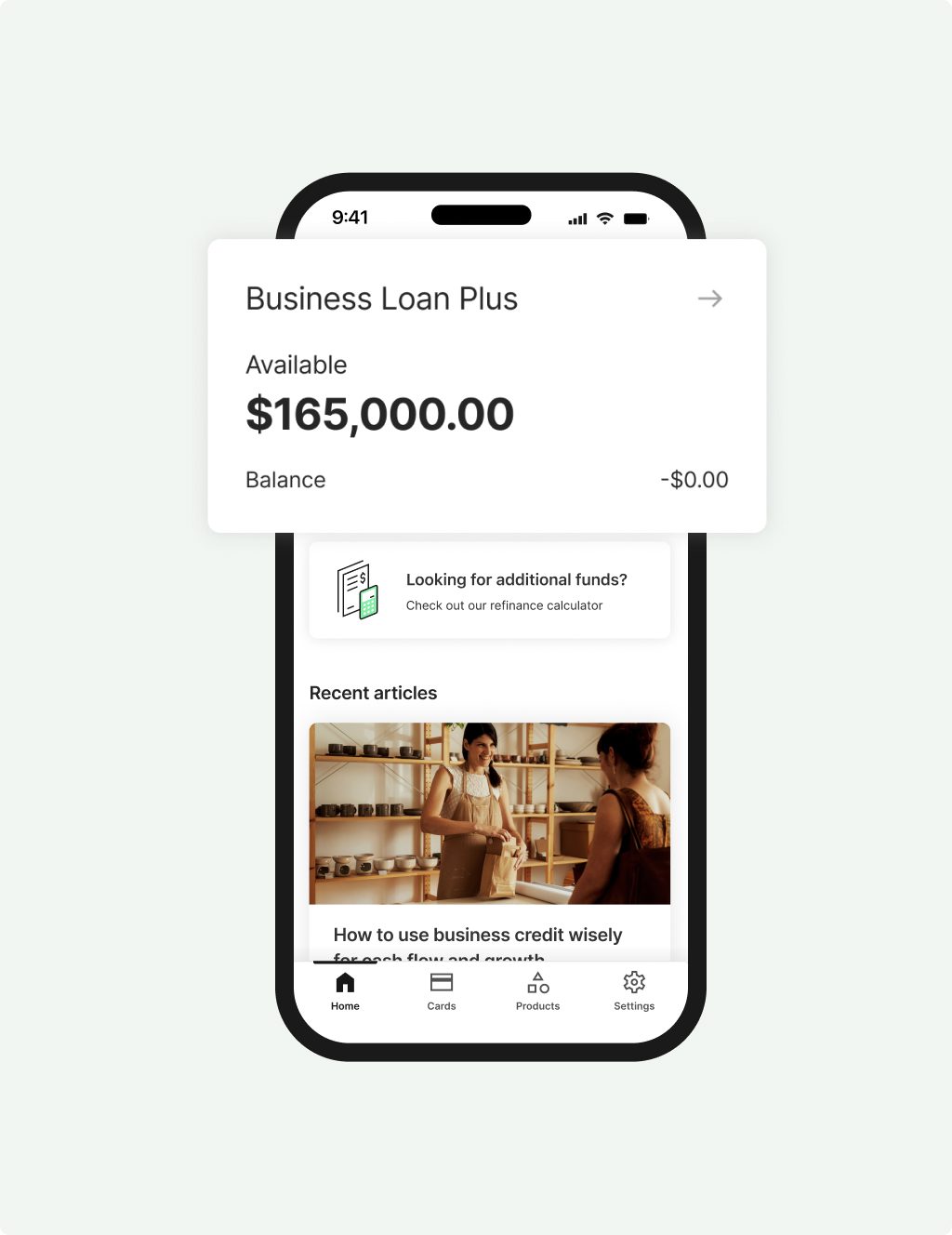

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

How do I qualify for a WA small business grant?

As a small business based in WA, you will automatically qualify to apply for a range of state funding and grant opportunities. These range from incentives, rebates and mentoring, to lump sum payments for things like research and development projects or staffing assistance.

At a more local level, you should check to see if your council or applicable authority supports community businesses with other types of funding or incentives. It’s a smart business move to investigate and make use of all the different options available to you.

Most grants are offered to businesses based on key indicators or requirements. For example, to qualify for staffing payments or incentives your business must be looking to employ new staff or, perhaps, seeking to offer apprenticeships and support younger people searching for work.

It’s always a good idea to check and double check all of the parameters and expectations attached to a grant which you intend to apply for at the time of application to ensure you understand exactly what is expected of your business in return for the grant.

The Department of Industry, Innovation and Science offers a thorough website where you can search for potential grants applicable to your state, needs and industry level. There are additional options for operators working remote or rural areas too. Check out www.business.gov.au for more information.

Available grants will often have a link to apply directly online or downloadable applications you can fill in later.

At Prospa, we support small businesses in WA. We have already invested over $1.65 billion into the Australian small business market, assisting thousands of businesses to grow and develop with finance options tailored for them.

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Customers making it happen with a Prospa loan

Read customer storiesAwards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |