How do I qualify for a QLD small business grant?

Depending on the business, and depending on where you’re operating, there’s a range of government assistance schemes available. QLD small business digital grants can help businesses build and expand across digital platforms at all levels of business development.

Many business grants come as lump sum amounts, however some take the form of small business incentives. One such grant is the Australian Apprenticeships Incentives Programme, designed to help small businesses explore opportunities to expand staffing or provide opportunities for young people to secure apprenticeships throughout QLD.

Small business grants QLD can also provide ongoing financial support to help with the cost of innovating, developing research and development programs, or finding opportunities for expansion. There are also small business grant options for mentoring, industry training and networking opportunities to build up your business profile.

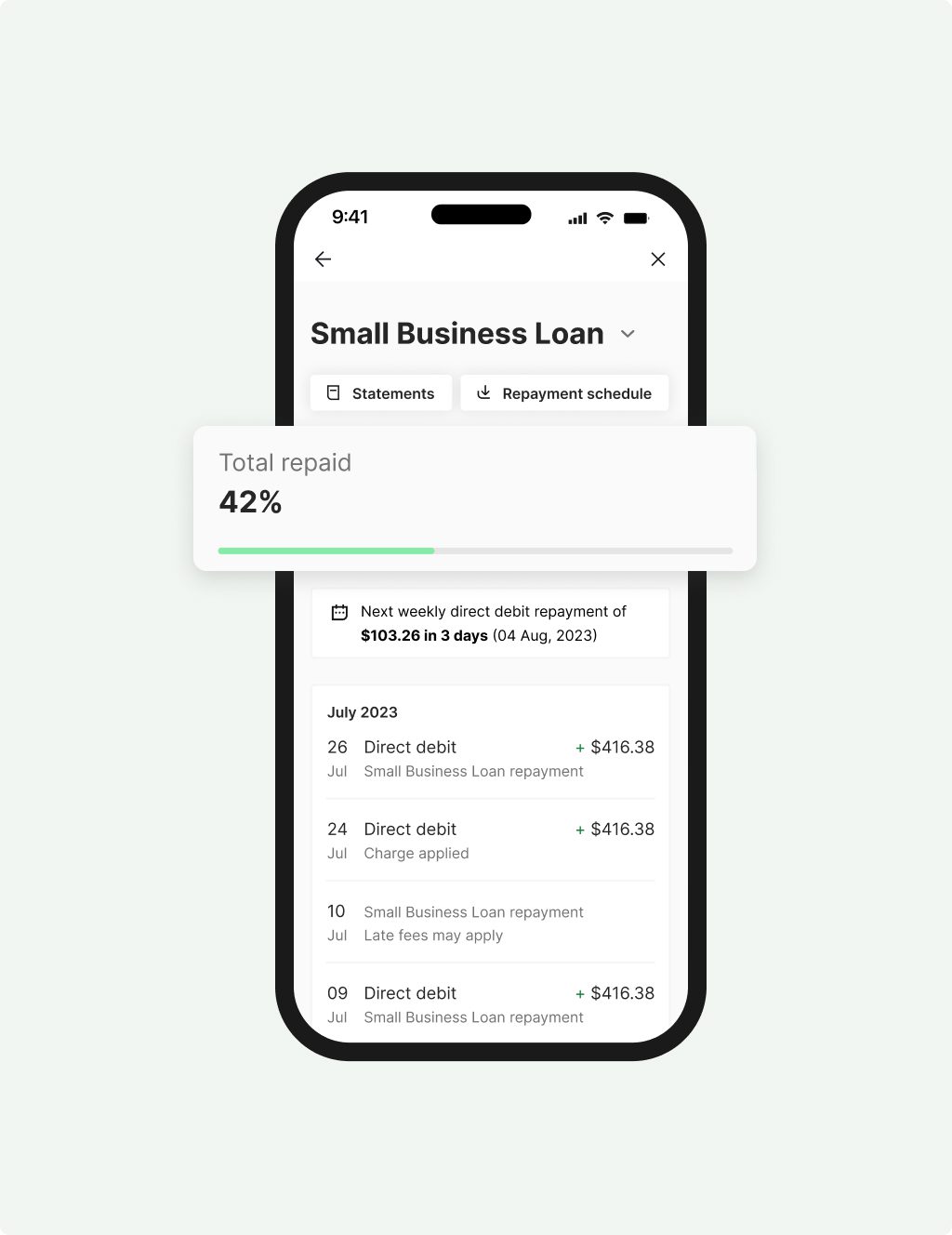

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

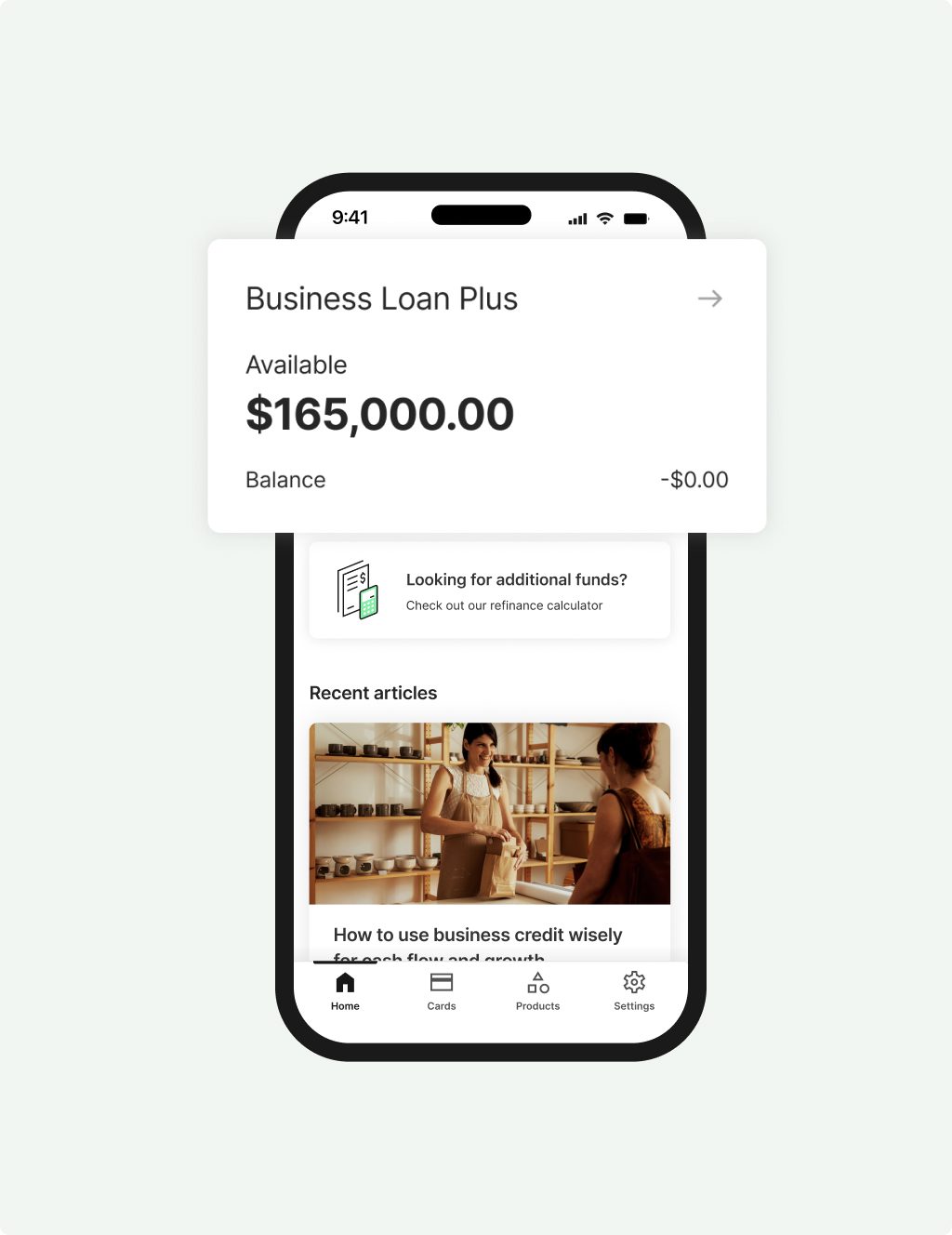

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Government assistance for small businesses in QLD

Small business grants QLD are available to businesses across the state. They are designed to help small businesses explore new opportunities to expand, navigate the tricky early stages of start-up, or withstand market events caused by weather or economic downturn.

Australian government organisations, operating on a state, federal and local level, offer a range of help in the form of rebates and grants. They cover areas including exploration into overseas export opportunities, researching and developing new products, and innovating new and exciting services for the Australian market.

If you are looking for options to help build new skills for your workforce, and for yourself, then there are a range of mentoring programmes and free and low-cost advisory programmes available in the form of small business grants QLD.

We have assembled some information you might find helpful for finding and applying for small business grants QLD – including small business start-up grants.

Can I apply for a QLD small business grant?

Most grants come with parameters such as maintaining business performance levels or staff retention levels. Be sure to check all of the terms and expectations attached to a grant before you apply and ensure you understand exactly what is expected of your business in return for the grant.

If you are already operating an Australian small business in QLD, then it is likely that you will qualify for most of the common grant types – these include mentoring programmes and soft skills training.

If you have a specific area you wish to expand, such as innovation or researching new products, then there are very specific state and federal government grants designed for these areas. At a local level you may find grants designed to help you building strong community ties.

Similarly, with staffing incentives, there are grants available in a range of industries, including apprenticeship programmes, and grants for supporting people with a disability.

It’s easy to apply for most small business grants. The Department of Industry, Innovation and Science offers a one-stop website where you can search for potential grants applicable to your state, needs and industry. There are additional options for operators working in remote or rural areas too. Check out www.business.gov.au for more information.

Available grants will often have a link to apply directly online or downloadable applications you can fill in later.

At Prospa, we support small businesses in QLD. We have already invested over $1.65 billion into the Australian small business market, assisting thousands of businesses to grow and develop with finance options tailored for them.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Customers making it happen with a Prospa loan

Read Customer StoriesAwards, thanks to your support

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |