Small Business Loans to match the needs of VIC businesses

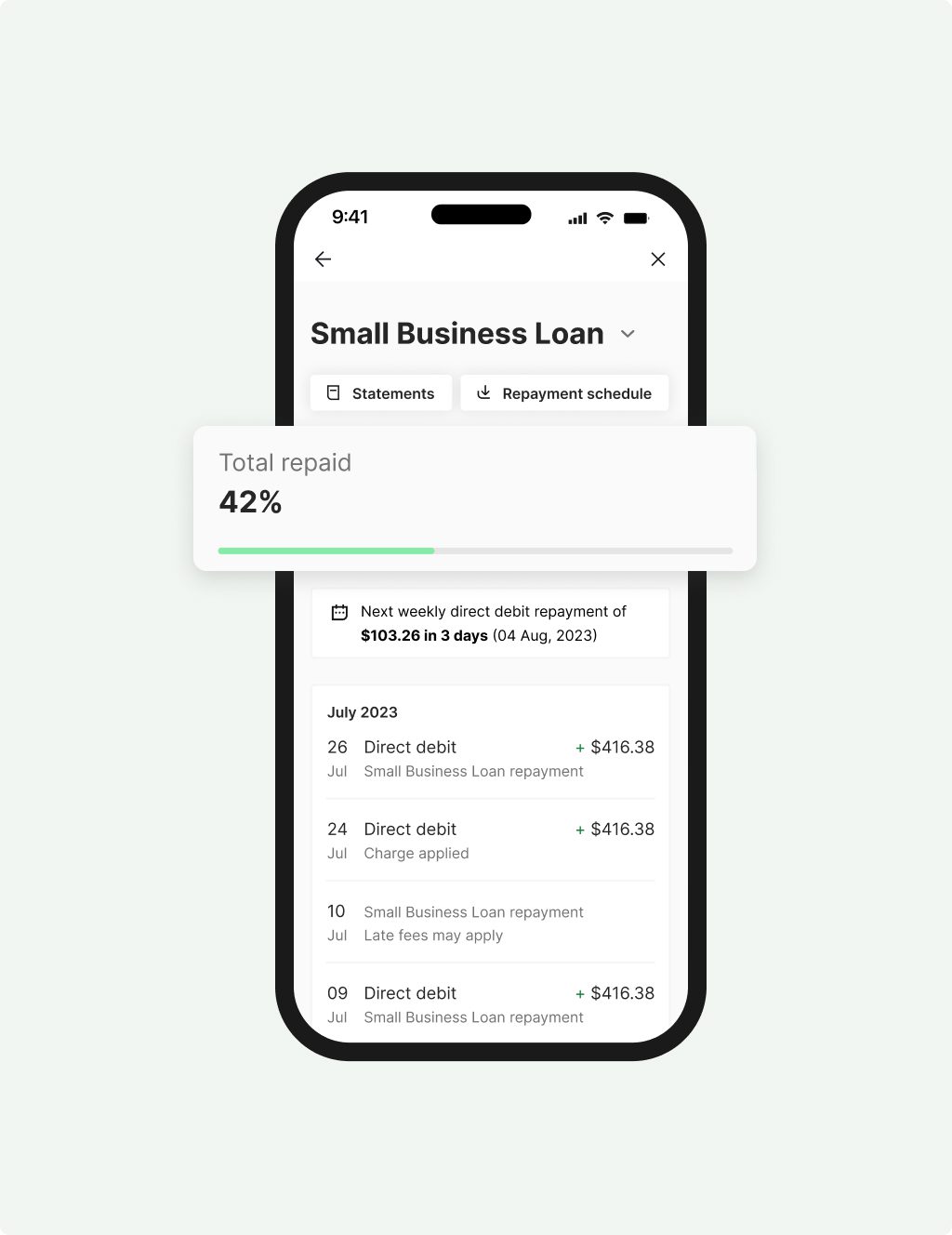

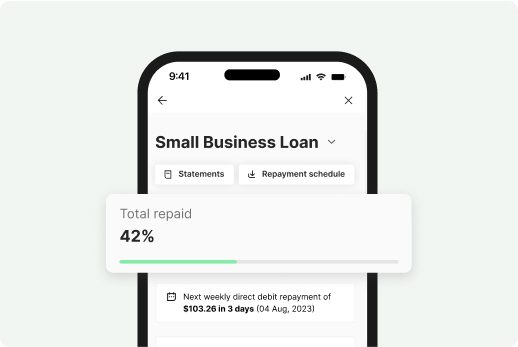

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

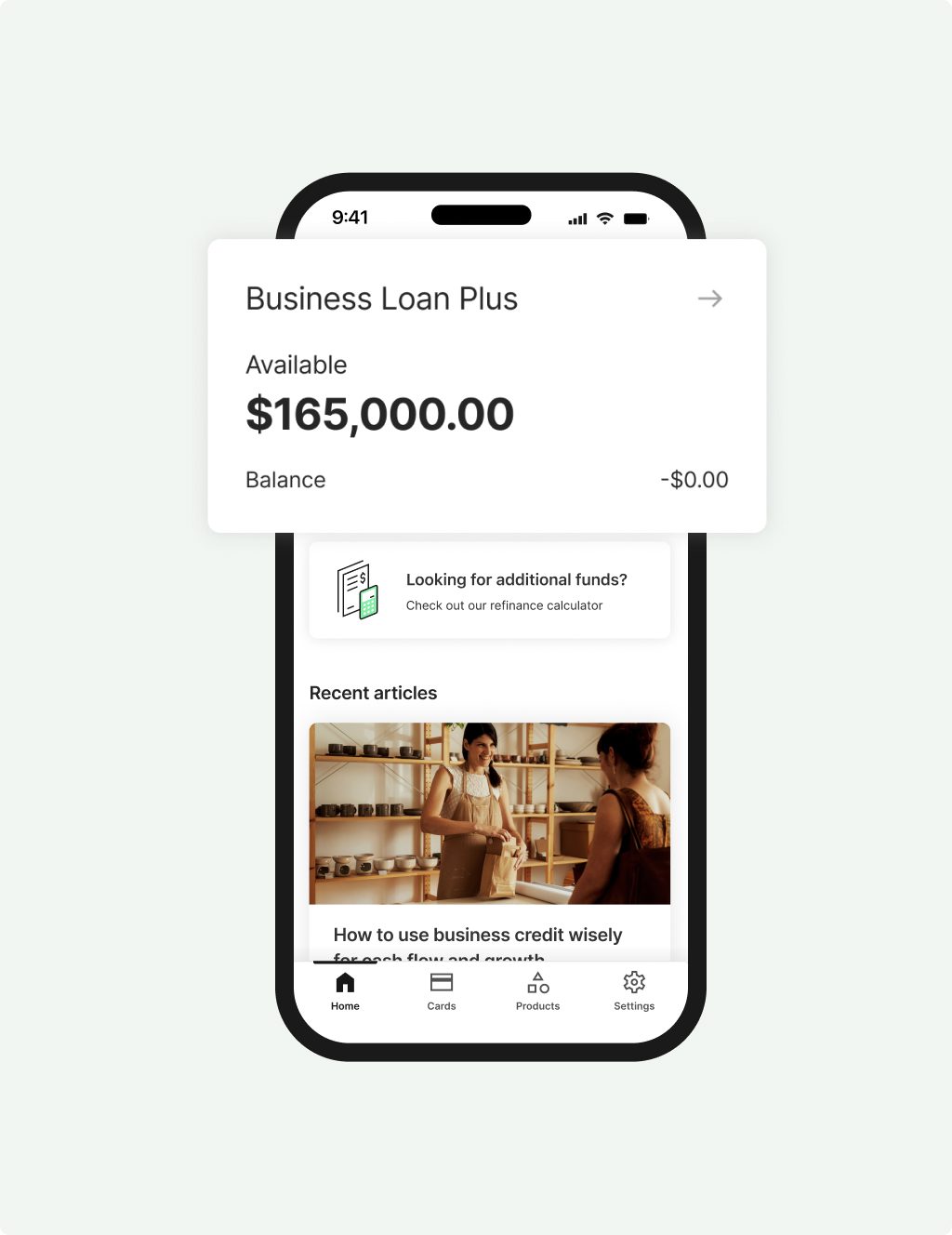

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Flexible funding solutions for VIC small businesses

When they choose Prospa, VIC small business owners like you enjoy a hassle-free application for amounts up to $500K.

You can get a fast decision and funding is possible in 24 hours – which means less stress when it comes to getting the funds you need.

See what other VIC small businesses are doing

Want to broaden your customer base? Need tips on chasing invoices? Get a taste of how other VIC small businesses tackle challenges and opportunities.

Flexibility

Fast application and decision, and funding possible in 24 hours on flexible options up to $500K.

Support

A dedicated Business Lending Specialist will get to know you and your business and provide a personalised solution.

Confidence

Join thousands of Aussie small businesses who thrive with the support of Australia’s #1 online lender to small business.