Prospa Business Line of Credit

Similar to a business overdraft, the Business Line of Credit allows you to easily manage your cash flow and any unexpected costs with a simple draw down of funds. Apply in minutes, with funding possible in hours.

Always have access to funds for unexpected costs

Line of Credit between $2K and $150K

Apply online in 10 minutes with minimal paperwork. Funding possible in hours.

Flexible repayments

Only pay interest on the funds you use.

Flexible terms

Renewable 24-month term.

No upfront security

No need to put your house or other assets down as security to access up to $150K in Prospa funding.

01

Apply in under 10 minutes

Apply in under 10 minutes

02

Get a same-day decision – often in just a few hours

Get a same-day decision – often in just a few hours

03

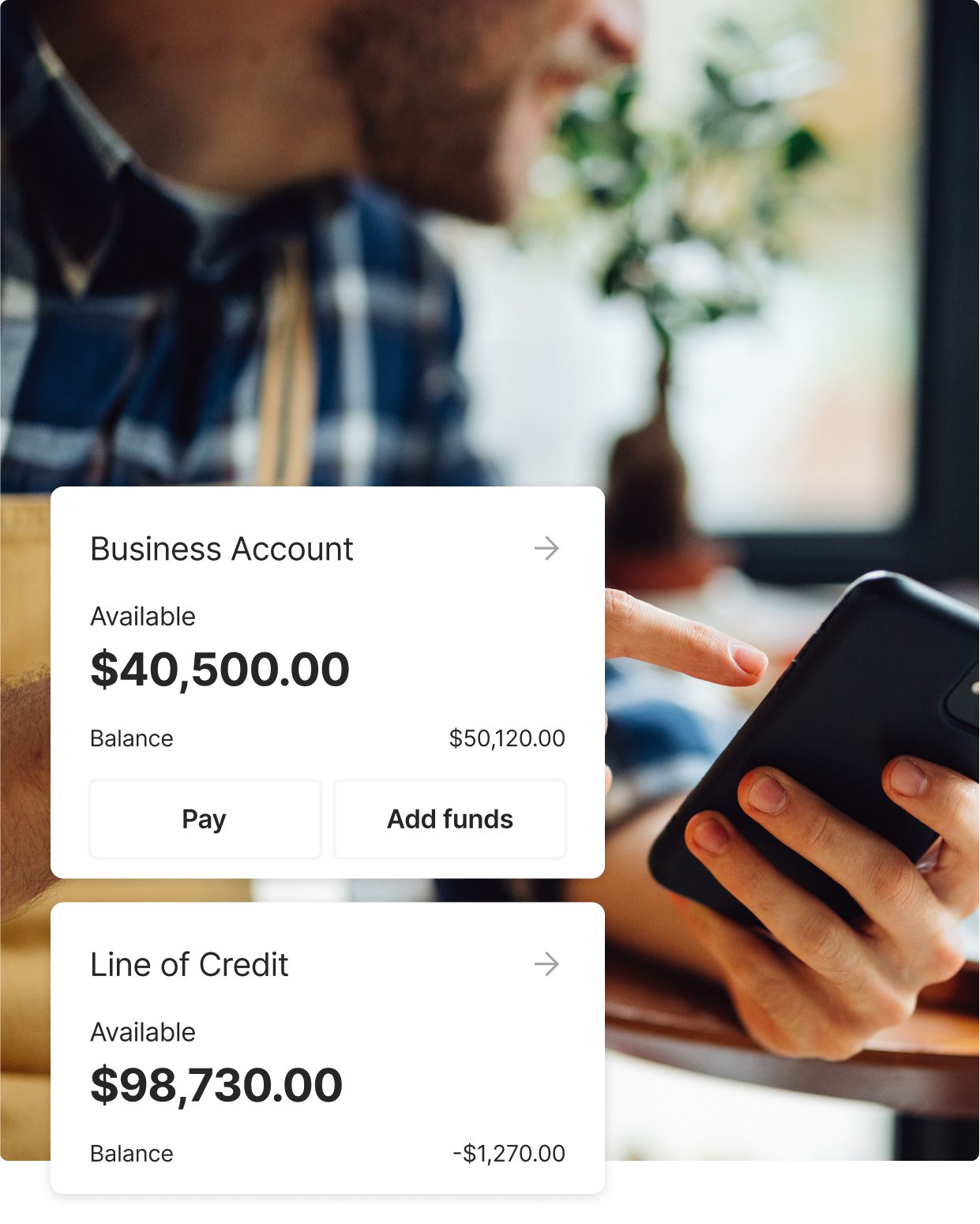

Access funds on the go

Access funds on the go

FAQs

Common questions answered

With the Business Line of Credit you pay:

- A weekly service fee is charged weekly from the date of settlement.

- Interest, but you only pay interest on the funds you have drawn down, and only until you repay those funds. Interest is charged at a fixed rate, calculated daily based on your drawn balance (i.e. the amount of your facility that has been drawn down and not repaid), and interest is charged weekly. The facility limit of your line of credit, and your interest rate, will be based on our assessment of your business.

- Every week we will attempt to Direct Debit your business account for the repayment amount owing that week, any unsuccessful attempt will attract a $25 dishonour fee, as well as a late payment fee.

You can apply for a Business Line of Credit if you:

- are an Australian Citizen (or permanent resident)

- are over 18 years, own an Australian business (with a valid ABN/ACN)

- Minimum trading history applies

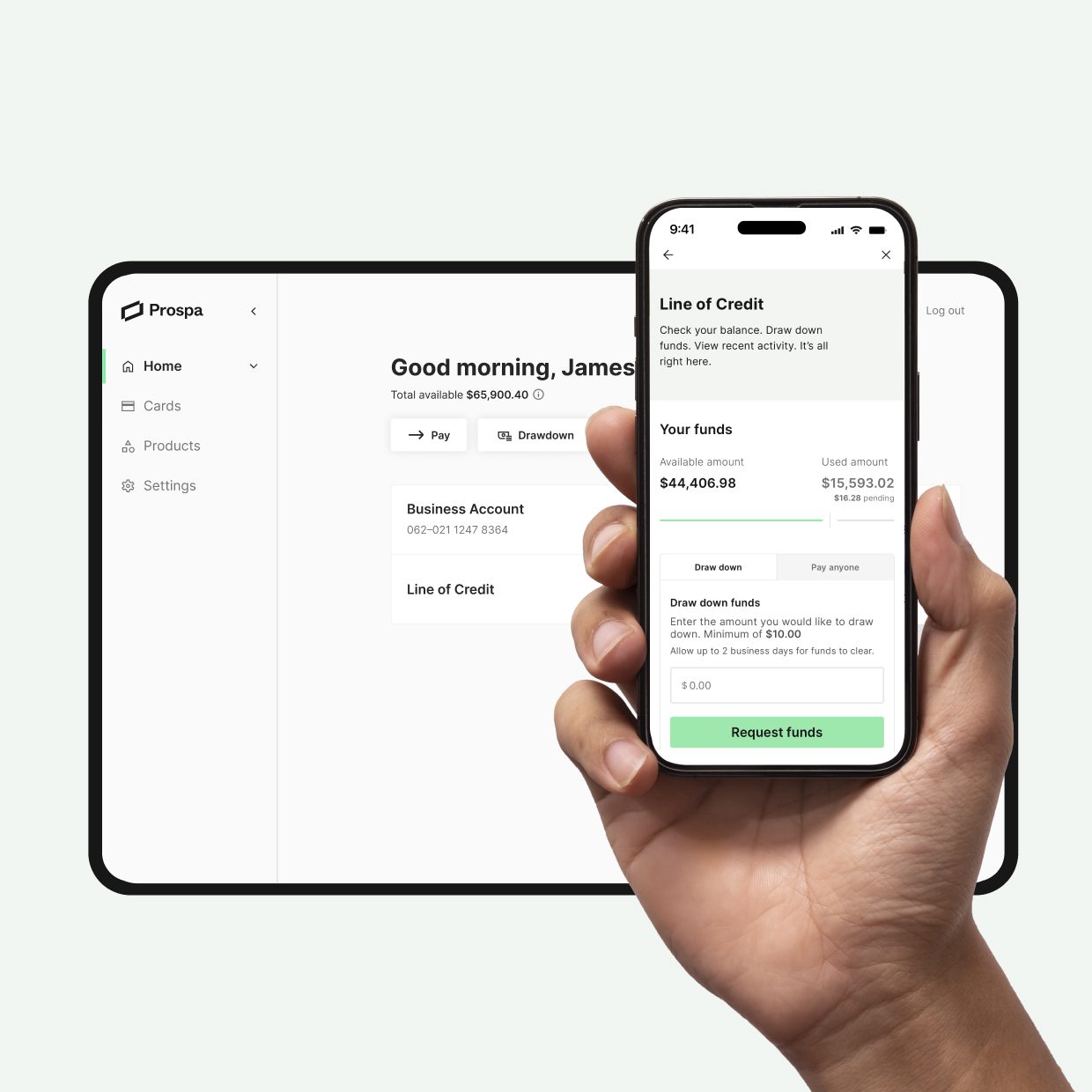

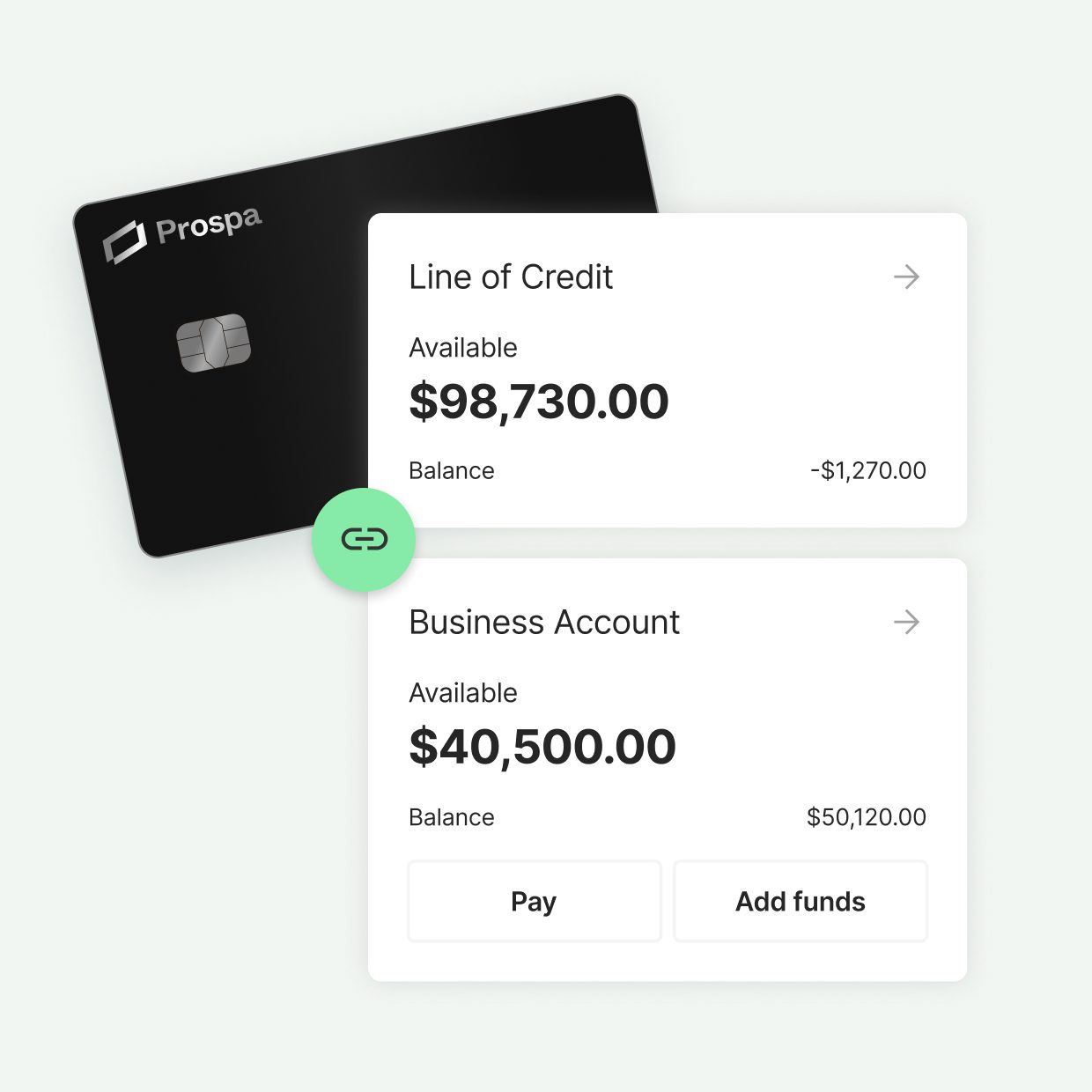

There are two ways to access and use your Business Line of Credit:

- Via the Prospa Online

- Via the Prospa App

Once you have logged in, you will be able to view transactions, draw down funds to your nominated business bank account, directly pay invoices and suppliers and much more.

Visit our getting started page for more details.

We will set up an automatic repayment schedule with set weekly repayments over 24 months. The weekly repayment will comprise interest and a portion of principal as well as any applicable fees, such as the weekly service fee.

So that you don’t need to worry about missing a payment, your weekly repayments will be automatically debited from your nominated business bank account.

You can choose to simply pay the set weekly repayments, or you can make additional payments at any time to reduce your drawn balance, thus reducing the amount of interest you pay. It’s up to you.

On or before the end of the 24-month term you can choose from the following options:

- you can apply to renew your line of credit for a further 24-month term; or

- you can arrange to close your line of credit.

If you elect to renew your line of credit for a further 24-month term, we will need to complete a new assessment to check whether there have been any changes in your business. If you are approved, you can also review your facility limit based on your business’s current needs.

If you elect to close your line of credit at the end of the term, there are two possible options available to you to repay the outstanding balance:

- you can elect to repay the entire outstanding balance at the end of the term. This can be done in one lump sum payment via BPAY.

- if you are eligible, you may elect to repay your outstanding balance on a 52-week repayment plan. This repayment plan will commence immediately after your line of credit term finishes. At this time, your access to the facility will be suspended and the outstanding balance of your line of credit will be divided into 52 instalments. These instalments will be direct debited from your bank account each week along with that week’s accrued interest and weekly service fee until your outstanding balance is paid down to $0. Interest will accrue on the outstanding balance throughout the 52 weeks at the same rate as your line of credit. To be eligible for the 52-week repayment plan you must not be in arrears at the end of your line of credit term.

If you do not select an option on or before the date on which the term ends or you apply for and are not approved for a term extension, your line of credit will be closed and, if eligible, you will be placed on the 52-week repayment plan.

Prospa Advance Pty Ltd (Prospa) (ABN 47 154 775 667) is not a bank or authorised deposit taking institution. The Prospa Business Account and Prospa Card are issued by Hay Limited ABN 34 629 037 403 which holds Australian Financial Services Licence no. 515459 (Hay). Hay is not a bank or authorised deposit taking institution. All customer funds held in a Prospa Account are held with an authorised deposit-taking institution (ADI). Information published on this website is provided without considering your individual objectives, financial situation or needs. Please make sure to read the Financial Services Guide, Target Market Determination, Product Disclosure Statement and the Card and Account terms and conditions prior to deciding whether these products are appropriate for you. Eligibility criteria, fees, terms and conditions apply.

Eligibility and approval is subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants. Fees, terms and conditions apply.