Things you need to know when applying for a business loan

If you’re applying for a business loan, then the first question you’re likely to ask yourself is: how do business loans work? Prospa is Australia’s #1 online lender to small business, and we support local Australian businesses with easy and hassle-free application on small business loans with a quick decision on loan amounts of between $5K and $500K. Terms range between 3 and 36 months and repayments are fixed either daily or weekly to work with your cash flow, plus early repayment options are available.

Here we’ll take you through some basic information regarding our application process, plus answer some of the questions you might have about how business loans work – such as what you need to provide when applying, what your business can do with a loan if you are approved and what loan amounts and terms might be available. We’ll also cover what you might expect when you apply for business finance options in Australia.

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

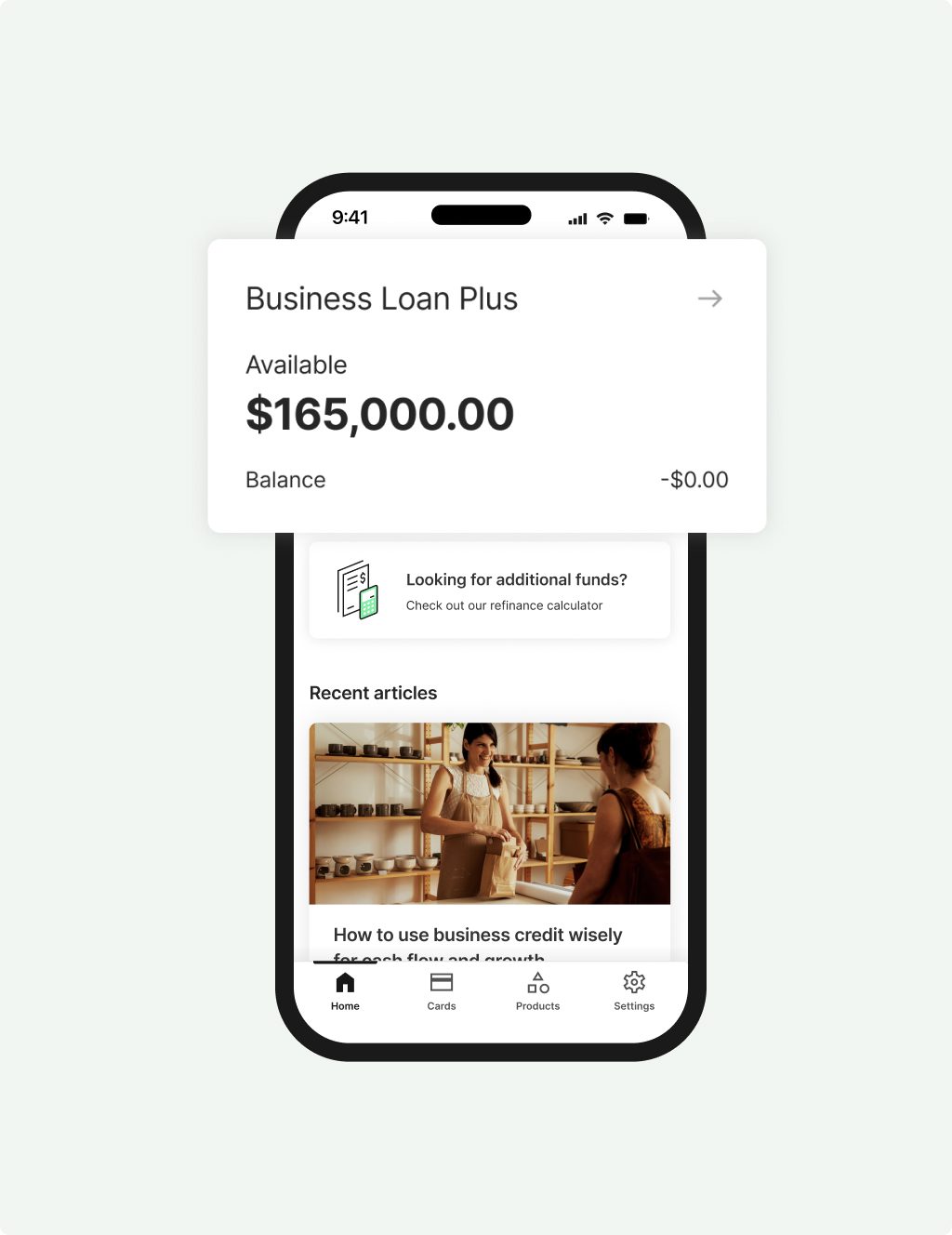

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

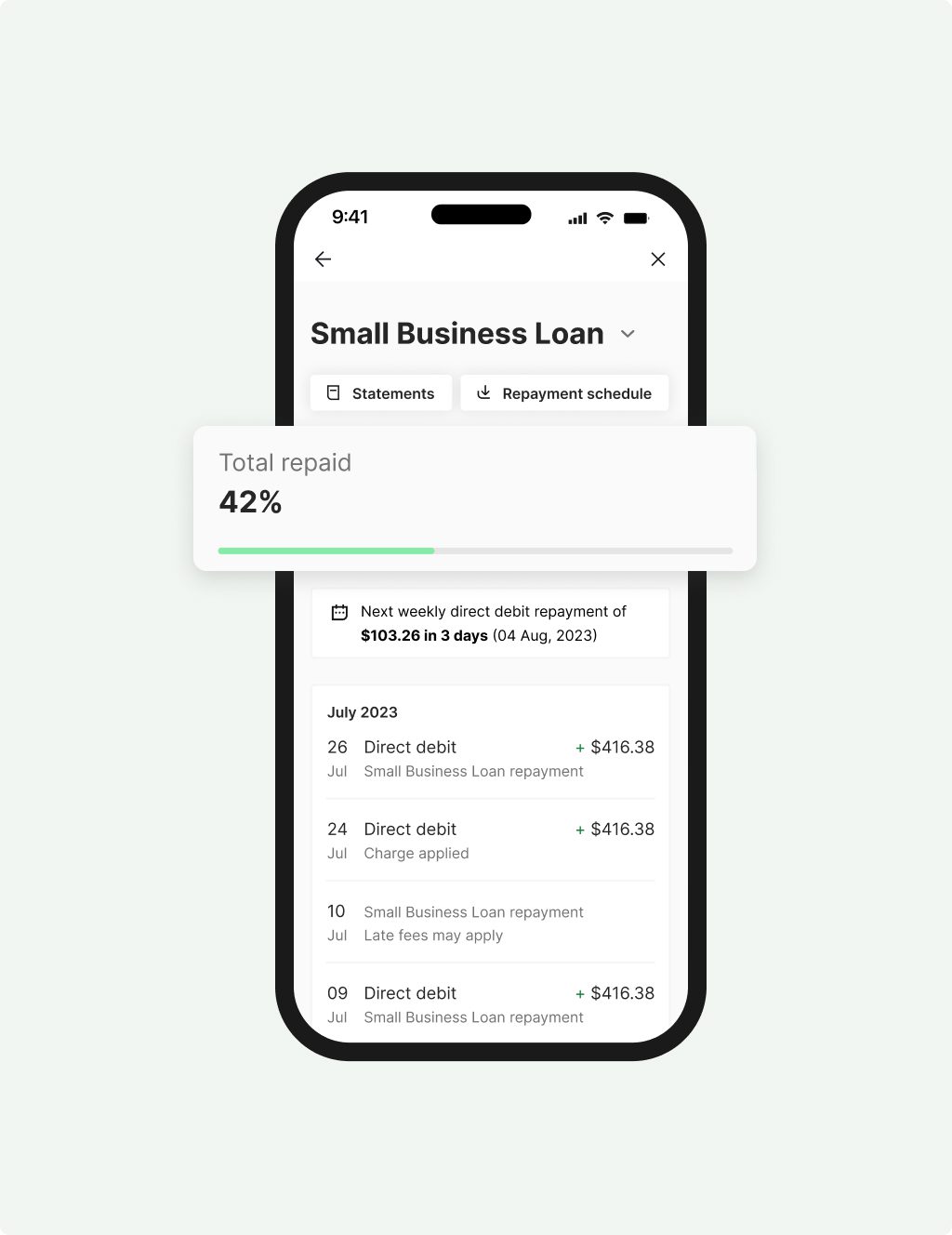

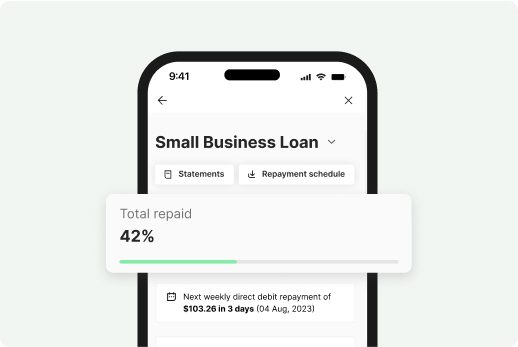

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

How to get a business loan

When you choose Prospa to help your business to grow over the short term or long term, you can look forward to a fast application process and friendly business loan specialists to support your business. There are early payout options, and we offer cash flow friendly repayments to work with small businesses, so we can do our best to support growing success.

Prospa continues to meet the changing needs of small businesses. We have already helped thousands of Australian and New Zealand businesses with business loan funding and we’re proudly committed to maintaining our 4.8/5 TrustScore rating.

To begin an application for a business loan of $250K or less you will need:

- Your driver’s licence number

- Your ABN

- Your BSB and bank account number

For loan applications requesting more than $250K you will also need basic financial statements such as your Profit & Loss and cash flow.

Applications take just 10 minutes to complete online and we do our best to get back to you with a decision quickly – in fact when you apply within standard business hours you could receive a response within the hour. If your application is approved before 4pm on a business day, it is possible to receive your new funds into your business account the very next business day.

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

FAQs

Frequently asked questions

When it comes to business loan types, Prospa supports eligible customers with two products. A Small Business Loan which is ideal for one-off purchases or expenses and a Line of Credit which offers ongoing access to funds to cover working capital. You can use funds from Prospa for business purposes, which might include taking advantage of growth opportunities including purchasing new inventory or equipment, investing in a marketing campaign or renovating and updating your premises. You could even use Prospa funds to build or expand your business by adding a new product or service. With both business loan products, no asset security is required upfront to access up to $150K in Prospa funding.

When you apply for any of our business loan products, we will ask you questions such as what your business’ current financial obligations are, including any debt that you currently have. If you are already repaying another loan, the impact on your business credit report may depend on a range of factors. As a prudent lender, credit applications are thoroughly reviewed before we can offer business loan interest rates and loan features, such as daily or weekly repayments, that suit the health and financial situation of your business.

When you decide to go ahead with an application with Prospa, we recommend that you are as thorough about your business’ current financial circumstances as possible. This ensures that we can quickly (and more accurately) evaluate your business’ eligibility for funding and provide a decision. If approved, your information helps us come back to you with a loan offer based on the circumstances of your business. As part of the application process, we will ask questions that help us to assess whether your business would be able to repay the loan. We take pride in our customer service, and would love to continue to be an award winning market leader in Aussie online small business finance. That’s why we will work to support businesses to the best of our ability.

If you want to know how to get a business loan to kick-start your business idea, there are several options. There may be start-up cash loans available, various sources of crowd funding, and several different types of business grants from Government agencies and some private companies. There can be quite a lot of work involved in the planning stages like creating your business plan, registering for any appropriate permits and licences and ensuring that you have processes in place such as solid business accounting.

Prospa specialises in supporting existing Aussie small businesses to grow and succeed, with flexible and hassle-free application for business lending options including a business loan and a line of credit. If you want support to build, expand or update your business we may be able to help. As Australia’s #1 online lender to small business we are committed to supporting businesses with the funds they need to consolidate their growth and create long term stability.

To find out how to get a business loan from Prospa, you can check out our FAQs and discover more about our loan products here. If you have any questions, please get in contact with one of our business lending specialists. Our friendly team will help you understand what kind of loan options might be available, any applicable fees and charges and how we might be able to help your business apply for a small business loan that remains cash flow friendly with manageable repayment schedules.

Other questions?

Awards , thanks to you

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |