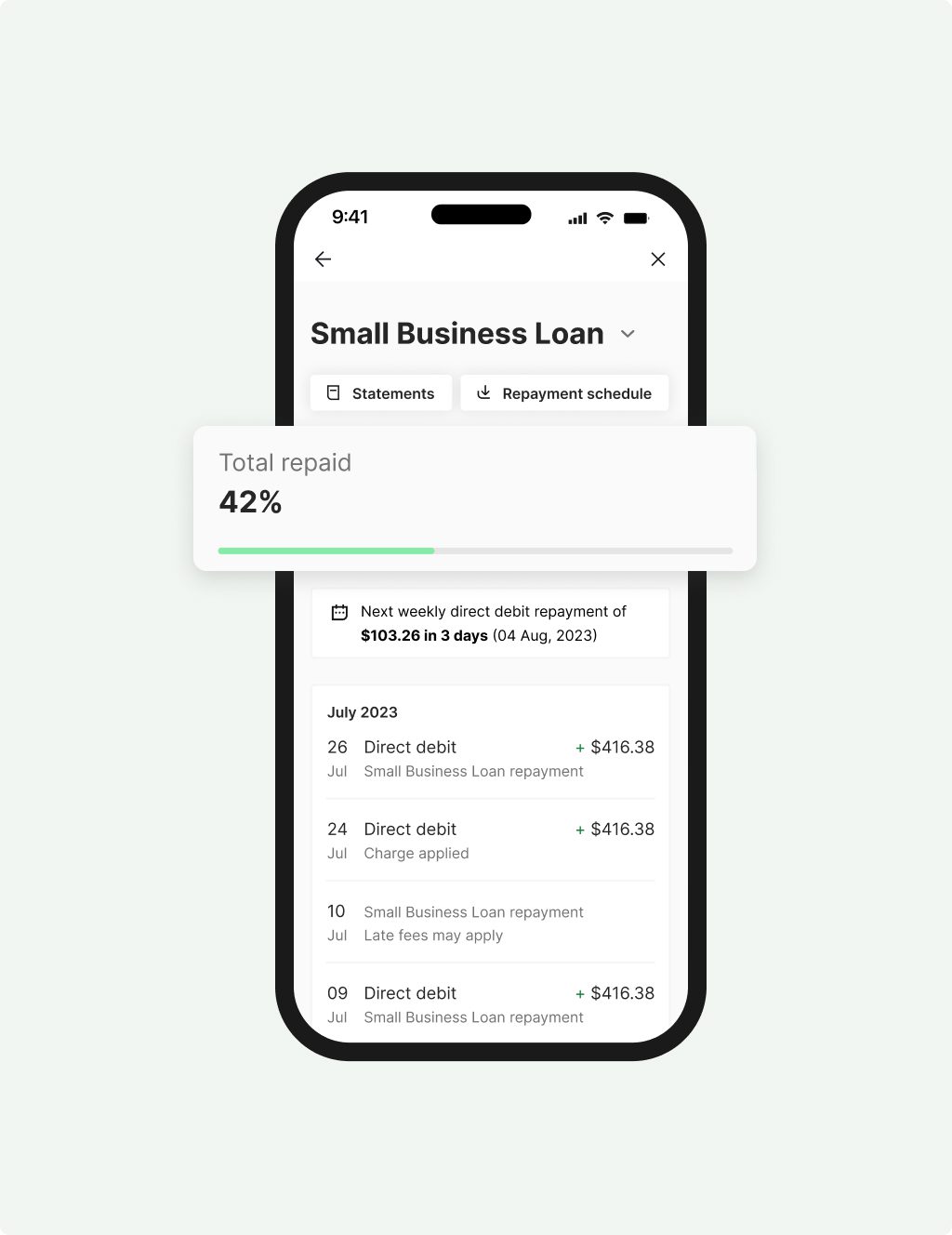

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

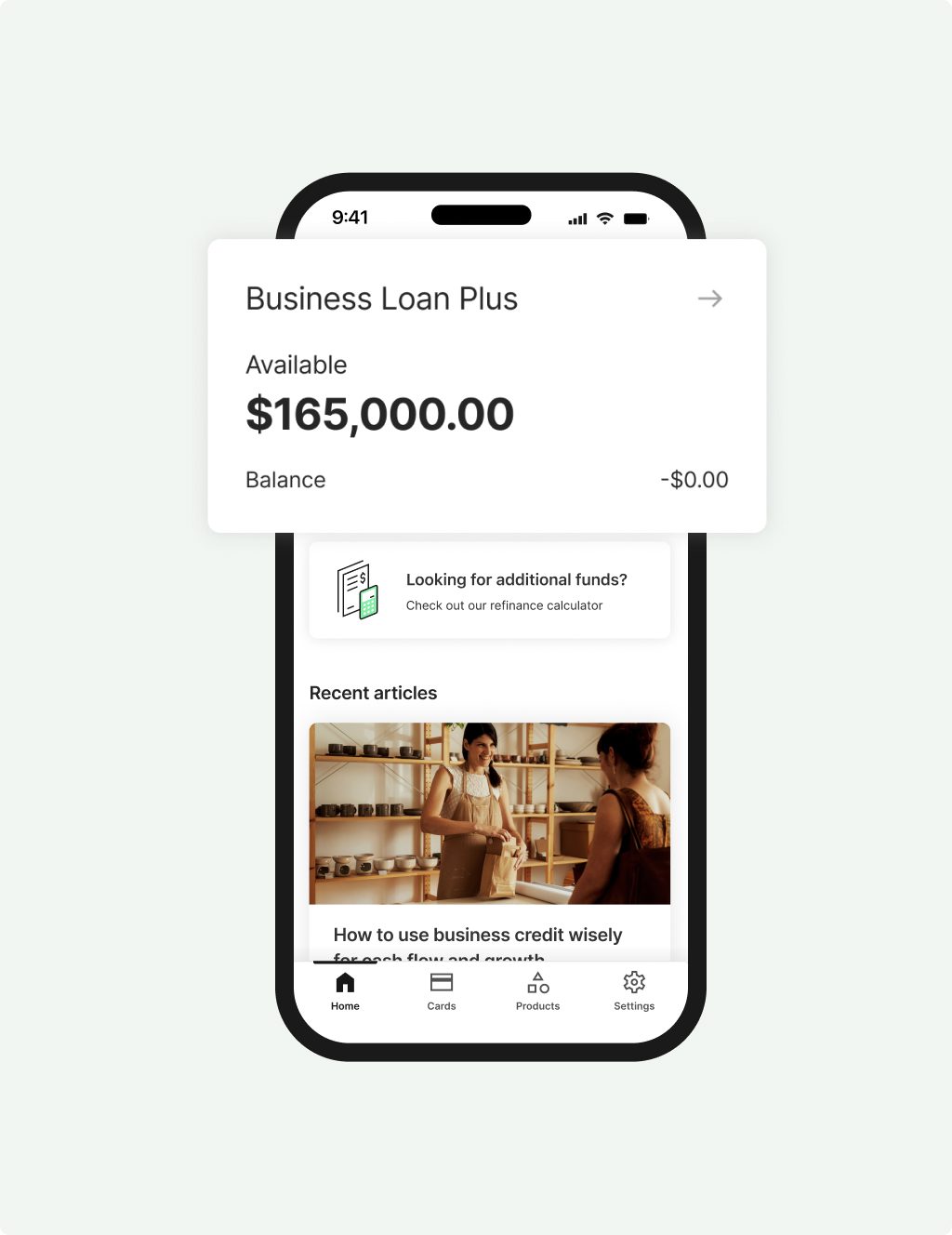

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Explore funding options for buying commercial equipment

Prospa has helped thousands of small businesses to grow and thrive with a range of lending options, including equipment financing. We provide the financial support to help businesses remain competitive in a constantly changing market.

Whether it’s farm equipment, construction equipment or other heavy equipment, keeping your business up to date with the right commercial equipment is vital. The perfect place to start is with a Prospa Small Business Loan of $5K to $150K – talk to us today.

Flexibility

Support

Confidence

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Common questions answered

Equipment finance is a loan type many businesses use to purchase new equipment or update capital assets. Equipment loans can be used for large scale capital items, like farm equipment. It can also fund other heavy equipment that your business uses to produce your goods or services. This type of finance is often secured against the value of the asset you are intending to purchase, in much the same way a car loan or a home mortgage works.

Prospa can help you simplify the entire equipment financing process. Our small business loan offers regular repayments that fit with your cash flow. You’ll also have access to a friendly customer service team to help you throughout the process.

We are more than just your average online lender, we have small business at the centre of everything we do. We can help you access a great equipment finance option today, and then help to offer financial support if your business needs more funds to grow.

If you’re looking to purchase heavy equipment, Prospa can help with the finance you need. Heavy equipment includes assets like commercial equipment for kitchens or factories, construction-related machinery, farm machinery and any work-related vehicles.

Heavy equipment can be expensive – which is why a business loan is a great option if you don’t have the funds up front. Prospa offers business loans of up to $150,000. No asset security required upfront to access Prospa funding up to $150,000.

Are you a primary producer? We love supporting Aussie farmers. Our business loans have already helped small businesses in the agriculture industry get the funds they need to buy equipment and tools to grow and expand. We can help you access an equipment loan to purchase farm equipment to keep your farming business moving.

Most businesses need to purchase or upgrade equipment from time to time. There are many business finance options available for equipment purchases, including leasing arrangements, but whatever you choose, it’s great to know that your lender supports small business.

At Prospa, our business loans are a great alternative for equipment purchases. The online application process is fast and straight-forward, you get a fast decision and funding is possible in 24 hours. To discuss your equipment loan or financing possibilities, simply contact us today or start an online application.

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |