Business Loans

Prospa provide local Aussies small business loans in Brisbane for between $5K and $150K. Our fast and friendly service has helped thousands of people just like you to get the most from their small business opportunities and support growth into new markets and beyond. Apply for your business loans Brisbane today and discover how your business can start growing with Prospa right behind it.

Business loans Brisbane have already helped locals like you to really get their prospects off the ground and fund existing company growth with a range of business loans. With over 29,400 customers and $1.65 billion in small business investment already made, it’s small wonder that Prospa are Australia’s #1 small business lender.

Not sure what you need to borrow? Unsure how to plan the next stage in your business development? Our Brisbane lending specialists are here to help you determine what sort of loan you would like to take on and provide business focused terms and cash flow friendly repayments.

We have achieved and continue to maintain a 4.8/5 TrustScore through providing high level service and flexible loan rates for our clients. We don’t penalise you for paying out your loan amount early and we ensure cash flow friendly repayment options which your business to really focus on building sustainable business growth and utilising your business loan as effectively as possible.

Our small business loans can be used for business renovations, marketing campaigns, stock and inventory purchasing, new equipment and infrastructure, general working capital and more. For whatever your business needs to succeed, think Prospa.

Contact one of our friendly staff today or start your online application immediately. Applications are entirely online and completed in just 10 minutes. Approved customers receive approval in an hour and the funds they have applied for are usually released within 24hrs or the next business day.

Talk to a business lending specialist

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

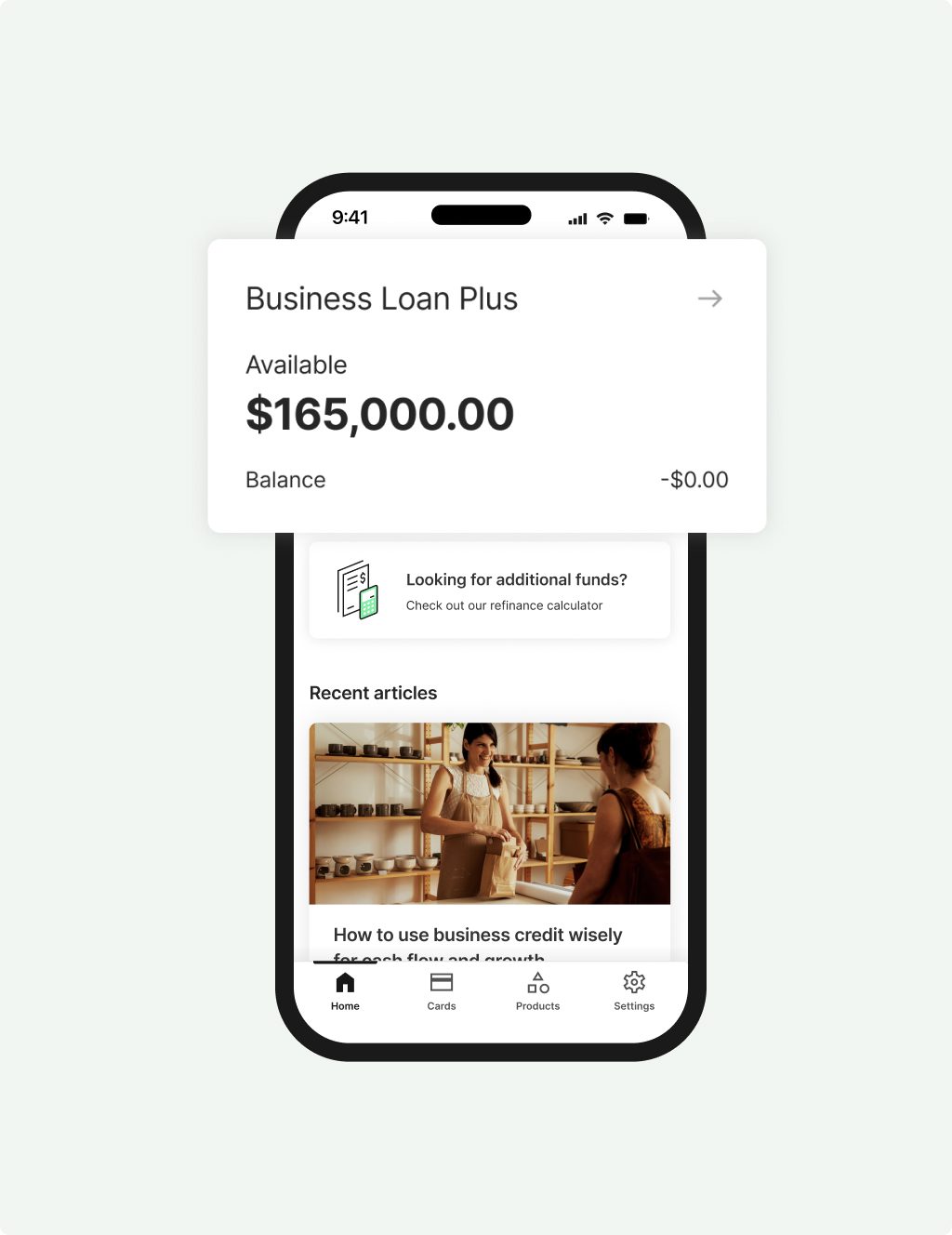

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

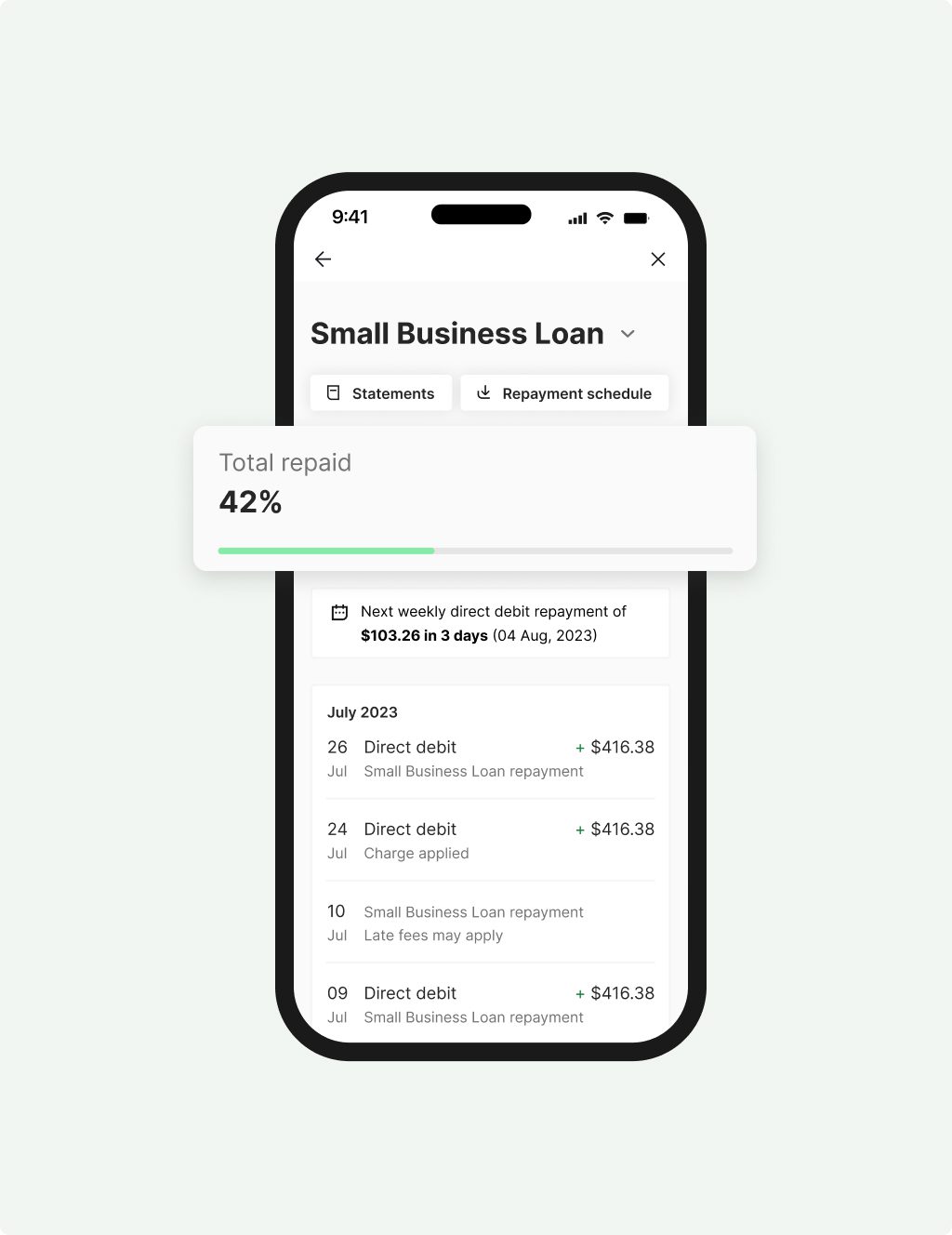

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Awards, thanks to your support

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |