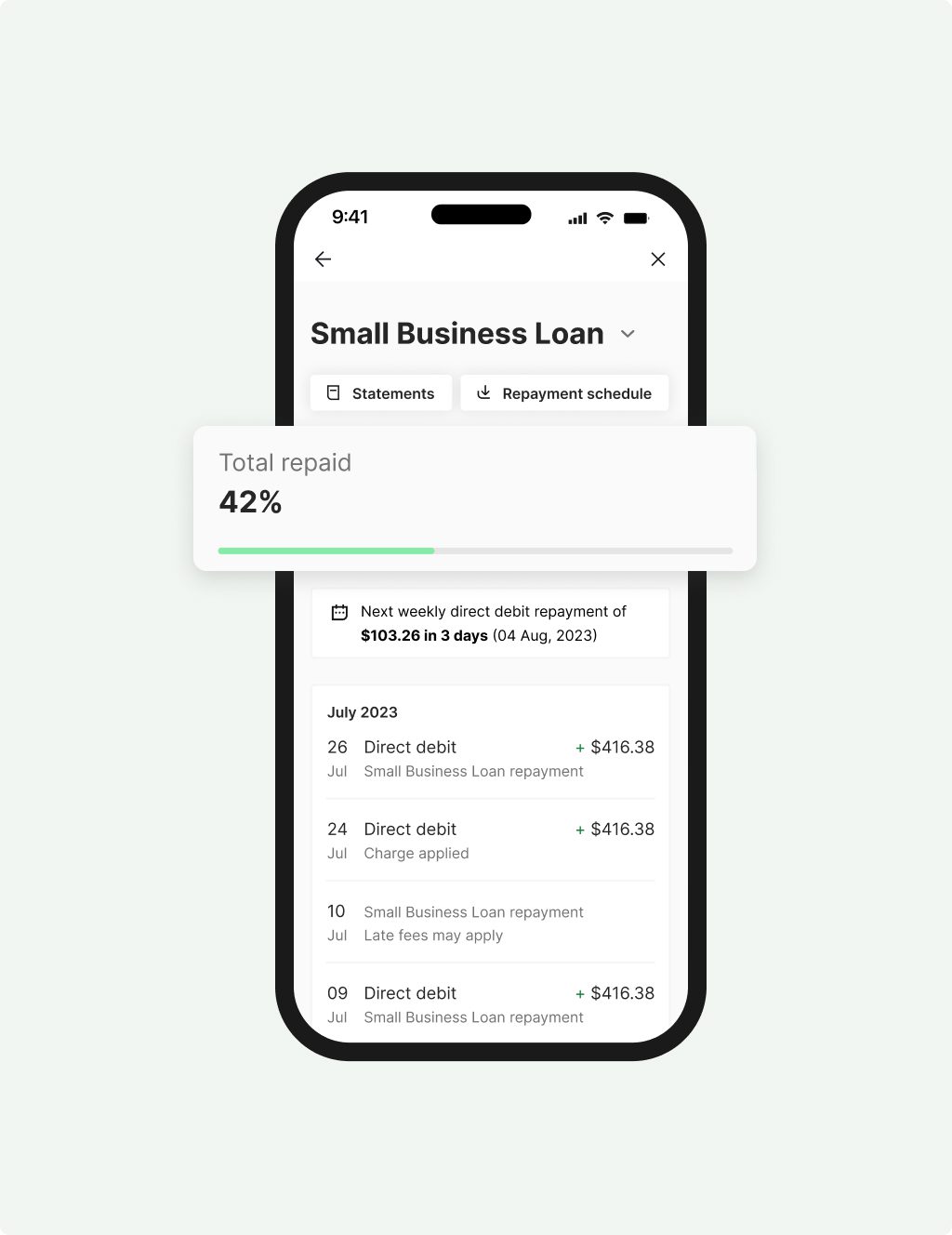

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

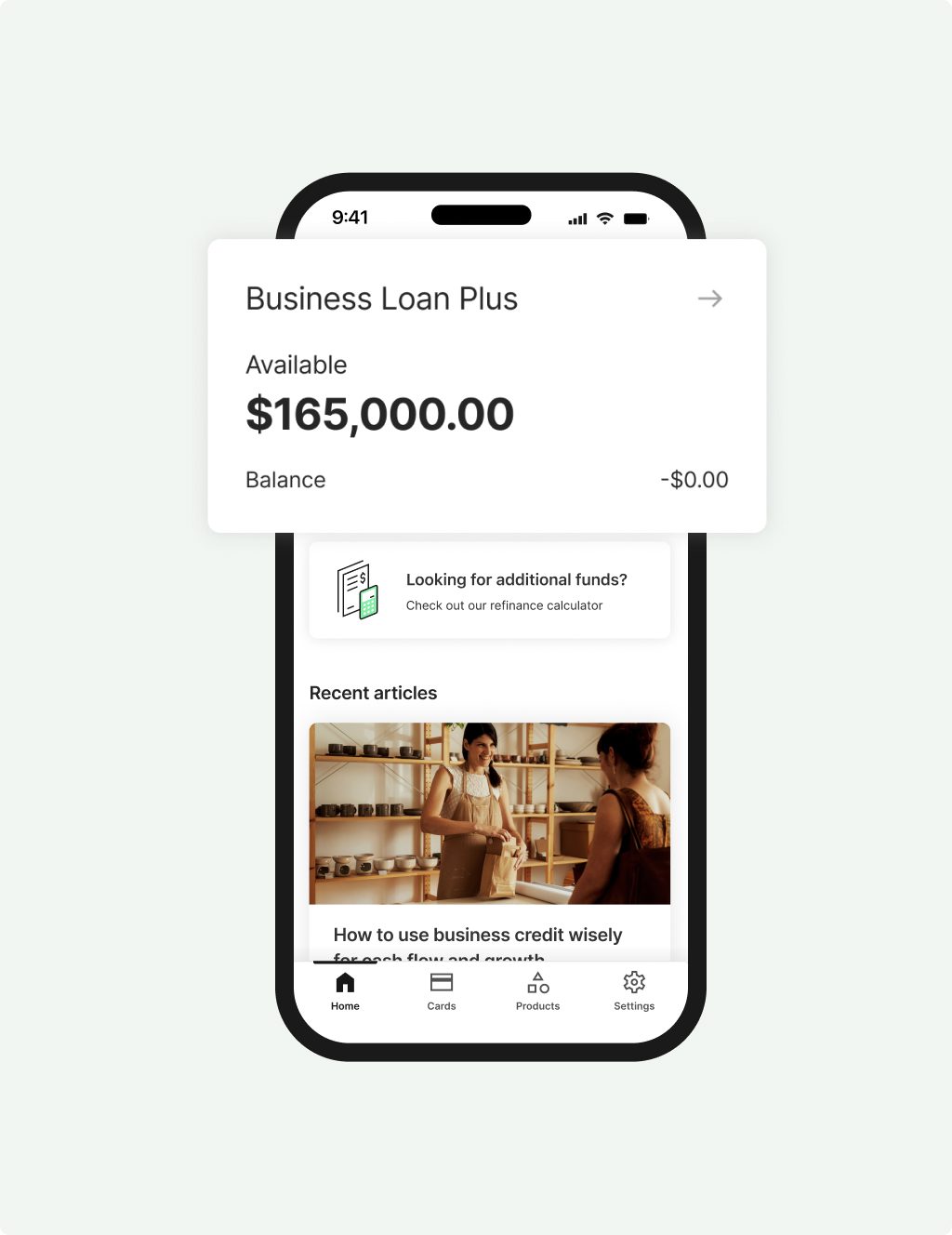

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Easy application

Apply online in under 10 minutes with minimal paperwork.

Flexible terms

We offer repayment terms of 3 - 36 months, with the freedom to pay out your loan early and save on interest

Custom pricing

Our rate is determined by how much you're borrowing, the size of your business and credit score.

Business Loan Sydney

Unlike the big banks and lenders, Prospa is here to help the local Aussie business in Sydney fund their big dreams. Business loans Sydney start at $5K and are offered up to $500K. Join thousands of happy local Aussies just like you start reaching your small business goals with business loans Sydney approved within the hour.

As Australia’s #1 small business lender, we have built and maintained a 4.8/5 TrustScore by investing into local businesses just like yours. With our business loans Sydney, we seek to help you prosper. By providing fast and easy applications, approvals with the hour and your funds usually transferred within 24 hours, Prospa is the small business lender focusing on local Sydney clients and their businesses, not numbers and deadlines.

What sort of business are you looking to build? We have helped every type and trade:

- Café’s

- Local tradespeople

- Restaurants

- Builders

- Retailers and wholesalers

- Hair & beauty specialists

Our short term Sydney loans are available on terms for 3 – 36 months. No asset security required upfront to access Prospa funding up to $150,000.

What could your local business in Sydney do with a short term business loan? How much can you grow your prospects with Prospa’s help?

- Building renovations – expand the café or put in that extra office space

- Technology and innovation upgrades – streamline your production or get the latest software upgrades

- Advertising and rebranding – reach a bigger market with a broad campaign across the city or the country

- New appliances – get the latest cookers, coffee machines, slicers, packers

Prospa has already helped thousands of Aussies get the most from their business finance. We tailor your finance experience to ensure your business is always first with cash flow friendly repayments and no penalties on paying out your loan amount ahead of schedule.

Apply online today and discover your business potential with Prospa.

Prospa. Funding solutions to match your business needs

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

How our customers have put their funds to work

Read Customer StoriesAwards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |