Business Loans

Prospa provide fast business loans Canberra for local businesses across territory. Our easy online application process could have you approved within the hour without unnecessary paperwork, time and hassle. Approved applicant usually receive funds within 24hrs or one business day later. Get your business moving with Prospa.

We have already helped thousands of clients with products like our business loans Canberra assisting with critical renovations, growing and expanding premises with additional office space. We could help you purchase updated machinery or business capital. Looking forward to a busy season? Build your current stock inventory levels coming into busy seasons with Prospa’s help and get your local Aussie business prepared for expansion and growth.

We have funded over $1.65 billion to more than 29,400 Australian businesses and as an award winning market leader, it’s no surprise that we have maintained a 4.8/5 TrustScore.

Our fast and friendly business loans Canberra maintain a strong client focus helping you to achieve your business goals. There are no penalties for early payouts and we provide flexible cash flow friendly repayment terms to help you build on your success and keep your business steadily growing.

Our short term loans are available for 3 – 36 months and start at just $5K. Our application time takes 10 minutes to complete online. No asset security required upfront to access Prospa funding up to $150K and you could have the funds in 24 hours.

Unlike the big banks and lenders, Prospa is looking out for the small and local businesses. We want to ensure that you receive the funds you need to grow your business without the hassle, headache and paperwork. Start your application today or call to speak to one of consultants about what sort of options you might have to work with.

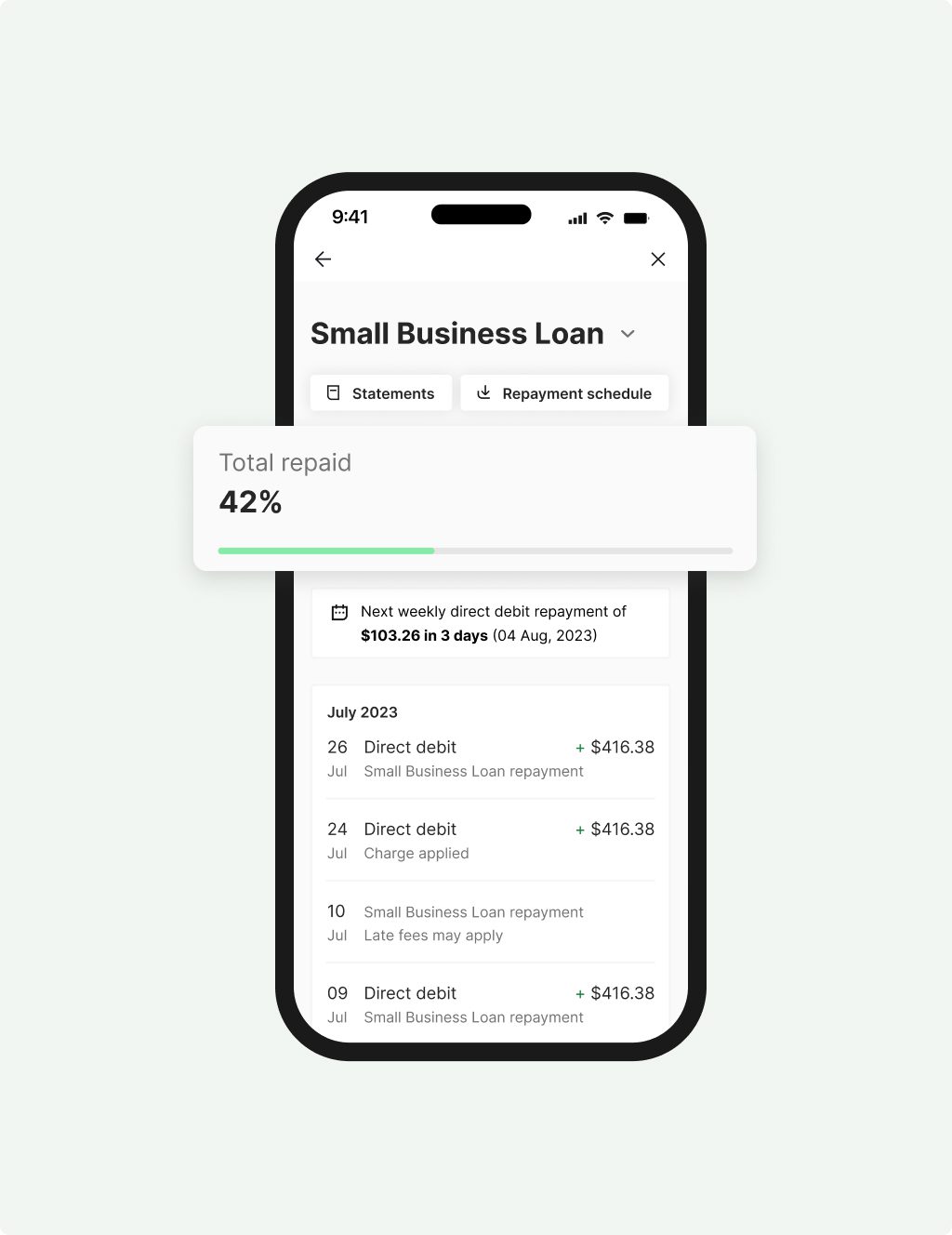

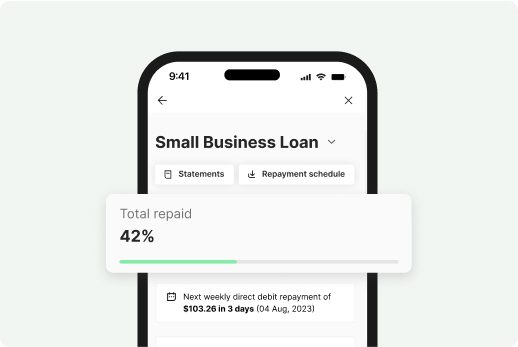

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

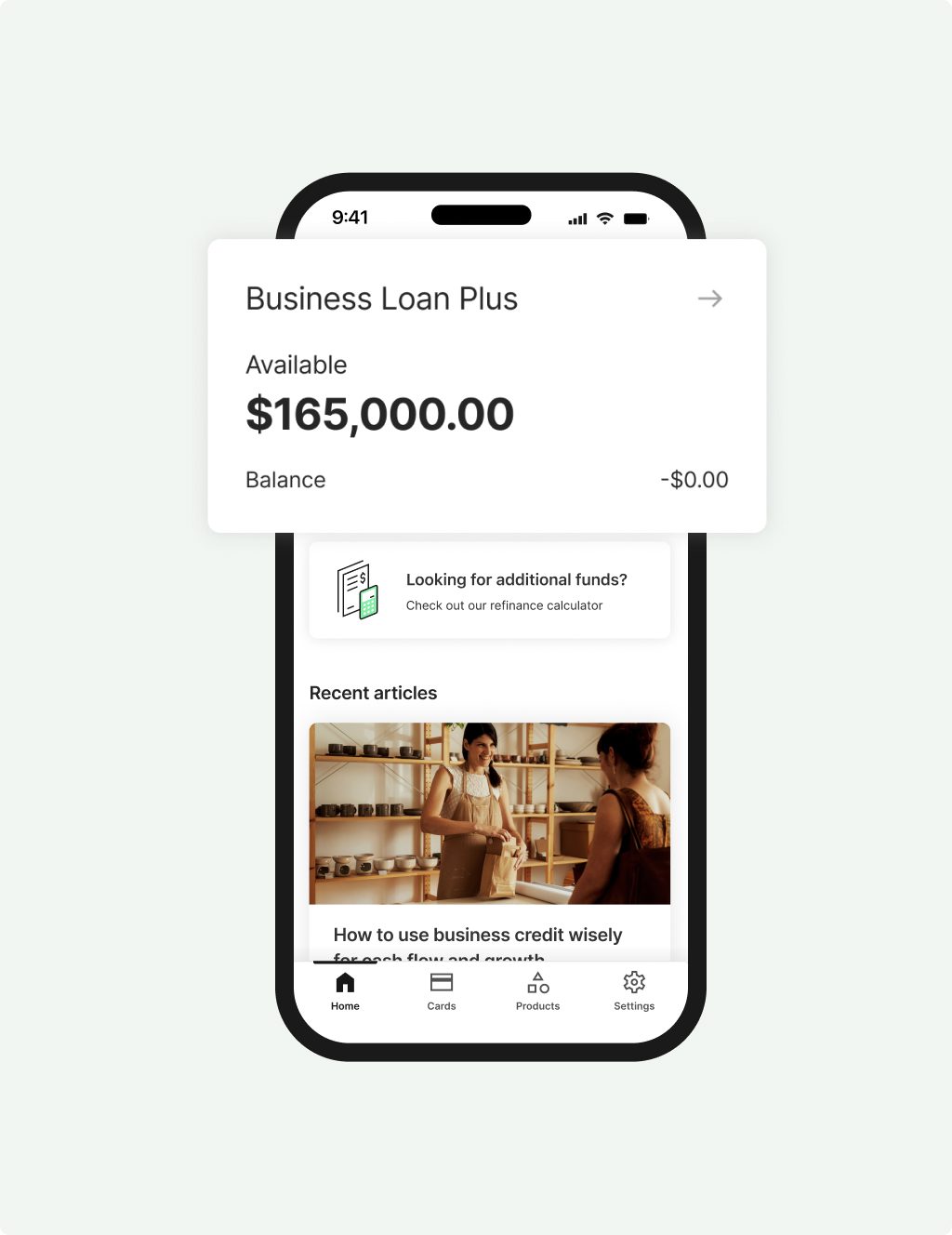

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |