Business Loan Broker

Looking for a Business Loan Broker?

Discover Prospa’s Business Finance Solutions.

If you're seeking a business loan broker to navigate the complexities of securing funding, consider the streamlined and direct approach offered by Prospa.

One platform

A range of funding solutions

Already know what

you’re after? .

Need help?

Why Choose Prospa for Your Business Funding Needs?

- Quick and Simple Application Process: Apply online in under 10 minutes and receive funding as fast as 24 hours after approval.

- Flexible Funding Options: Access loans ranging from $5K to $500K with terms between 3 and 36 months, featuring repayment schedules that align with your cash flow.

- Transparent Terms: Benefit from clear, competitive rates with no hidden fees, ensuring you understand your commitments fully.

- Dedicated Support: Our team of funding specialists is available to guide you through the process, providing personalized assistance to help you achieve your business goals.

How Prospa's Business Loans Can Empower Your Business

Prospa's business loans are designed to support various business objectives, including:

- Expansion: Open new locations, invest in equipment, or hire additional staff to scale your operations.

- Cash Flow Management: Cover everyday expenses such as rent, utilities, and wages to maintain smooth operations.

- Opportunity Seizure: Quickly capitalize on growth opportunities, like bulk inventory purchases or seasonal demand.

- Technology Upgrades: Invest in modern tools, software, or machinery to enhance efficiency and competitiveness.

01

Apply Online

Apply Online

02

Fast Decision

Fast Decision

03

Receive Funds

Receive Funds

Success Stories from Prospa Customers

Prospa has empowered over 50,000 Australian small businesses across various industries. Here are a few examples:

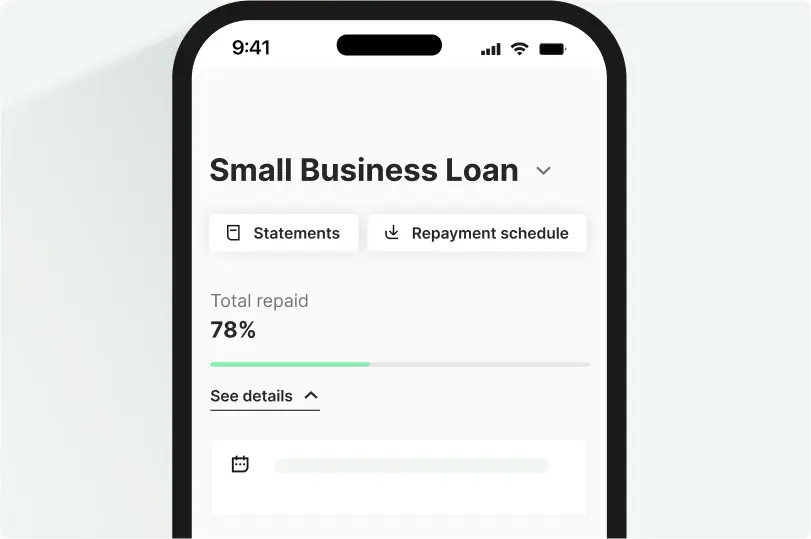

Hands from Heaven

Tony Logan-Stevens expanded his remedial massage therapy clinic with a Prospa Small Business Loan, allowing him to double the business’s floor space and offer more holistic treatment methods.

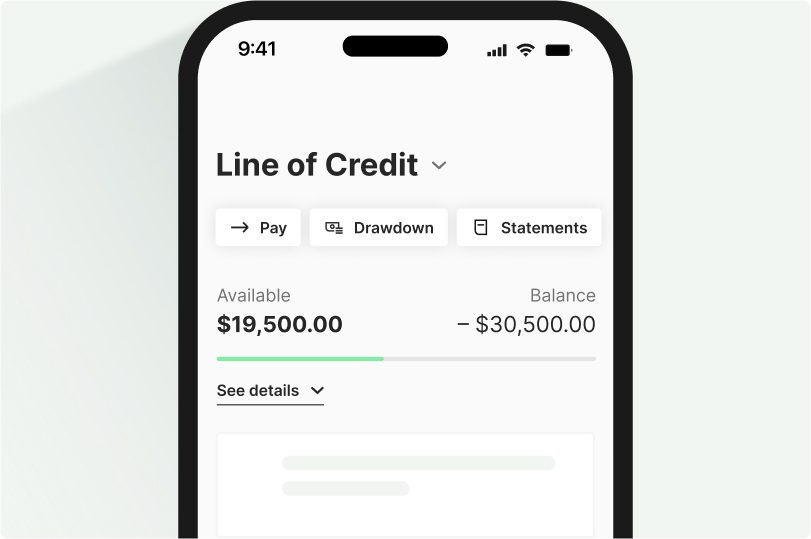

My Perfume Shop

Matt Stanley utilized a Prospa Line of Credit to purchase bulk inventory and partner with a third-party fulfillment center, helping his e-commerce business reach $1 million in turnover.