Business Lending

Find tailored lending solutions to meet your business goals

Business Lending

Meet Australia’s #1 online lender to small business and find out for yourself why Prospa has maintained a 4.8/5 TrustScore from over 29,400 happy and prosperous clients. We put our clients first with tailored business lending solutions that help you achieve the dreams and goals you have for your small business.

Prospa small business financing options start with loans of $5,000 and extend up to $150,000. Applying is fast and easy with our 10 minute online form and a decision is usually received within the hour. Approved clients normally receive the funds they have been approved for in 24hrs or the next business day.

How can we help you to build and expand your small business?

Prospa is the place small businesses go to get the boost they need to really grow. No matter what type of business you have or why you might be looking for finance, Prospa is here to help.

- Premises renovations

- Hardware and software upgrades

- Advertising and rebranding

- New appliances

Financing over $1.65 billion in business loans, Prospa has already helped thousands of Aussies get the most from their business finance. We tailor your finance experience to ensure your business is always first.

No asset security required upfront to access Prospa funding up to $150K. We don’t penalise our clients for early payouts which means you maintain control of your small business finance. Repayment options are developed by your lending consultant to ensure you maintain cash flow friendly terms.

Start your application process today with a fast and easy online application. Let us help you secure prosperity.

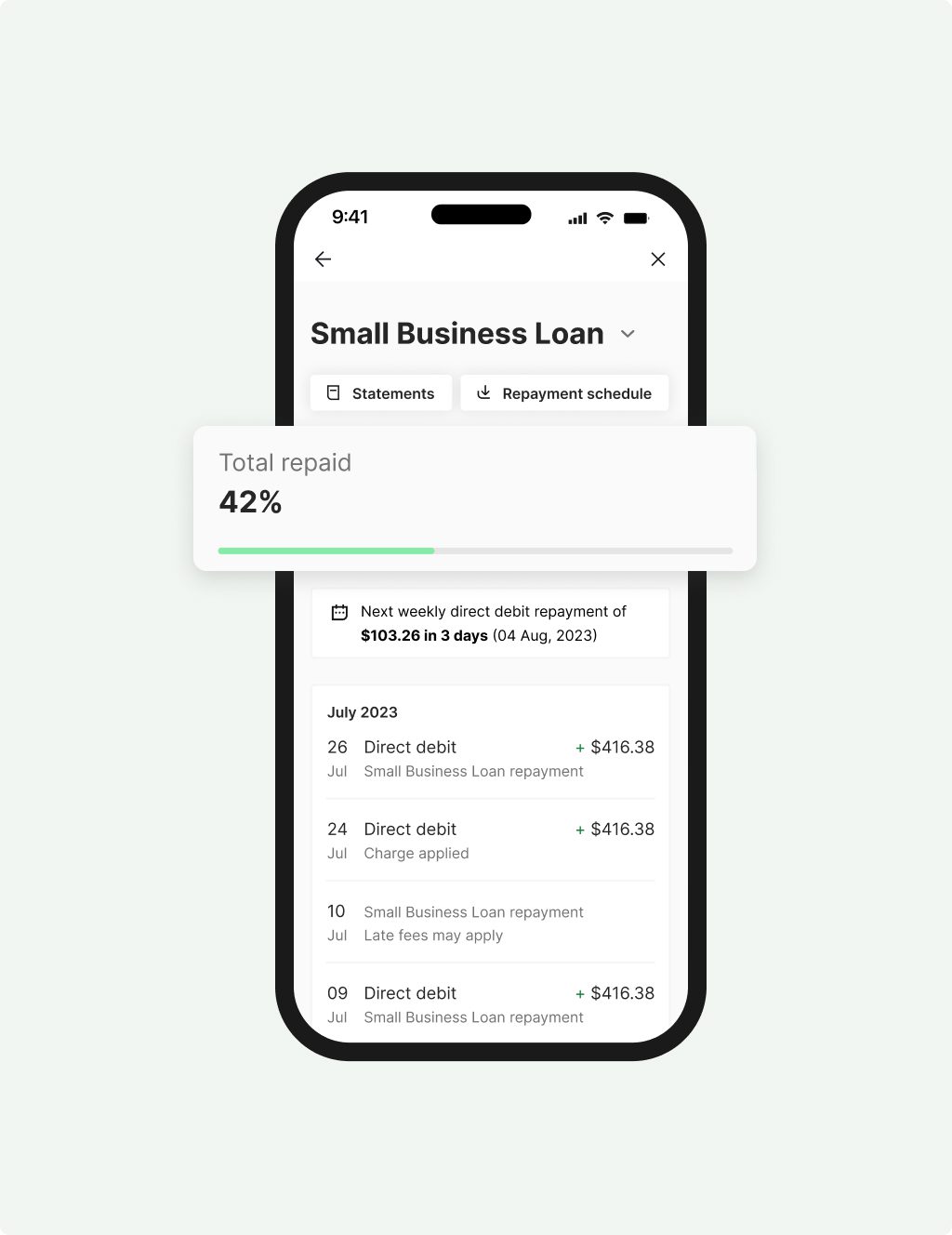

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

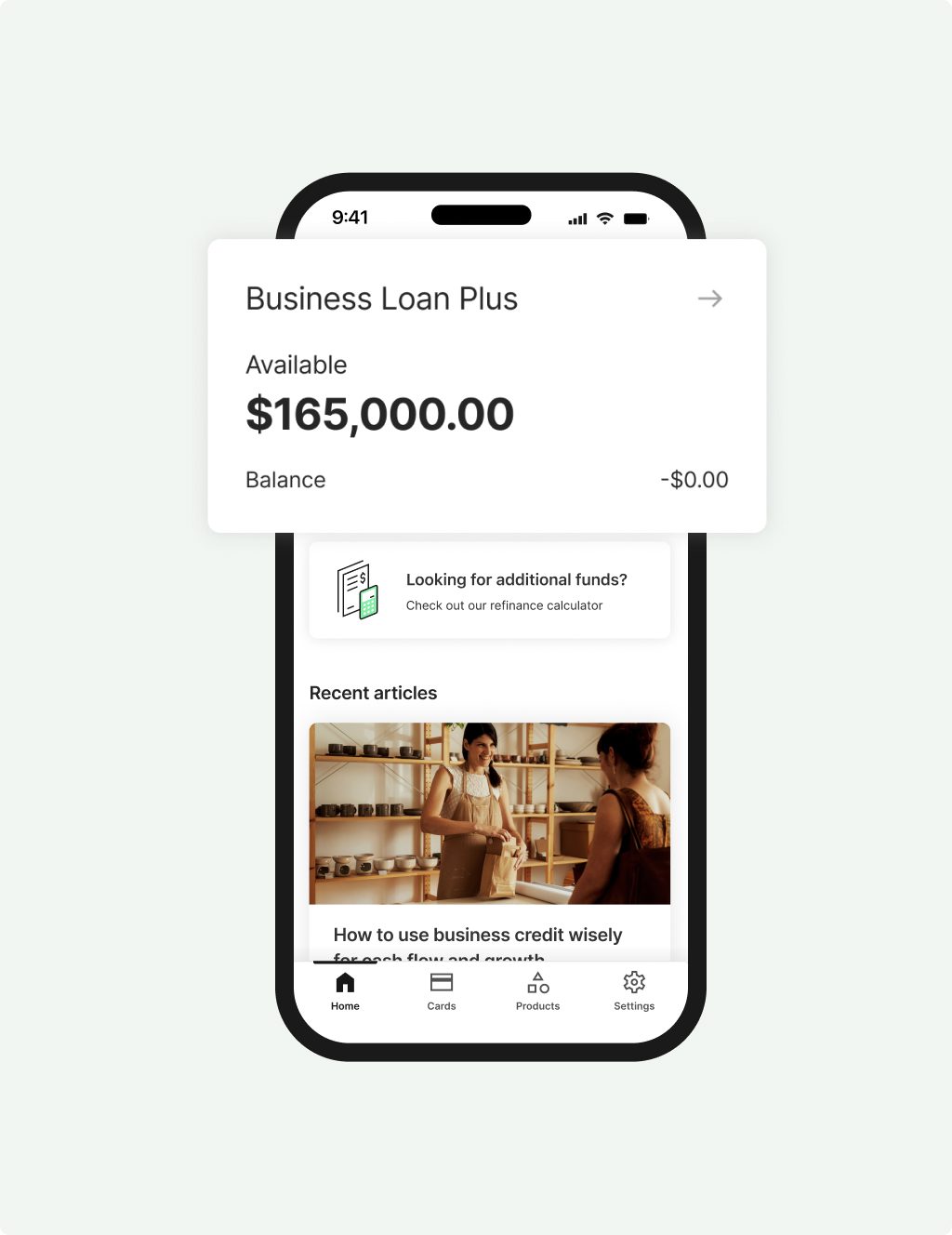

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

How our customers have put their funds to work

Read Customer StoriesAwards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |