NEWS: Construction set to take off

Flexible funding solutions to help you:

- Get on top of cash flow up front

- Optimise tech to increase efficiencies

- Invest in new approaches and differentiate

Flexible business funding for tradies

Tired of the see-saw, balancing act of running a business? With Prospa, this time tomorrow you could be back on the tools doing what you love rather than stewing over the admin.

That’s right, with our flexible funding solutions, you can apply for up to $500K online in 10 minutes, and, if approved, have the funding in your account in just 24 hours.

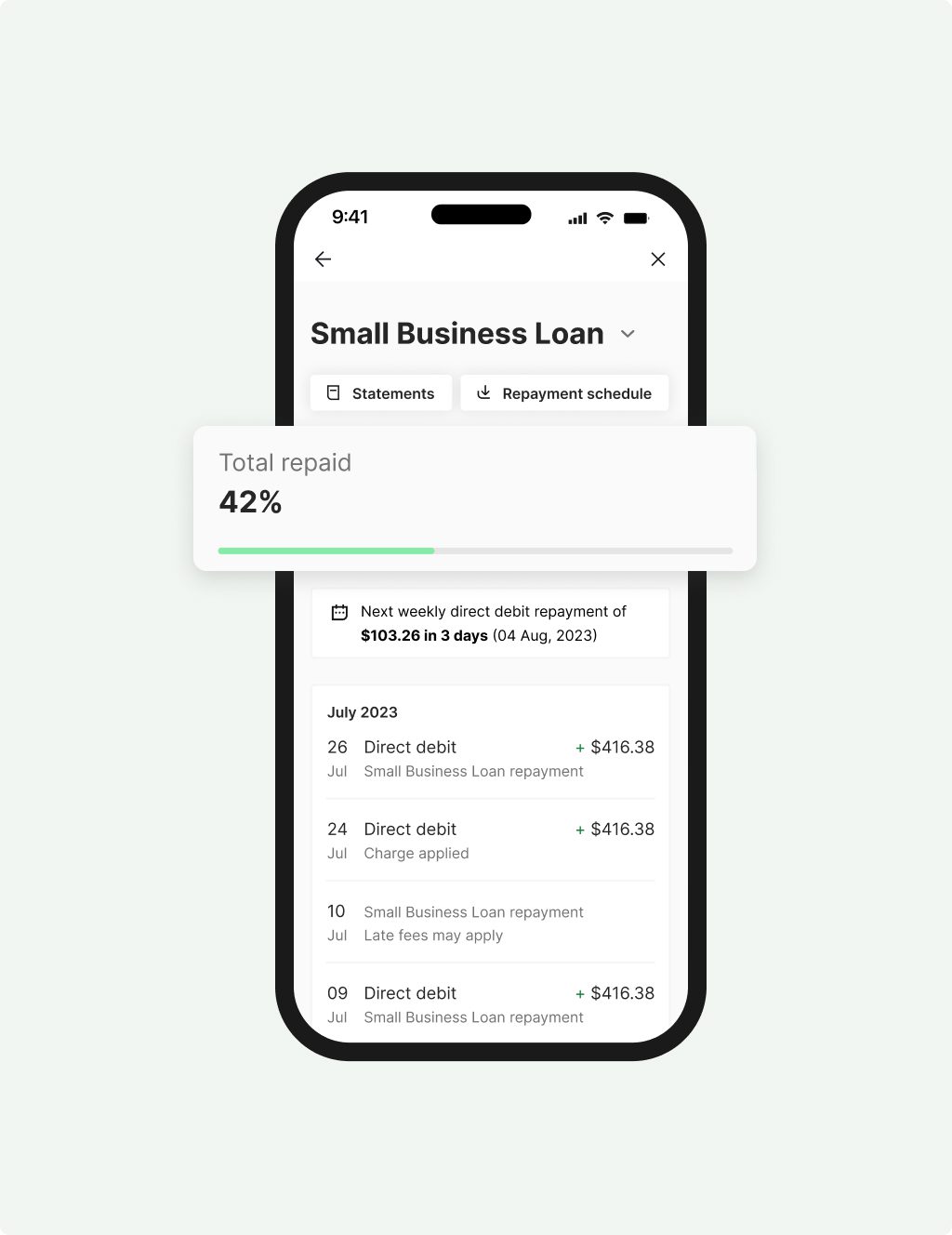

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

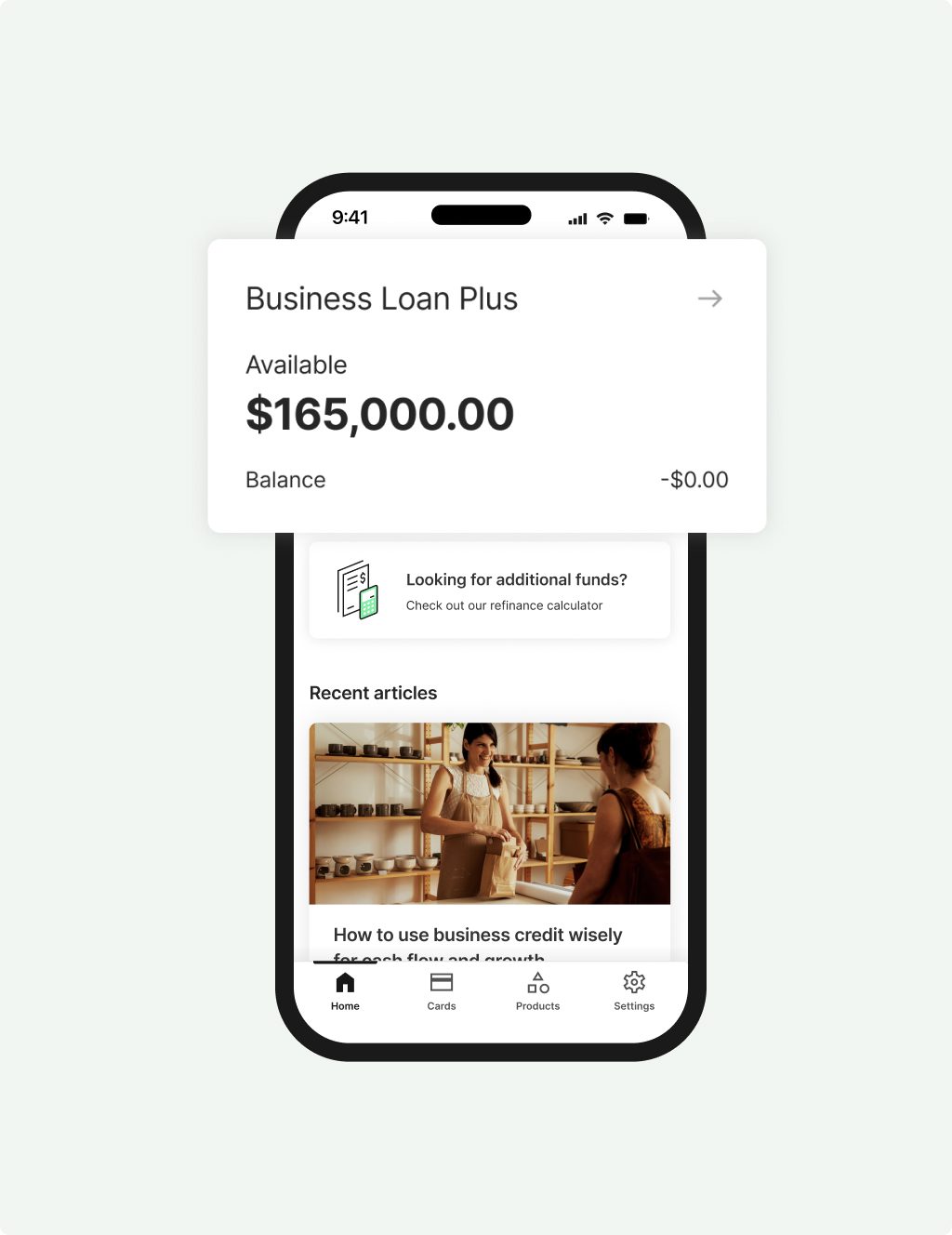

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Cashflow or Growth. We could help with both!

As a tradie, you know that cash flow can play a vital role in your business’s day-to-day. Then there are the times you might need funds to take business up a notch. Talk to Prospa.

Whether you’re on the tools or managing others who are, this time tomorrow you could have a flexible funding solution suited to your business’s needs – whatever they may be.

- Cover cash flow gaps. Keep everything moving when billing and client payments don’t quite line up.

- Upgrade vehicles and equipment. Avoid forced downtime due to equipment failure by staying on top of your maintenance.

- Keep your suppliers on side. Maintain the reputation that you always pay your contractors and suppliers on time.

- Stock up. Make sure you’re prepared well in advance for upcoming jobs with everything you need on hand.

- Put yourself out there. Marketing and advertising are an important part of lining up new contracts, so it’s best done right.

- And more. Having hassle-free access to funding can help give builders and tradies the freedom to move quickly.

Awards, thanks to you

It’s nice to know we’re doing something right.

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |