Ross Aucutt has been immersed in the world of business finance for as long as he can remember. He witnessed his own father, a small business owner, constantly wrestle with cash flow challenges. Now as Prospa’s CFO, he spends his days finding ways for small businesses to overcome such challenges.

The Prospa comms team caught up with Ross after a keynote address at the Reckon Partners Conference – where he discussed the important role accountants can play in smoothing the way for SMEs, especially through times of economic downturn.

“Cash is King.” It’s a mantra that Ross Aucutt, Prospa CFO, lives by wherever he goes and shares it at every available opportunity. From an early age, Ross had a keen interest in finance. He started working with his father, a small business owner who was constantly under pressure to find working capital, relying on big supplier contracts to pay on time to cover staff wages.

“We didn’t have the financial options back then that we do today,” said Ross. “We lived hand to mouth so my father had enough capital to manage day-to-day operation costs.”

“Sometimes invoice payments were late, and he was forced to beg, borrow, and defer just to pay the bills and manage cash flow,” Ross reflected. Even though the business was doing well, it got to the point where Ross’s father decided that it was better to downsize the company than deal with the ongoing cash flow challenges.

What happened to Ross’s father’s business is not uncommon. In fact, in the current economic climate, many small business owners are questioning the risk of doing business and asking, “Is it really worth it?”

Ross believes that if COVID taught us anything, it’s that economic downturns are inevitable, and it just takes proactivity and a switch in thinking to help small businesses arm themselves against external pressures or unexpected events.

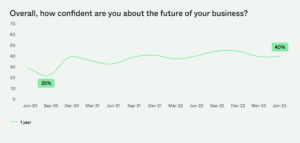

Recent research commissioned by Prospa and conducted by RFI Group shows that business confidence is on the decline with around 40% of small businesses no longer confident about the future. This is only marginally better than the all-time low of 25% seen during the height of the pandemic.1

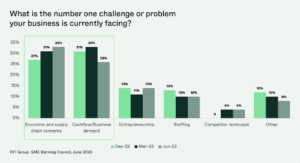

The research also asked businesses about their current challenges. Topping the list was an increase in fears and concerns around the effects of macro-economic factors on the supply chain and concerns around rising costs of materials.2

Uncertainties around business operations ranked next, with sole traders and micro businesses more concerned about cash flow, while larger businesses find staffing to be more of a challenge.

So what does this mean for accountants and bookkeepers?

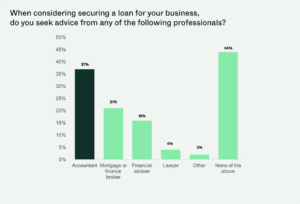

On the upside, more and more small to medium businesses are looking for advice when it comes to business operations and finance. The research revealed that 37% of them turn to their accountants.3

“My father’s accountant was a key advisor, and his sage advice was gold for Dad,” said Ross. “As a result, he became a very good friend.”

Small businesses often rely on their accountants or bookkeepers for advice on how to manage their business. This represents a huge opportunity for accountants to turn the tables slightly, and proactively talk to small business clients about cash levels. Acting like an on-call CFO can help mitigate pending challenges but also to strengthen relationships.

Detecting cash flow red flags early is key

“Accountants have a unique vantage point when it comes to a small business client’s financial health and can often spot red flags even before they do,” said Ross.

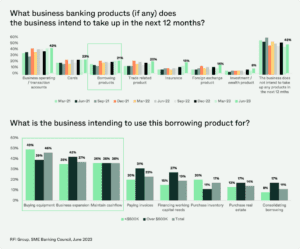

The RFI research showed that 1 in 5 small to medium businesses say they will be looking for funding in the next 12 months, to maintain cash flow and buy equipment to support business development.4

“This figure only shows businesses that anticipate the need for extra funding,” said Ross. “It doesn’t consider those that haven’t spotted the need for capital.” Ross believes that’s where the real opportunity lies, and why it’s so important for accountants to be proactive.

Tailored solutions for diverse business needs

Every business is unique, with different working capital needs based on variables like size and industry. Fortunately, there are solutions available to help fill a diverse range of needs. For instance, Prospa offers a Line of Credit which is a safety net of funds to cover the gap between supplier invoices being paid and operational costs and wages.

A Small Business Loan, on the other hand, offers a simple lump sum to pay for new equipment or a new fit-out in equal installments, making it easy to plan ahead and work into a budget.

As accountants, you can play a crucial role in assessing the financial requirements of small to medium business clients and matching them to a suitable financing solution.

Ross’s foundational experience in his father’s small business taught him to understand where SMEs comfort zones lie and that trusted advisors are key to solving financial challenges.

He truly believes Prospa’s simple referral model is a winner. “All the heavy lifting is done by the lender with the accountant or advisor ultimately holding the client relationship,” he concluded.

If you are interested in finding out more about the referral model and how Prospa can help support your business clients, visit the website or contact Prospa on 1300 964 808