At a glance

- The right tools give you clarity and control, helping you plan ahead, avoid shortfalls and make confident financial decisions.

- Tools for forecasting, invoicing, budgeting, expense tracking and loan repayment planning are essentials every small business needs.

- Take action today with practical tools, free templates, calculators and expert guidance.

With more than 200 finance tools available to Australian small businesses, narrowing down the right ones can feel like a full-time job in itself. From cash flow forecasting apps and cash flow management tools to budgeting software, invoice trackers and loan calculators, the options are endless, but not every tool will suit your business.

In this article we’ve pulled together four must-have types of financial tools to stay on top of your finances in 2025. For each one, you’ll find a link to a free tool, a downloadable template, or practical advice on how to choose the best app or software for your needs. This way, you can stop researching and start taking action.

What the right finance tools can do for your business

Running your business without the right finance tools can cost you in time, money and missed opportunities. Without clear visibility over your numbers, it’s easy to underestimate expenses, fall behind on payments, or make decisions based on gut feel instead of facts. And when cash flow is tight, even a small mistake can have a big impact.

Here’s what the right tools can do:

- Get a clear view of your cash flow so you can spot shortfalls early and avoid surprises.

- Plan for seasonal dips or big expenses with tools that map out income and outgoings.

- Track and control your spending by categorising expenses and spotting unnecessary costs early.

- Save time on admin with tools that automate invoicing, payment tracking and expense management.

- Understand your loan repayments before you commit by calculating interest, timelines and affordability in advance.

1. Cash flow forecasting tools

The timing of cash in and cash out can make or break a business. That’s why cash flow forecasting is one of the most important habits you can build — and the right tools can make it far easier.

To help you choose the best option, we’ve included the top tools recommended by James Scott, principal of JD Scott + Co, who advises a wide range of small and medium businesses on cash flow and forecasting.

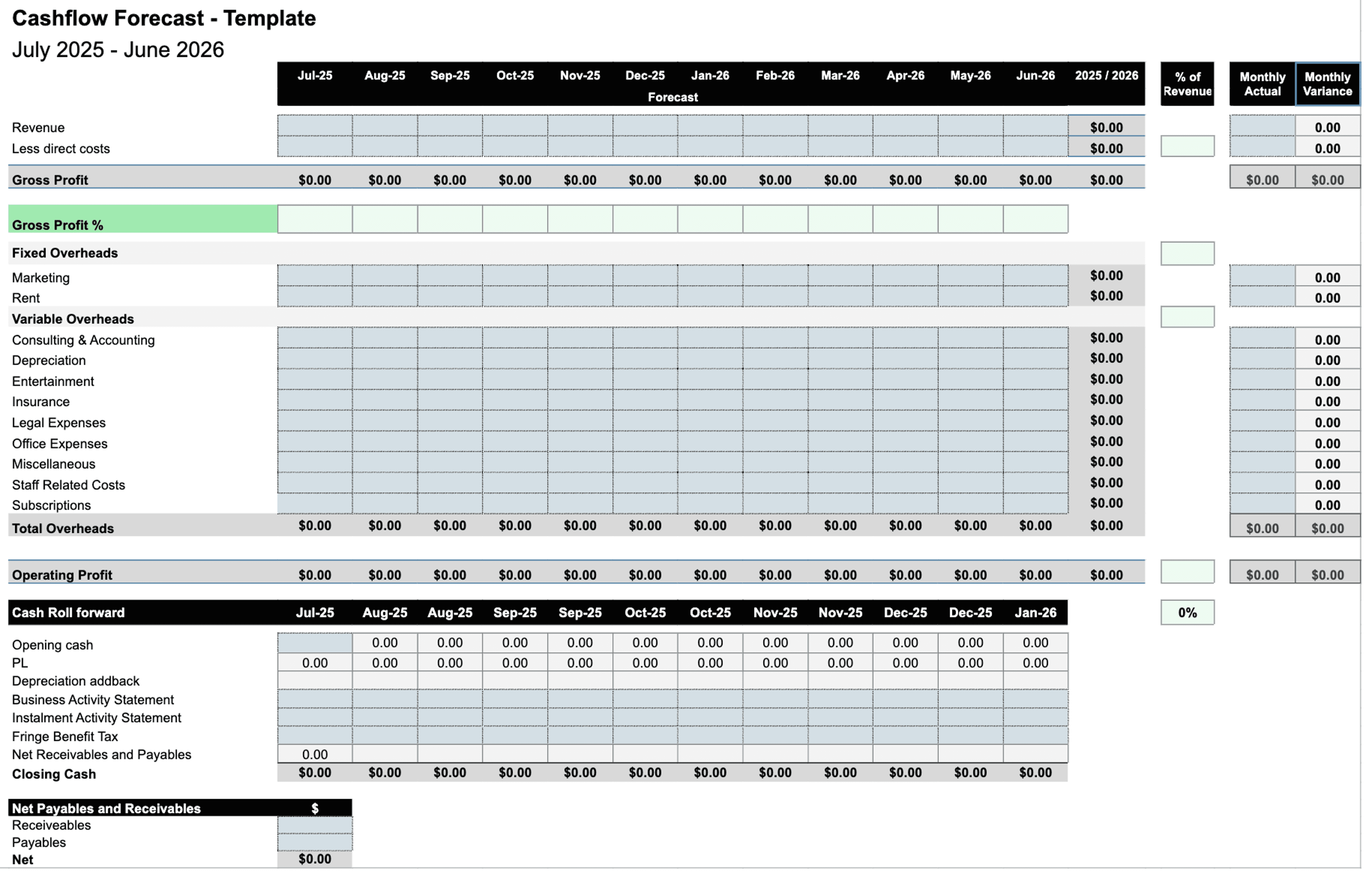

Start simple with Prospa’s free cash flow forecasting template

At a basic level, a simple spreadsheet can help you forecast your cash position and spot shortfalls in advance. The free Excel template developed by Prospa in collaboration with JD Scott + Co is ideal for sole traders or early-stage businesses who want a hands-on way to track income and expenses. You can also use it alongside this Profit and Loss projection tool to gain a clearer view of your overall financial position.

Level up with cash flow forecasting software

Level up with cash flow forecasting software

If you’re ready for something more advanced, software tools offer greater precision and automation, with each serving a different purpose:

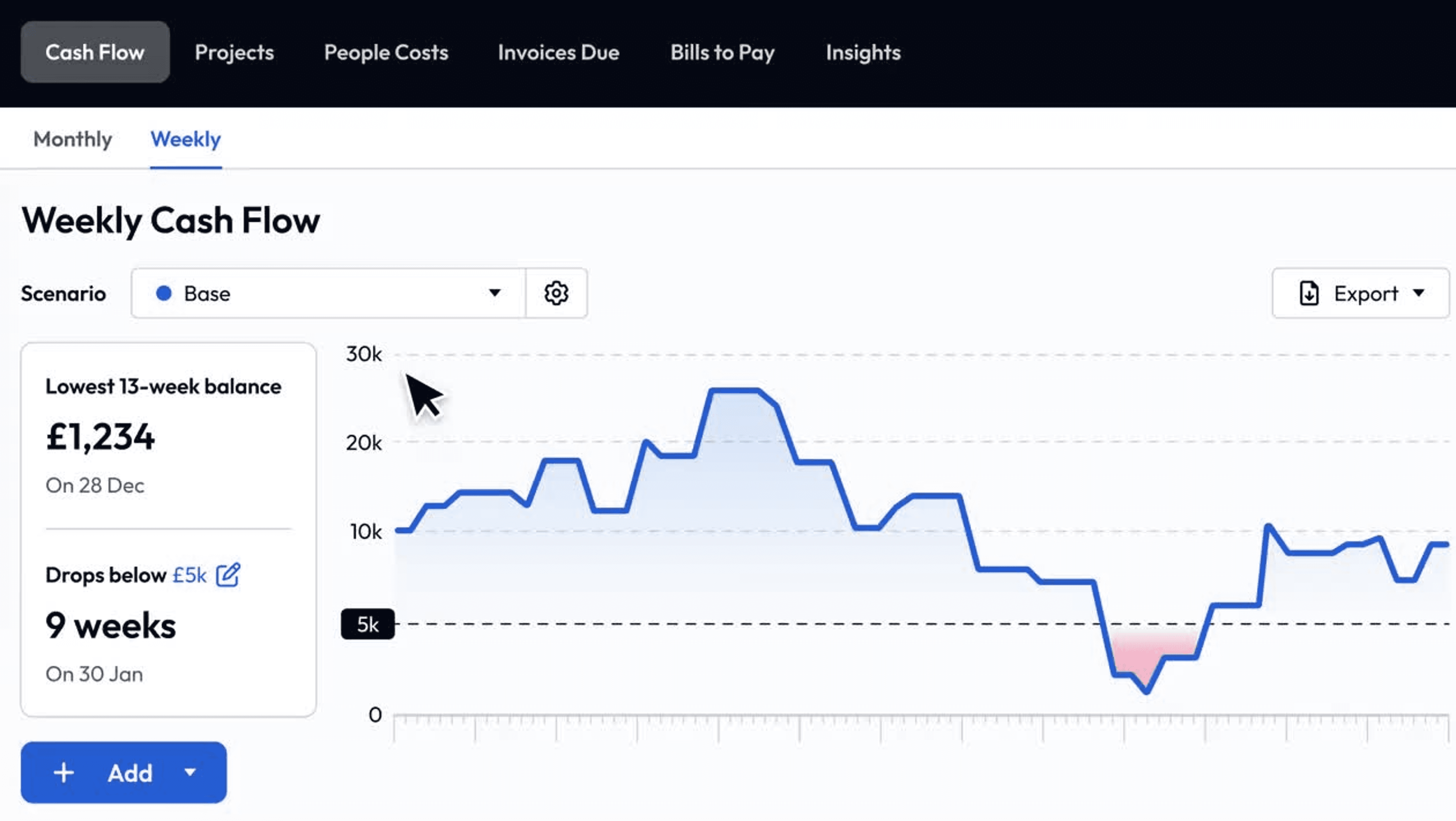

- Float is designed for day-by-day cash flow forecasting. It connects to your accounting software and gives you real-time visibility over incoming and outgoing cash. It’s ideal for managing recurring payments like payroll, rent and supplier invoices.

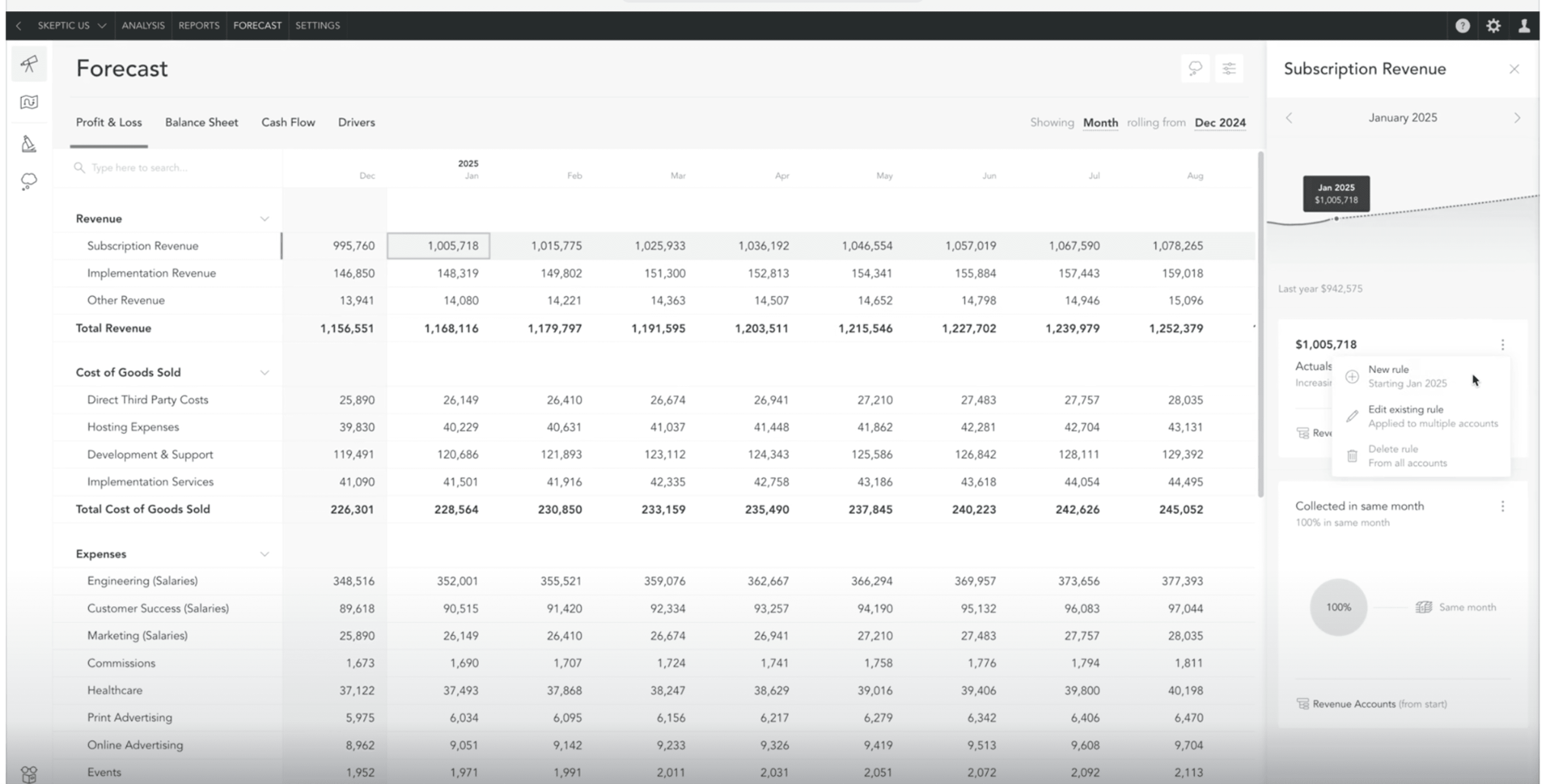

- Fathom blends forecasting with performance insights and KPI tracking, giving you a bigger-picture view of your business. If you’re looking to tie cash flow to broader financial goals, this is a strong option.

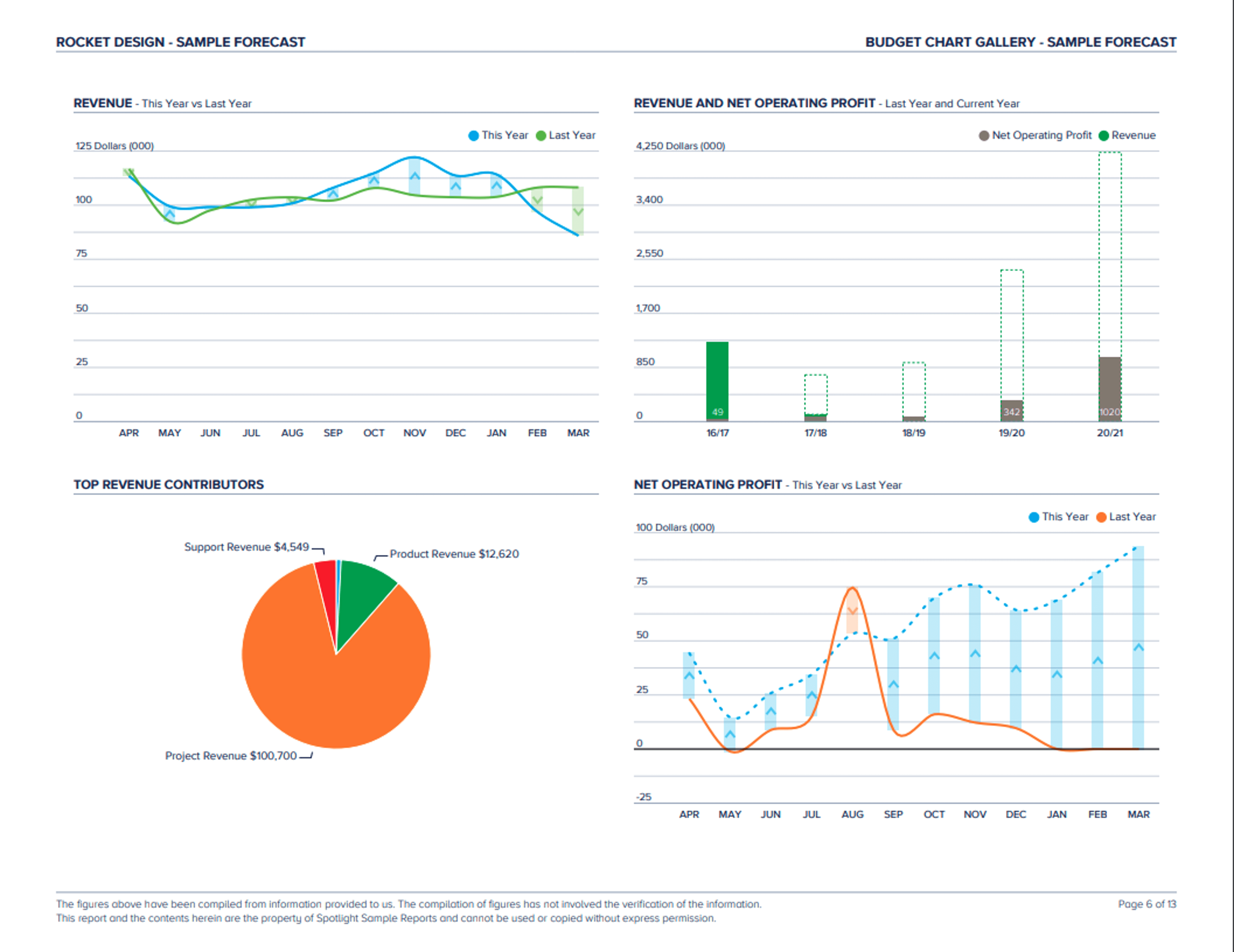

- Spotlight Reporting allows for three-way forecasting by integrating your profit and loss, balance sheet and cash flow into one view. This approach is more comprehensive and particularly helpful for growing businesses or those seeking funding or financial advice.

“To get an accurate view of your future cash position, you need a three-way forecast — one that pulls together your P&L, balance sheet and cash flow in one place.” — James Scott, JD Scott + Co

Whether you’re after full control with a spreadsheet or want to automate and scale your forecasting, there’s a tool to match your business needs. Scroll down for a side-by-side comparison of the most popular options.

Cash Flow Forecasting Tools Comparison

| Tool | Best for | Ideal if you… | Considerations |

|---|---|---|---|

| Excel | Full control and customisation | Enjoy building models manually and understand forecasting | Excel is like the old-fashioned hammer. It’s simple, but you need to know how to use it |

| Float | Day-by-day cash flow forecasting | Need visibility over weekly/monthly cash ins and outs like payroll, rent, GST, and invoices | It’s important to make sure it’s customised and set up properly for your needs |

| Spotlight Reporting | Three-way forecasting (P&L, balance sheet, cash flow) | Want a solid tool that goes beyond Excel but is still usable without deep technical skills | Designed for accountants and advisors, but still accessible to business owners with basic finance skills |

| Fathom | Performance reporting and scenario-based forecasting | Want to track KPIs and model different financial outcomes | Best suited to businesses looking for strategic insights and comfortable interpreting financial metrics |

Want more tools to manage cash flow? From invoicing apps to payment platforms, there are plenty of ways to improve visibility over your finances.

2. Invoice and payment tracking tools

Even if business is booming, cash flow can stall if your invoices aren’t paid on time. Chasing payments manually takes time, and it’s rarely how small business owners want to spend their day.

According to Small Business Insider, two in three (67 per cent) SMEs consider accounting and bookkeeping software their most critical technology investment in 2025.

This makes sense. These tools reduce admin and make it easier to:

- Send professional, timely invoices

- Track due and overdue payments

- Automate reminders and follow-ups

- Reconcile payments with your accounts

- Keep your cash flow running smoothly

Instead of juggling spreadsheets or scrolling through email threads, invoice and payment tracking tools give you a clear view of who’s paid, what’s outstanding, and what payments are coming up.

Xero, MYOB, and QuickBooks are some of the most widely used tools for small businesses, with built-in invoicing and payment tracking features that integrate directly with your accounts. If you’re exploring alternatives, there are many other tools on the market, each with different features, pricing, and integrations. This independent review of the top 7 accounting tools for Australian small businesses can help you find the right fit.

Tip: Invoice and payment tracking tools can also support forecasting. See how two businesses use them to plan ahead.

3. Budgeting and expense management apps

It’s easy to lose track of where your money goes, especially when small, everyday costs start adding up. Budgeting and expense management tools help you stay on top of spending and allow you to:

- Categorise and monitor expenses in real time

- Spot unnecessary costs and spending patterns

- Compare actual spending against budgets

- Decide where to cut back or reinvest

Popular options include:

- Xero Expenses. Designed for businesses already using Xero, this tool makes it easy to capture receipts, submit expense claims, and track spending in real time. It integrates directly with your chart of accounts, helping you keep your records up to date without manual data entry.

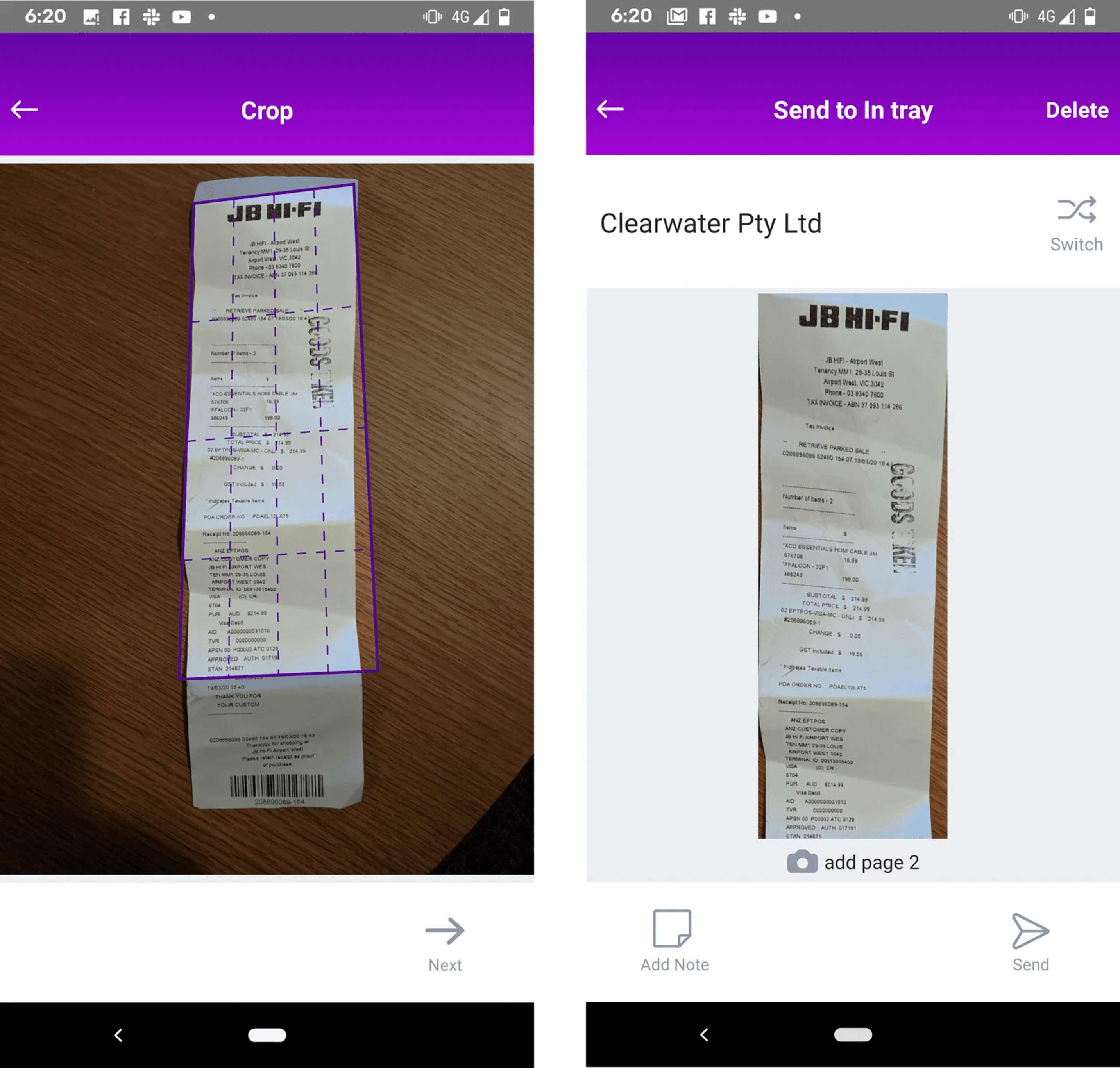

- MYOB Capture & Expenses. These tools work with MYOB Business to streamline expense management. You can snap and upload receipts from your phone, automate expense categorisation, and track costs against jobs or budgets.

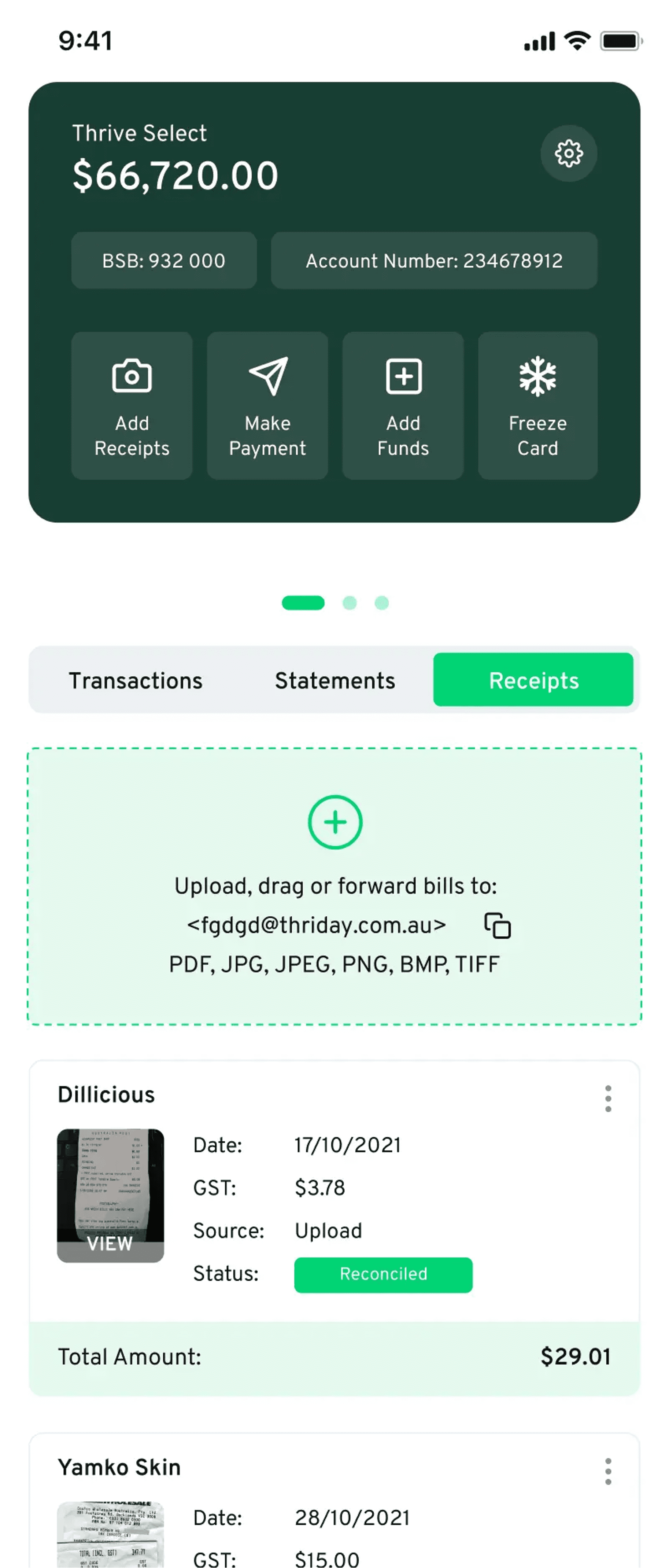

- Thriday. Designed for sole traders and small businesses, Thriday combines expense tracking with banking and automated bookkeeping. It’s useful for those who want an all-in-one platform to reduce admin and simplify tax time.

- Hnry. Hnry is purpose-built for sole traders and contractors. It handles expense tracking, invoicing and tax payments all in one. As you earn, it automatically sets aside tax and files returns on your behalf.

- Frollo. Frollo is a personal finance app that’s gained popularity among sole traders and freelancers. It offers smart budgeting tools, expense categorisation, and goal setting — all with an intuitive mobile interface.

Budgeting and expense tools comparison

| Tool | Best for | Ideal if you | Considerations |

|---|---|---|---|

| Xero Expenses | Real-time tracking within Xero | Already use Xero and want integrated expense tracking | Requires Xero subscription |

| MYOB Capture | Capturing receipts on the go | Want a mobile-friendly way to snap and track receipts | Works best with MYOB Business |

| Thriday | All-in-one expense and tax solution | Want automated banking, invoicing and expense management | Newer platform, best suited to sole traders and small teams |

| Hnry | Hands-free finances for sole traders | Want a tool that tracks expenses, pays tax and files returns | Only available for sole traders and contractors |

| Frollo | Budgeting and goal tracking on mobile | Prefer a visual, app-based view of your personal and business cash flow | Not designed specifically for business use, but still useful for sole traders |

4. Business loan repayment calculators

If you’ve ever asked yourself, “Can I afford this loan?” you’re not alone. When it comes to borrowing for your business, understanding how repayments will affect your cash flow is critical, especially in today’s economic climate.

A business loan calculator can give you guidance before committing. It’s a useful indication as to whether repayments will be manageable, especially when comparing finance options or forecasting cash flow over the coming months.

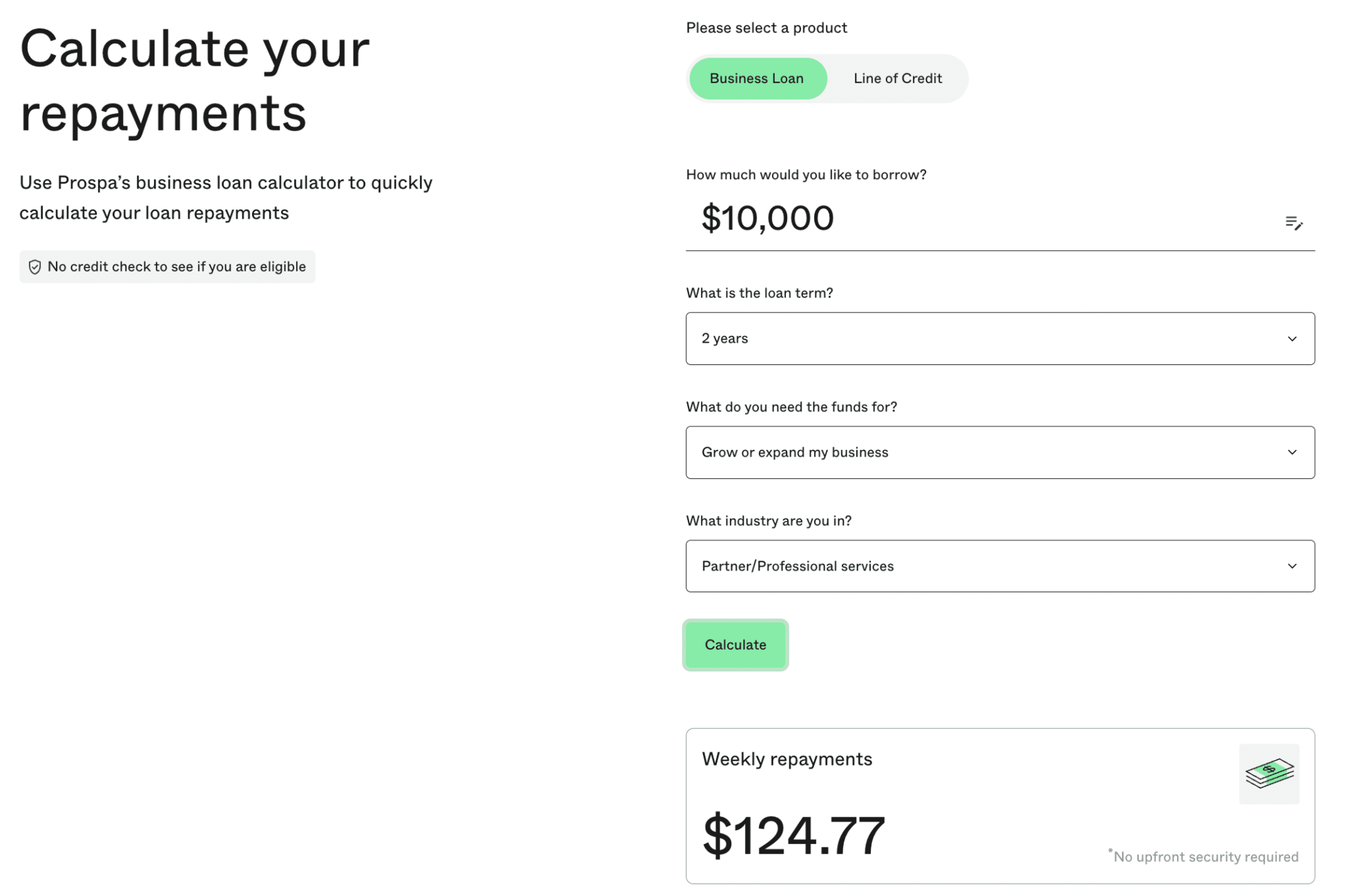

Prospa’s Business Loan Calculator is free to use, quick to complete, and doesn’t require a credit check. Simply enter:

- How much you want to borrow

- The loan term (from 3 months to 2 years)

- What you need the funds for (e.g. hiring staff, purchasing inventory, paying tax debt)

- Your business type or industry (e.g. retail, hospitality, professional services)

You’ll instantly see an estimate of your first weekly repayment, including principal, interest and service fees. For example, borrowing $10,000 over two years might result in a weekly repayment of $124.77.

You’ll instantly see an estimate of your first weekly repayment, including principal, interest and service fees. For example, borrowing $10,000 over two years might result in a weekly repayment of $124.77.

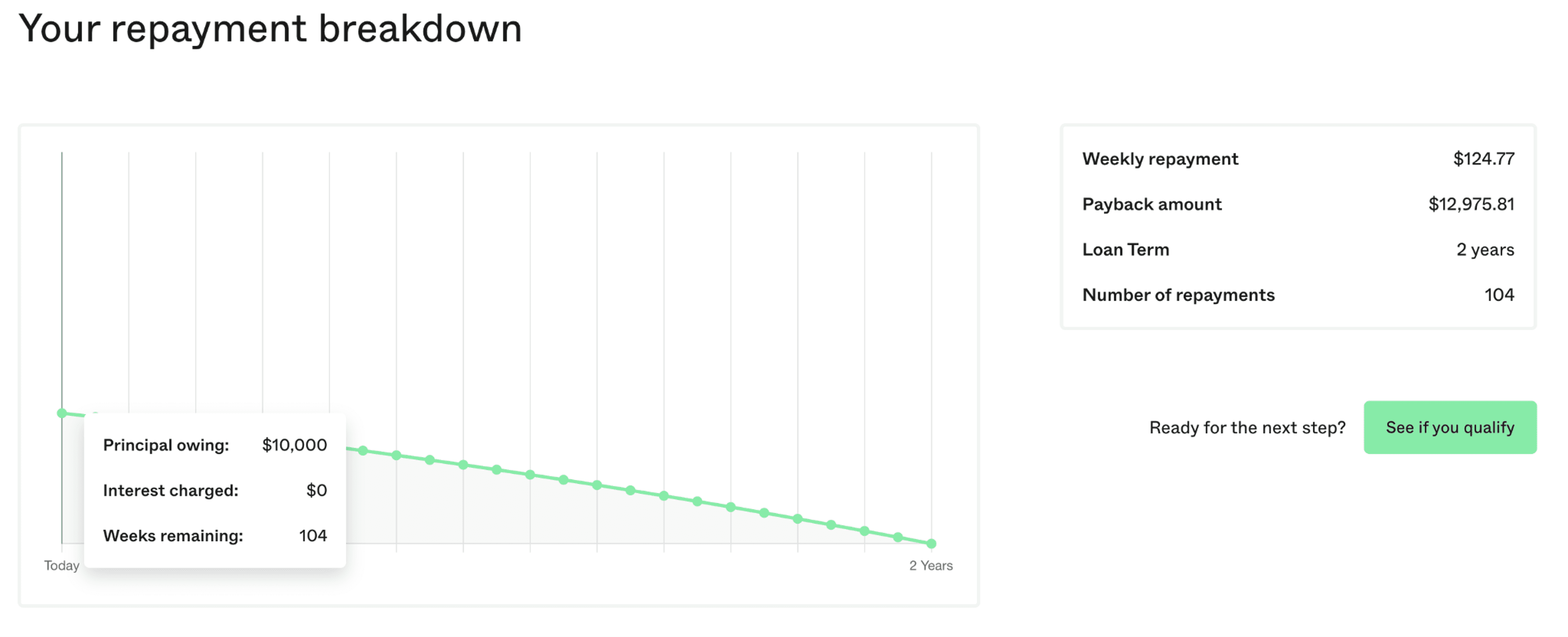

You can also view a detailed repayment breakdown showing the total amount to repay over time, the number of payments, and the weeks remaining.

Why it matters: Loan repayments usually come at fixed intervals, which makes them easy to overlook when forecasting cash flow. A calculator helps you stay one step ahead.

Why it matters: Loan repayments usually come at fixed intervals, which makes them easy to overlook when forecasting cash flow. A calculator helps you stay one step ahead.

Try the loan calculator or speak to a Prospa specialist about your business finance options.