Not sure how to apply for a business loan?

We specialise in Australian small business loans between $5K and $150K with funding possible in just 24 hours. Terms range between 3 and 36 months and repayments are fixed either daily or weekly to work with your cash flow, there are also early repayment options that could save you interest.

Here, we have answered some common questions you might have about applying for a Prospa business loan – such as what are the credit criteria for a Prospa small business loan, how hard is it to qualify for a Prospa small business loan and do I need a business plan to get a Prospa small business loan. Hopefully this will stop you wondering: ‘Do I qualify for a business loan?’

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

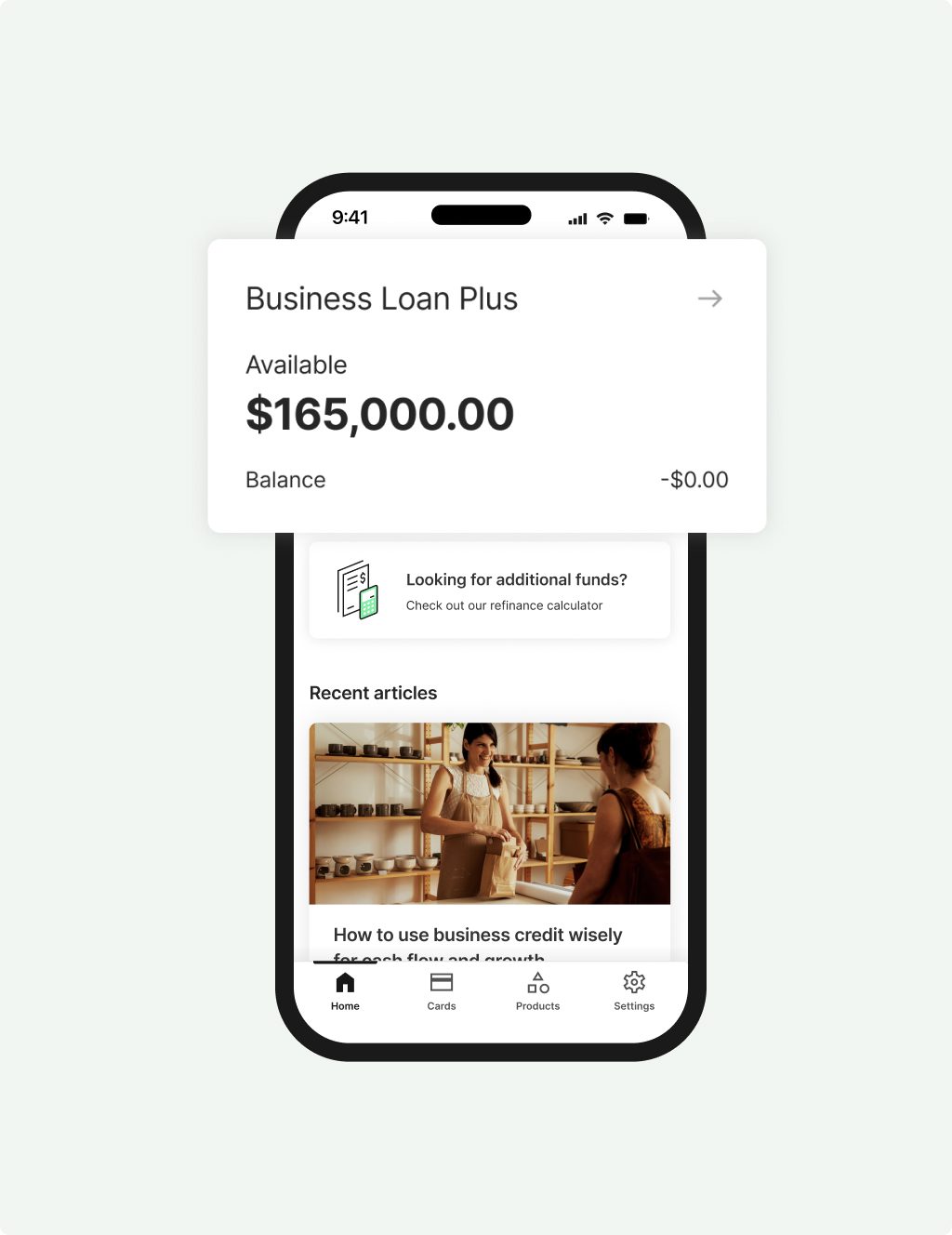

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

What are the criteria for a small business loan?

The lending criteria for a small business loan from Prospa include a minimum trading history as well as a minimum monthly turnover of $6K. For business loans of less than $150K, no asset security is required upfront. For amounts over $150K, your last 2 years financial reporting may be required. All applications require an active ABN and your business account details.

How hard is it to apply for a small business loan?

The application process including to find out whether you qualify for a business loan from Prospa is quick and easy. For starters, you need to be an Australian business with minimum trading history and a monthly turnover of no less than $6K. For amounts over $150K, your last 2 years financial reporting may be required. We’ll also ask you for some identification documentation, like your drivers licence and you’ll need to provide your ABN.

As a responsible business lender, we do a credit check at the time of your application. When you apply, we’ll talk to you about how business is going and what plans you have. Every application that we receive is carefully reviewed and all details relevant to the financial circumstances of your business are taken into consideration. We will only approve a loan if we believe you have the capacity to repay the loan and that the fixed repayments will work comfortably in your cash flow.

Do I need a business plan to get a small business loan?

Applying for funding from Prospa is quick and easy. We won’t ask you for a business plan at the time of your application. For amounts over $150K, your last 2 years financial reporting may be required.

How to get a business loan

Getting a business loan from Prospa can be a quick and hassle-free experience. Our online application form can be completed in less than 10 minutes and we specialise in fast decisions. If your application is approved, we will send you a loan contract. Once you have reviewed the loan contract and chosen to accept the offer, we then release the funds, sometimes almost immediately. In many cases, if all goes to plan funds can be received within just 24 hours or the next business day.

Talk to Australia’s #1 online lender to small business

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

FAQs

Frequently asked questions

At the moment, Prospa only lends to established businesses. Part of our standard qualifying criteria for a business loan includes being able to demonstrate minimum trading history. That means, if you cannot supply details of your business’s trading history and a minimum monthly turnover of at least $6K then unfortunately your business may not yet be eligible for a business loan from us.

How to apply for a business loan.

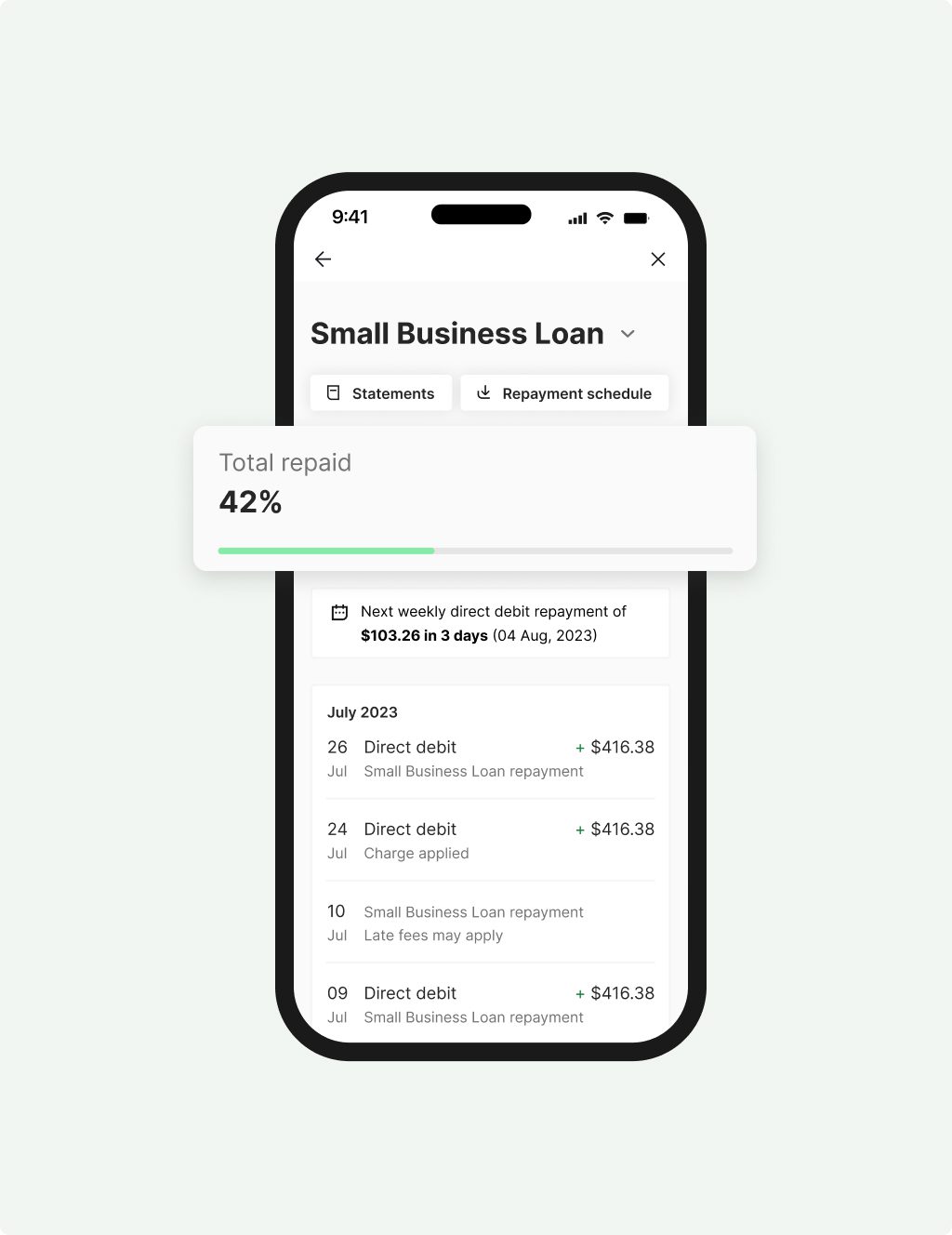

It’s quick and easy to apply for a business loan when you choose Prospa. Using our online application form, it takes just 10 minutes to complete and submit. You’ll need to know how much money you are applying for and how much time you wish repay your loan over. Loan terms from Prospa are available for between 3 and 36 months with either daily or weekly repayment options available. Our client focused approach to business finance means that we tailor our repayment schedules to work with your business cash flow. The result is that we’re proud to maintain our 4.9/5 TrustScore with in excess of 29,400 Australian business customers in our journey so far.

Absolutely. To access Prospa funding (loan amounts) up to $150K, you don’t need to provide asset security upfront to secure your loan.

We offer loans from between $5K and $500K and you don’t need to provide upfront asset security to access Prospa funding up to $150K.

Prospa doesn’t provide business grants, but we can help you with small business funding. If you are a small business owner with a business that has a minimum monthly turnover of at least $6K, then you are eligible to apply for a small business loan or a business line of credit.

Business funding from Prospa can be used for many business purposes, from investing in new equipment to finally launching a nationwide marketing campaign. Whatever you have planned for your business growth and stability, we may be able to help you with the funding you need to achieve your business dreams. When you choose to get business funding with Prospa, you will enjoy cash-flow friendly repayments that work with your business and you can manage and maintain your loan 24/7 using our app.

Apply for a business loan from Prospa in under 10 minutes and enjoy a quick and hassle-free experience. If your application is approved, we will send you a loan contract. Once you have reviewed and accepted the loan contract, your business loan funds are released quickly which means that you could have the money your business needs in as little as 24 hours. If you have any further questions about our business loan or our line of credit, then please feel free to get in contact with our business lending specialists on 1300 458 283 or via our website.

Other questions?

Awards, thanks to you

It’s nice to know we’re doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |