Automate and accelerate your business

Take your business to the next level with Prospa’s tailored funding solutions.

Flexible business funding for your ‘next level’

Tired of balancing the competing demands of your business? Invest in your tech capabilities and shave hours off admin, boost productivity and focus on the things that really matter to you.

Prospa’s flexible range of funding solutions could be just the ticket! It takes just 10 minutes to apply online for funds up to $500K, and approved funding is possible in just 24 hours. What are you waiting for?

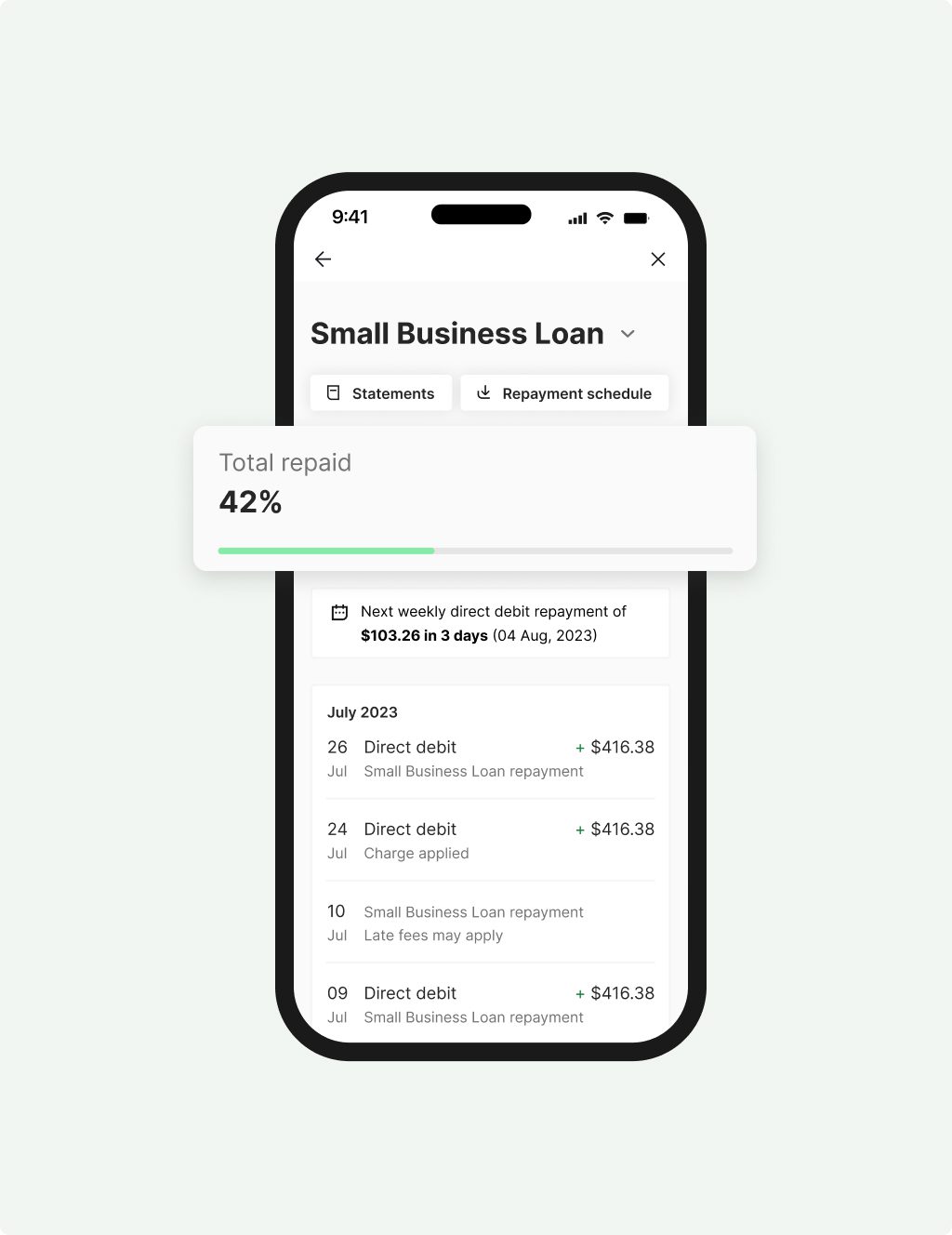

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

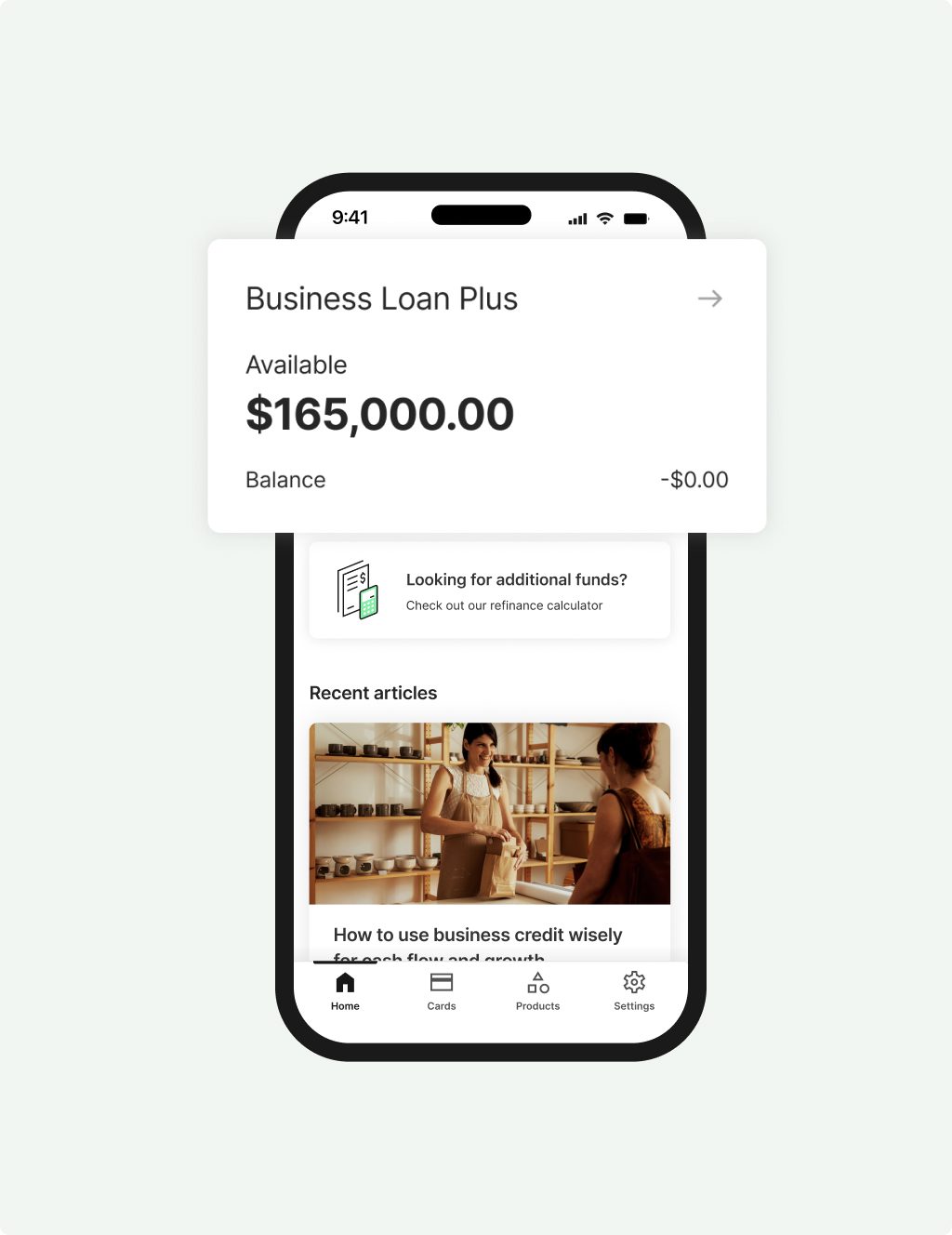

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Cashflow or Growth. We help with both!

As a professional services provider, you know that cash flow plays a vital role in your business’s day-to-day. Plus, there are times when you might need funds to invest in your business to take it to the next level.

Whether you’re a lawyer, an accountant, in advertising or IT, or offer some other professional service to your clients, talk to Prospa about our flexible funding solutions. We can help you find an option to suit your business’s needs – whatever they may be.

Cover unpaid invoices

Pay wages and suppliers

Outsourcing

Improvements

Marketing

And more

Why Prospa? Because we believe in small business.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

How our customers have put their funds to work

Read Customer StoriesAwards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |

| 2024 | Great Place to Work | Recognised as one of the Top 10 Best Workplaces in Technology |

| 2024 | Work180 | Recognised by WORK180 as one of Australia’s top 101 workplaces for women |